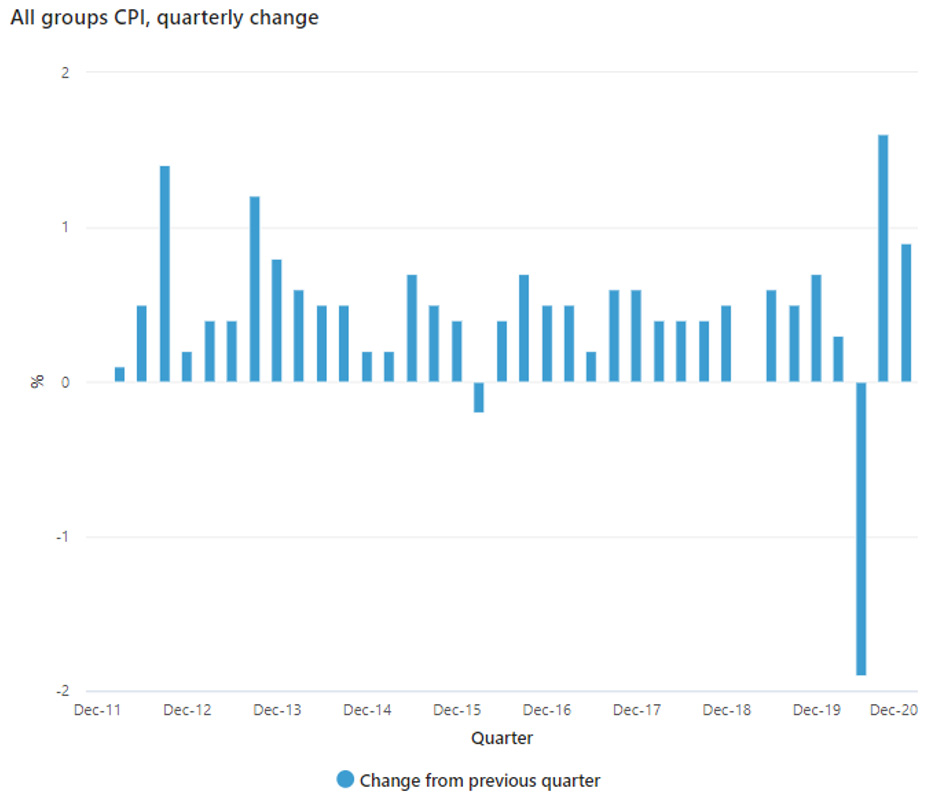

I’ve had a number of questions about inflation over the last few weeks and thought I would share them with you. First here’s a graph of historic CPI quarter over quarter. You can see the significant drop last year and the corresponding spike the next quarter. However, nothing more or less than 2% in the last decade.

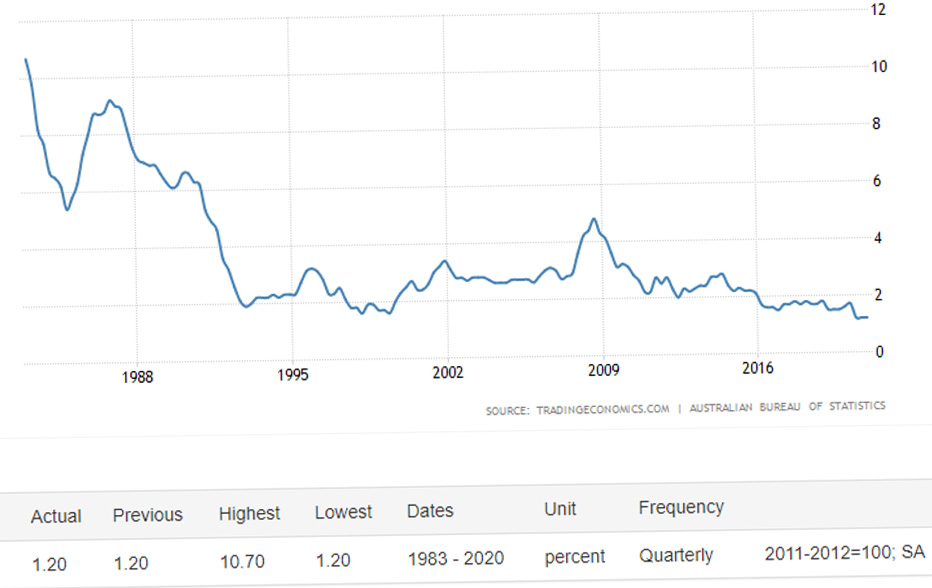

Here’s another chart showing the core inflation rate, which has declined from double digits in the 1980s to be under 2% since 2016.

Core Inflation since 1983

While inflation has recently hit the headlines, the cost to invest in the sector has increased, and in Janus Henderson’s latest review Inside the bond market sell-off, Jay Sivapalan – Head of Australian Fixed Interest, said:

“Our sizeable allocation to inflation-linked bonds has largely served the purpose of protecting portfolios against the market’s expectation of a sharp lift in inflation. However, the best time to own inflation protection is when others don’t want it or are not thinking about it, and that time is now gradually passing.

“As such, we have taken some profit through the sale of some of our holdings of government inflation-linked bonds, though we have retained some exposure in order to reduce the impact of inflation expectations rising even higher should they break out to the upside.”

Question

Dear Elizabeth

Firstly, my thanks and appreciation for your work. Your commentary and analysis have been my go-to source of information on fixed income for several years now, and I much appreciate your professionalism and independent analysis.

Background: I manage our SMSF in mid-to-late pension mode, and the avoidance of major capital loss is our highest priority, followed by the generation of modest returns.

Along with many others, I am wrestling with our Fund’s inflation strategy and am looking at the ILB ETF and other inflation-hedge type investments.

While nobody has a clear crystal ball, my fear is stagflation, where the US Fed and our Reserve are politically impelled to keep official rates low (due to the burgeoning level of public debt now being incurred) while the real economy sees steadily increasing inflation driven by copious cash, capricious consumption and a speculative grab for quick wealth, but where the productive and non-subsidised sectors of the economy simply stagnate.

Here is my problem and query, and I would much appreciate your comments (notice that I avoid the “advice” word).

As I understand it, inflation is officially measured by the CPI (if we ignore the ‘ex-basket’ speculative bubble-items). However, the RB attempts to control inflation via the official interest rate (cash rate), which then drives the BBSW rate. I don’t properly understand the relationship between the CPI, official interest rates and the BBSW? How well correlated are they? In other words, if official interest rates are being kept artificially low while inflation is rising rapidly, this must be very bad news for floating rate investors whose returns are linked to the 3-month BBSW rate? Conversely, if there is a good correlation between the official interest rate and the BBSW rate, then FRNs ought provide a reasonable, if lagging, hedge against inflation? At least this is what I am hoping?

In the case of ILBs, the I-Shares ILB ETF offering is based on a suite of government ILBs, but I have not been able to find out how these underlying govvie ILBs define inflation – is it the CPI or the Cash or Swap rates, or something else. Naive question I know, but my macro was never very strong.

Very grateful for your comments and ideas for further reading.

Bryan

Response

While I’m not an economist, nor as you say an adviser, here is my take on the relationship between CPI, BBSW and the cash rate.

First, the Consumer Price Index, represents changes in prices of a basket of goods and services. Some of the items regularly increase in price such as cigarettes, healthcare and education, while others go up and down, such as the price of fruit and vegetables which is dependent on climate, local and overseas supply and demand, and very recently we’ve seen, foreign workers to pick the crops! One of the big impacts on CPI is the oil price, which can directly feed into the other baskets like fruit and vegetables, which rely on transportation to get the goods to market. Thus, steeply rising oil prices are usually followed by higher inflation. Inflation has been well below the RBA’s target range of 2-3% for years now. While they say it’s important, they seem to have let the target go, preferring full employment, low interest rates to stimulate the economy (but stating they will not go to negative rates) and a comparably lower currency. One article I read recently suggested interest rates would need to be -3 to -4% for inflation to get back within the target range.

Typically, the cash rate and BBSW have been highly correlated and, as a rule of thumb, BBSW is a good indicator of RBA movements in the short term. However, there have been periods where the spread between the two is around 100 basis points, so like any correlation it’s not perfect.

It is important to keep in mind the central bank’s role (as described on its website):

It is the duty of the Reserve Bank Board, within the limits of its powers, to ensure that the monetary and banking policy of the Bank is directed to the greatest advantage of the people of Australia and that the powers of the Bank … are exercised in such a manner as, in the opinion of the Reserve Bank Board, will best contribute to:

- the stability of the currency of Australia;

- the maintenance of full employment in Australia; and

- the economic prosperity and welfare of the people of Australia.

This page on Monetary policy might also help – https://rba.gov.au/monetary-policy/about.html

In essence, it’s a balancing act and the RBA has conflicts within its charter.

I don’t think any of the relationships are perfect and can imagine inflation is allowed to rise and may even exceed the target 2-3% for a period, given the sustained lower inflation for some years now.

Investments with interest payments tied to 3 month BBSW are likely to stay low for around the three year period even if inflation starts rising as the central bank has promised the market to keep short term rates low. Traditionally floating rate investments have lagged inflation but risen to offset higher inflation, but it’s not a perfect hedge, like inflation-linked bonds which provide a 100% hedge.

I’ve always thought at some stage inflation would rise, all this stimulus and lower spending during COVID-19 means there is pent up demand. It’ll be interesting to see what happens when Europe and the UK open up again.

In terms of investing in government ILBs now, you are going to pay a premium, so you really need to think about existing allocations and try and work out how high inflation might go and the cost/ benefit of investing now. For example, those Syd 30s might rise in price to a point where you can make a decent, offsetting capital gain if inflation continues to rise.

Australian government inflation-linked bonds reference the CPI, I’m not sure about other sovereigns.

Question

I am interested in purchasing an Inflation Linked Bond for my SMSF. I don’t currently have any Fixed Interest exposure. I am looking to invest around 10% of my super fund.

Besides FIIG, are there any other ‘sellers’ of corporate bonds?

I want to be quite clear that I am not seeking financial advice. Just a suggestion/opinion.

I continue to enjoy/benefit from your articles and webinars.

Peter

Response

Thanks very much for reaching out. There are other bond brokers that would sell you inflation-linked bonds – BondIncome (part of the Cashwerkz group), Australian Bond Exchange and BCG Mint along with the major banks. It’s worth shopping around to see what they can offer you.

There are also some funds that might be of interest – Blackrock has a government inflation-linked ETF that has the code ILB, Vanguard and Mercer also have Australian Inflation funds. Another newer player, Ardea, also has an Inflation Linked Bond Fund. I’ve been impressed with their analysts.

Late last year Fortlake came to the market with inflation-linked funds and I met/ interviewed the CEO Christian Bayliss. Here’s a link to the article.

FYI, I found the funds listed above on the Fixed Income News website, hoping this will get you started.