Global Markets

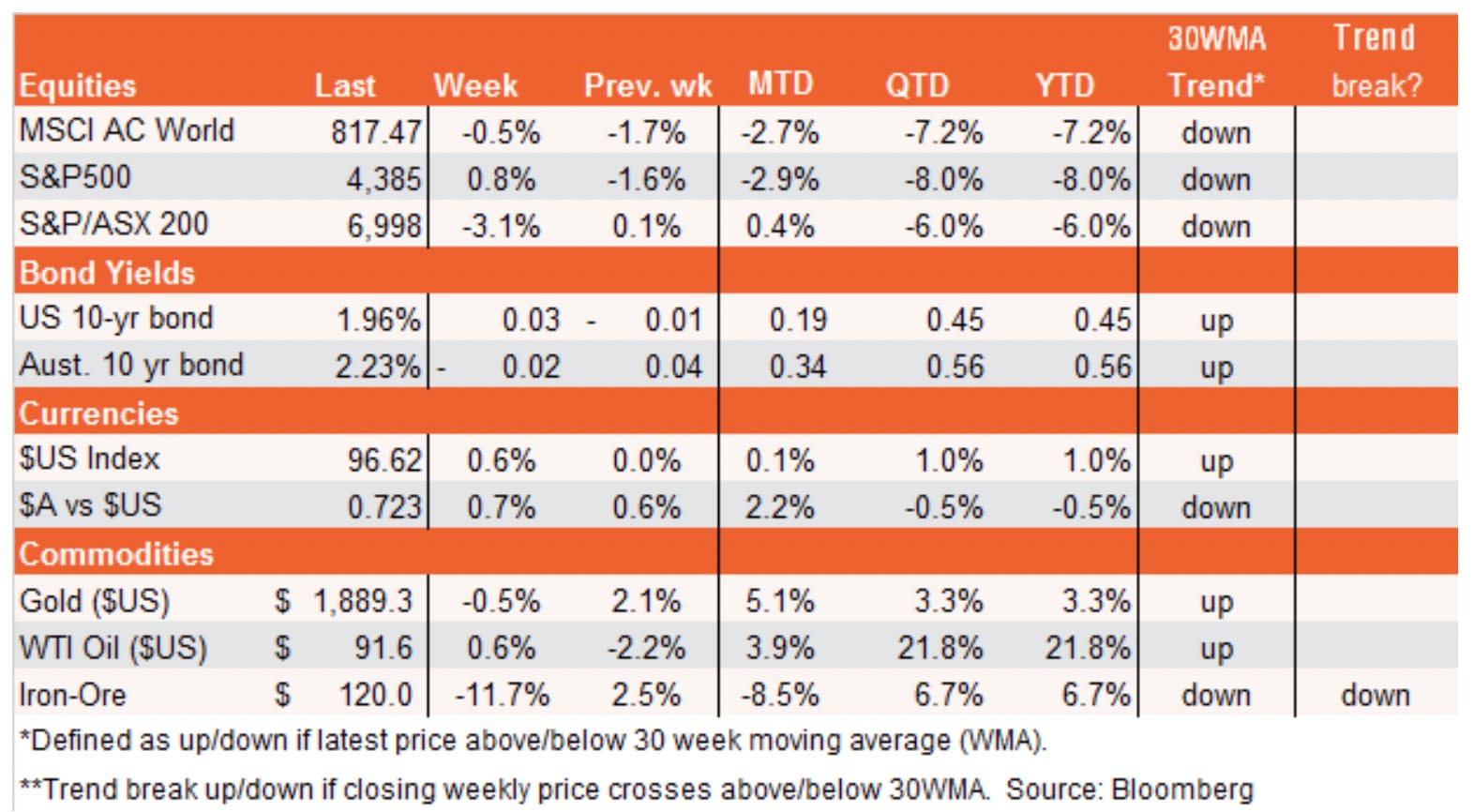

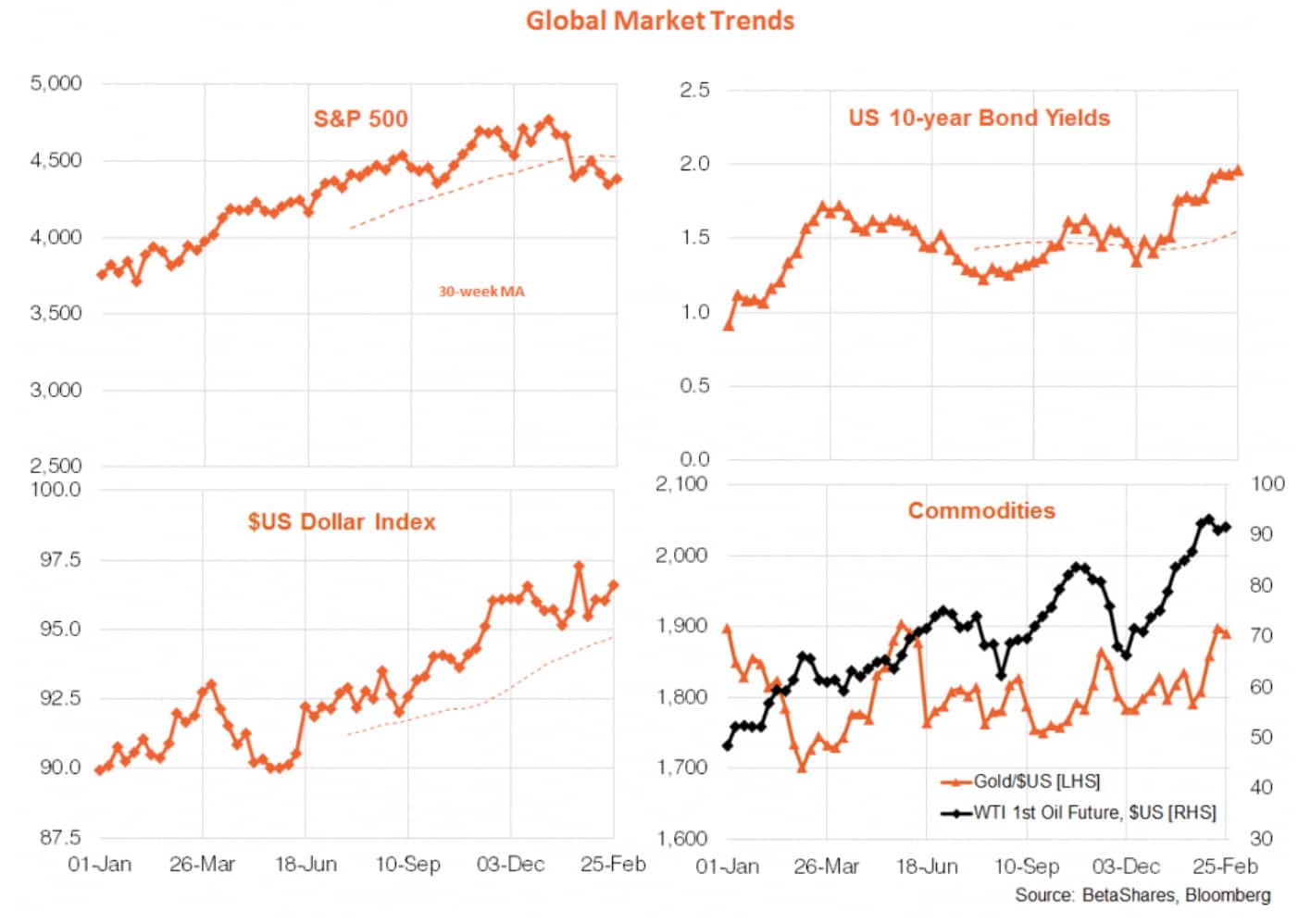

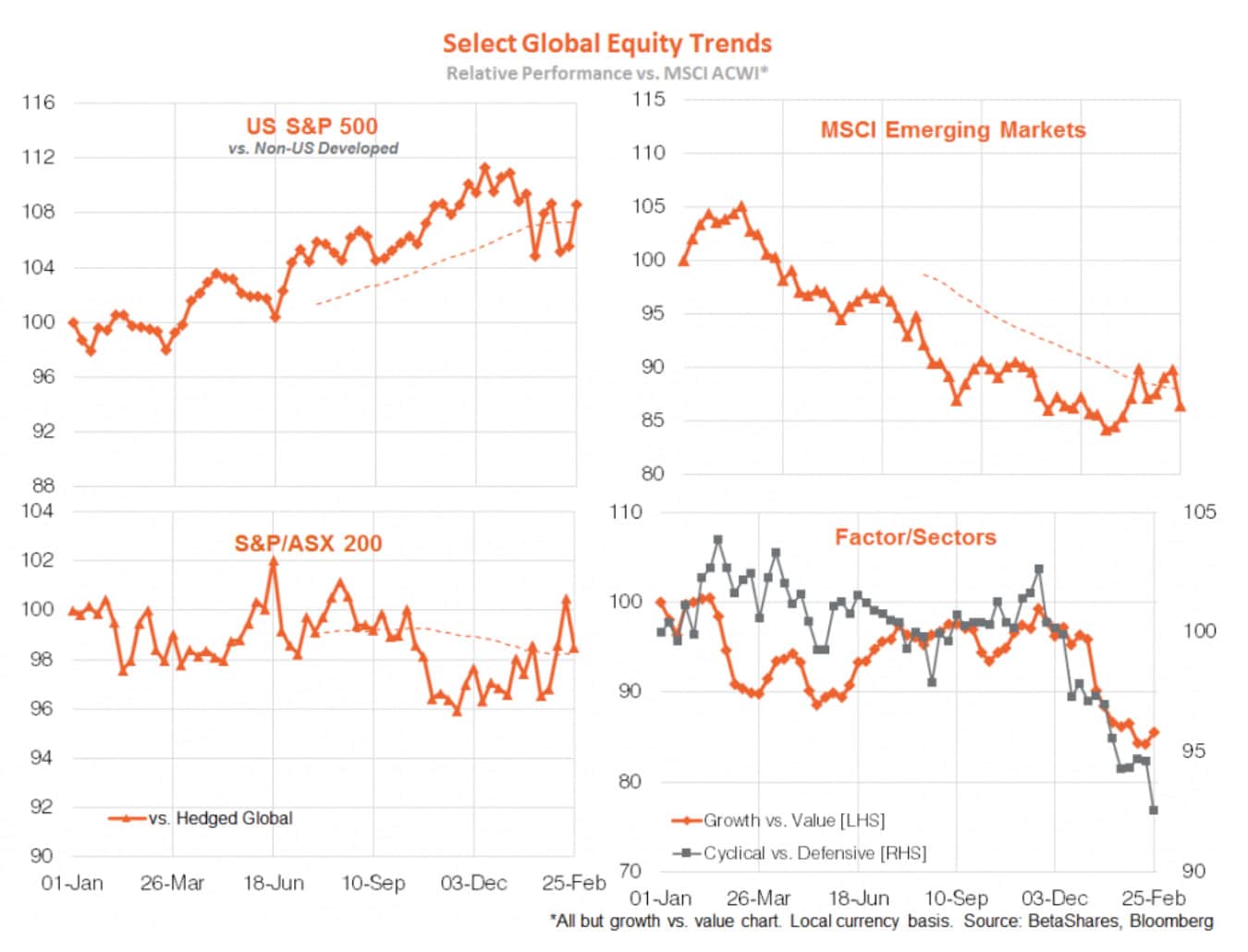

Last week was clearly volatile for global markets, with the attack on Ukraine initially causing a risk-off move, followed by a risk-on recovery on relief that Russian sanctions did not extend to oil and gas exports and all the mayhem at least seemingly reduced the risk of a 0.5% Fed rate hike next month. The S&P 500 actually ended the week up 0.8%, though the S&P/ASX 200 was down 3% as it was yet to reflect the strong Friday bounce on Wall Street. Bond yields, gold and the $US had only small net moves over the week.

Of course, a swag of new sanctions over the weekend – especially removal of many Russian banks from the SWIFT financial messaging system – seems likely to lead to a risk-off move when markets open up again this week. Key concerns are the extent to which the new sanctions will disrupt Russian oil and gas exports, and whether there’s spillover from a likely collapse in the Russian ruble and Russian bond and equity markets this week. The SWIFT move did not affect all Russian banks, which might be intended to still allow oil and gas exports to flow. Meanwhile, not helping was Putin’s weekend statement that he’s placed nuclear forces on high alert!

Also read: History Never Repeats… Or Does It?

In terms of thematics, the net risk-on move last week saw a bounce back in US and “growth” over “value” relative performance – though cyclical sectors still lost out to defensives.

Where to from here? The best case scenario would be a Russian back down, which might be humiliating enough to see the removal of Putin and new democratic hope for his beleaguered country. Otherwise, protracted fighting or a Russian takeover will see continued sanctions and ultimately potential disruption to oil and gas markets. In light of the tough new sanctions, one new risk factor to contemplate is a potential Russian debt default – which led to some market turbulence the last time this happened in 1998.

Global markets also have to focus on the Fed and the U.S. economic outlook. On that score, US payrolls on Friday will provide an update on the tightness of the labour market. A solid February employment gain of 450k is expected, with the unemployment rate ticking back down to 3.9% and annual growth in average hourly earnings lifting further to a blistering 5.8%. Powell also confronts Congress twice this week, with focus on to what extent the Ukraine crisis might limit interest rate increases over coming months.

On the topic of oil, OPEC also meets on Wednesday with focus on whether they might increase oil output in April by more than the planned 400,000 bpd increase. I won’t hold my breath!

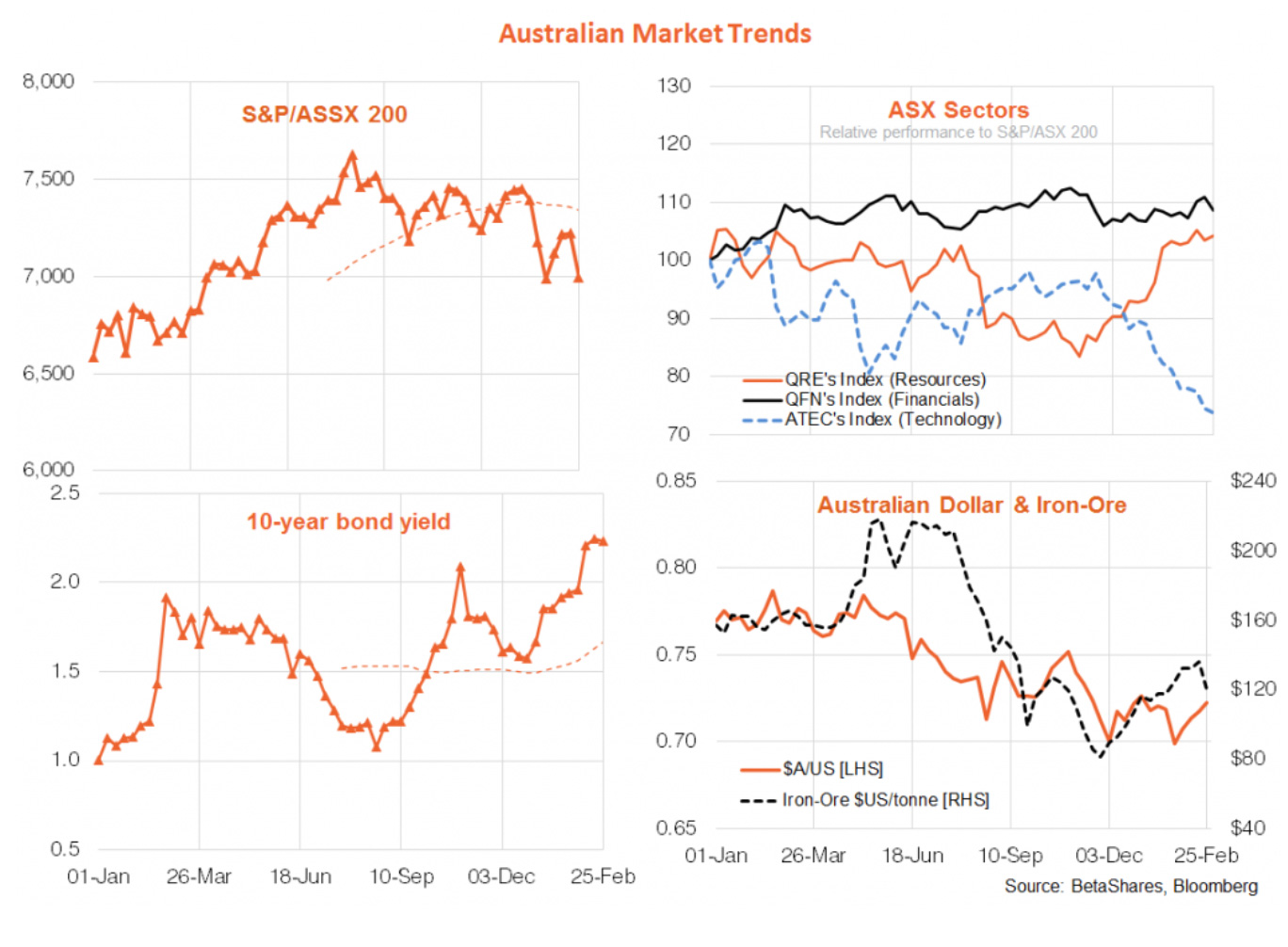

Australian Market

The key local data highlight last week was the wage price index which indicated a modest further lift in wage growth in the December quarter. Annual wage growth lifted to 2.3% from 2.2% – hardly a smoking gun for a rate rise anytime soon. The other notable development was a 11.7% slump in iron ore prices on concerns China might imposes new control on the market.

Of course, we’ll learn more about the Reserve Bank’s thinking after this Tuesday’s policy meeting, though I suspect given last week’s benign wage report and new geo-political concerns it won’t stray far from its recent “patience” rhetoric. Wednesday will see release of the December quarter GDP report, which is expected to show a nice 3% bounce back in growth after the COVID related 1.9% decline in the September quarter.