Conventional portfolio construction theory positions equities as the primary driver of returns, while fixed income typically takes a back seat as a low-return and low-risk asset class. However, this perspective often overlooks a crucial aspect of fixed income: its role in dampening portfolio volatility. By Darren Langer, Co-Head of Fixed Income, Yarra Capital Management.

Protecting portfolios through the storm

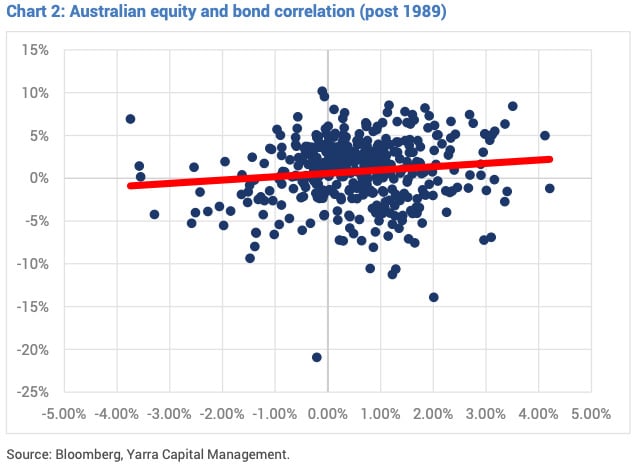

Contrary to the notion that fixed income should exhibit a negative correlation to equities, suggesting that when one goes up, the other goes down, in our view, it’s more accurate to view fixed income as a stabilising force within a portfolio. Instead of focusing solely on returns, investors should also consider the invaluable function of fixed income can have in reducing overall portfolio volatility and improving risk-adjusted returns.

Historically, equities have exhibited higher volatility, compared to bonds, reflecting the relatively stable income streams of bonds and their fixed coupon payments. While bonds can still experience price fluctuations, especially in response to changes in interest rates or credit risk, these movements are generally less pronounced compared to equities.

Also read: Five Takeaways From US Soft Landings

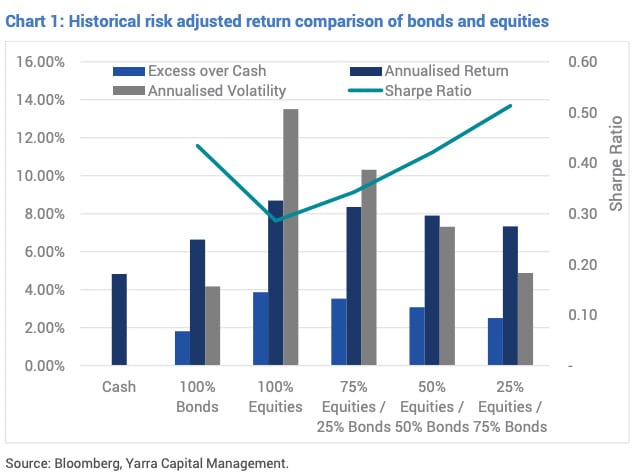

Even small bond allocations in a portfolio can help dampen portfolio volatility for a small reduction in overall return and improving risk adjusted returns (Sharpe ratio).

If equities and bonds were negatively correlated, fixed income would never deliver positive returns over the long-term. As shown below (refer Chart 2), the correlation is slightly positive.

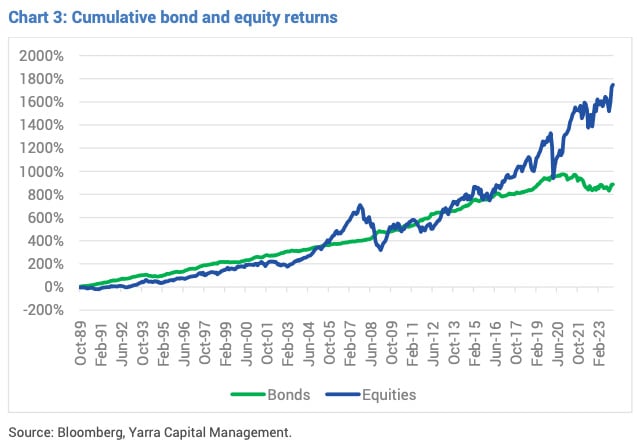

While it’s true that fixed income returns may lag during bull markets, the trade-off can be crucial: in times of market turbulence, fixed income can serve as a critical buffer against sharp declines in equity values, helping to preserve capital and reduce overall portfolio risk (refer Chart 3).

For much of the past 30 years, equity and bond returns have tracked each other. However, over the past decade, equity returns have significantly outstripped bonds by a considerable margin. This period coincides with governments and central banks pumping considerable liquidity into economies.

While the relationship between equities and bonds may still hold, (refer Chart 1), a combination of both asset classes can yield high returns while offering some important protection against equity corrections.

In essence, the role of fixed income extends beyond generating returns; it can provide a vital layer of defence against market volatility. By diversifying portfolios with fixed income, investors may achieve a more balanced risk-return profile, thereby enhancing long-term wealth preservation and stability.