In this Q&A, Sunita Kara and Brent Finck from Aviva Investors discuss why recent developments in high-yield markets strengthen the case for active management.

Read this article to understand:

-

How dispersion across credit-quality tiers creates opportunities for active fund managers

-

How variations across the market are being driven by sector-specific factors

-

The rationale behind our positioning

2024 is shaping up to be a rollercoaster. Over the first quarter we saw major shifts in market expectations around central bank policy, with all eyes on the US Federal Reserve. Expectations of a March rate cut suddenly flipped in late January, and while cuts are still anticipated this year, central banks remain cautious, with inflation not yet under control.

A higher interest-rate environment can cause problems for some companies. In March, three indebted high-yield issuers – Intrum AB, Altice France and Ardagh Packaging – started engaging in liability management proceedings after encountering difficulties.1 The news caused market jitters and prompted high-yield investors to pay renewed attention to security packages and bond documentation.

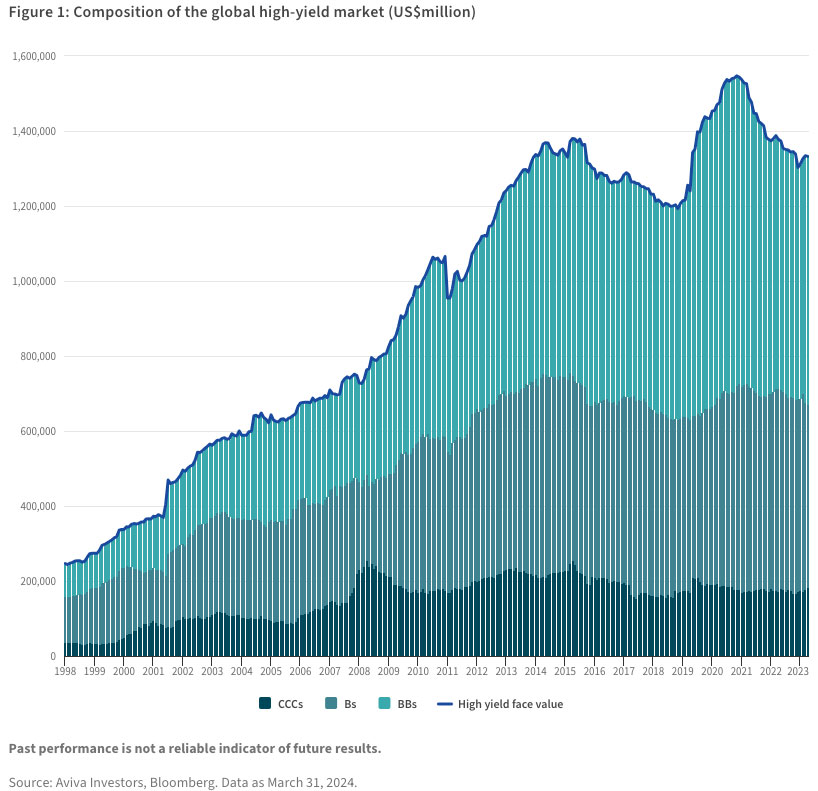

However, it is worth stressing these issuers and related entities account for only 1.8 per cent of the global high yield market and 3.5 per cent of the pan-European high-yield market, and so are unlikely to cause contagion risk. On the whole, the high-yield market is larger, higher-quality and more diversified than it has been in the past (see Figure 1), and has broadly shown impressive resilience over recent months despite a challenging backdrop of slow economic growth and high inflation. Rating agency Moody’s projects the global speculative-grade default rate will decline to 3.5 per cent by the end of the year, down from five per cent in January.

Nevertheless, the recent distress in parts of the European market shows the importance of an active approach to portfolio management and careful security selection based on bottom-up analysis of each credit. In a market seeing greater dispersion, an active approach can help protect capital and also create opportunities for alpha generation, as Aviva Investors’ co-heads of global high yield, Sunita Kara (SK) and Brent Finck (BF), argue in this Q&A.

March saw some volatility in high yield connected to liability management among three European issuers. What are the implications for investors?

SK: These events served as a timely reminder that just because a company can pay its debts doesn’t mean it will. The three issuers in question were not in immediate danger of failing to pay their debts, and could have used available liquidity or sold assets to cover short-term payments, but instead chose to begin negotiations with those to whom they owe money to reduce their debts.

The episode is likely to result in greater emphasis being placed on understanding security packages and weak documentation, which has unfortunately become the market norm for the best part of the last decade, and could also prompt greater recognition of the importance of active management.

We have seen increased dispersion across credit-quality tiers in the past year, including both double-B and single-B. What are the investment implications of this?

BF: Dispersion across the spectrum of credit quality allows active managers to identify mispriced opportunities. Unlike a compressed market scenario, in which securities with the same credit rating move closely together, the current environment allows for anomalies, such as double-B rated bonds trading at a similar level to single-B rated ones. The divergence extends in the “crossover” space, where certain triple-B rated bonds are trading at wider spread than double-Bs.

The most pronounced dispersion can be seen within the triple-C category, where there is a large divergence between what we call the “haves” and “have-nots”: the “haves” are performing credits with the potential to access the capital markets through traditional means and secure new financing. The “have-nots” represent a group of companies trading at distressed levels, reliant on non-traditional capital raising methods or liability-management exercises (LMEs) to extend their maturity profiles.

SK: There are significant variations driven by sector-specific factors. So we formulate a view on a sector first and are then able to act upon that.

For example, if we look at the dispersion within double-B bonds, some of the widest-trading on a spread basis are in the real estate sector. This sector has performed poorly over the past two years, primarily due to its sensitivity to rate hikes. However, opportunities arise when spreads are in line with median triple-C-rated names, which suggests investors are being compensated for the risk despite the ongoing challenges in the sector. Careful monitoring of relative spreads can highlight opportunities.

Taking a step back, how do you see the broader market dynamics playing out this year against a backdrop of potentially higher-for-longer interest rates?

SK: We’ve entered a phase where risk-free rates are higher and thus the proportion of spread to total yield may not be as significant. Despite spread comprising less than 50 per cent of the all-in yield, the current market offers a high all-in yield, suggesting that carry – the income that comes into a bond fund thanks to coupon payments, and a major factor in high-yield total returns – remains robust.

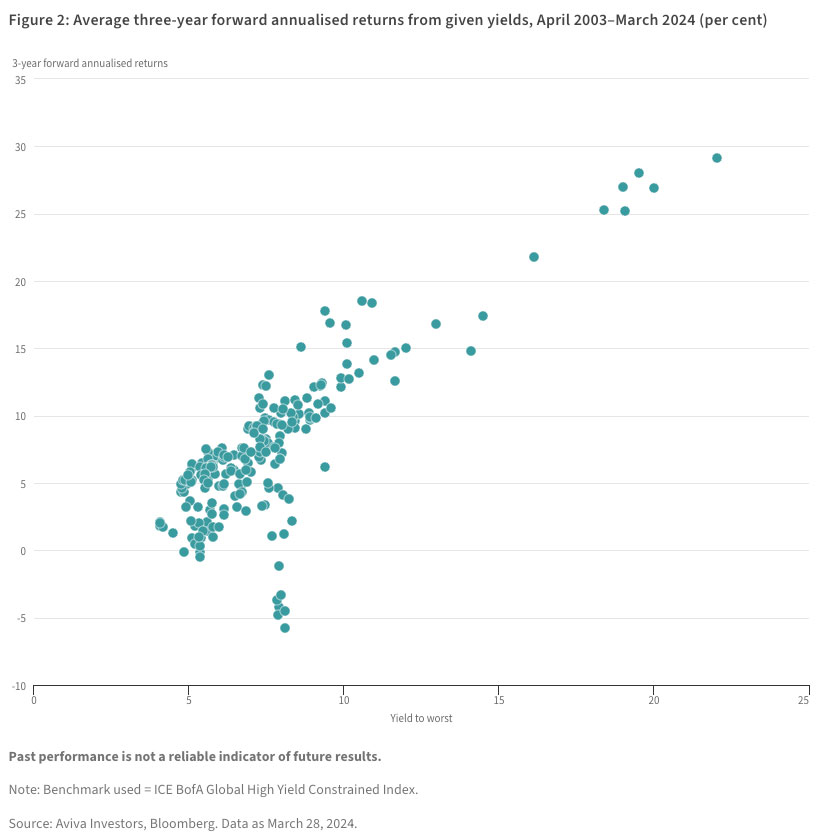

Our analysis of longer-term market trends shows that when the starting yield is at 7.5 per cent (its level on March 29), three-year forward returns have been positive 82 per cent of the time, with an average total return of 7 per cent (see Figure 2). At the same time, many bonds in the index are trading at discounts of between ten and 15 per cent, offering a cushion against potential losses but also potential opportunities if and when prices rise.

BF: From a total return standpoint, investors are not dependent on credit spread compression to drive positive total return in the current environment. They have the carry, and central banks cuts, if and when they occur, can also enhance returns by decreasing the overall yield and driving capital appreciation.

Last time we spoke you had higher conviction for European high yield over the US market, is this still the case?2

SK: Our stance remains unchanged and we maintain a significant overweight to Europe versus the US. In recent history, European high yield offered a spread advantage of about 60 basis points (bps) over US high yield. After the rally in November and December 2023, the spread differential narrowed to 30bps, but more recently the spread differential has widened back to about 60bps due to the aforementioned distressed large capital structures. Outside of these developing idiosyncratic credits, in our view the European market remains attractive due to its higher-quality composition, featuring more double-B-rated credits and fewer triple-C bonds than the US.

Moreover, as we hedge our bond exposures back to US dollars, we can benefit from additional foreign exchange (FX) gains, which in our opinion enhances the overall attractiveness of European high yield.

BF: With US inflation proving to be more stubborn than anticipated, there is speculation the European Central Bank might initiate rate cuts before the Federal Reserve does. So there is also a potential discrepancy in monetary policy easing between the two markets.

In which sectors do you see risks?

BF: The communication sector, encompassing telecoms, media and technology, faces several secular challenges. These include evolving consumer behaviours and intensified competition between wireless and cable companies. Numerous companies are struggling with high levels of debt, making it difficult to adapt to new market conditions. This has led to the sector being the poorest performer in the high-yield market last year, a trend that has continued into 2024.

Although there are opportunities to select individual securities within this sector, the overarching challenges are likely to persist, potentially leading to a higher default rate among these issuers. Consequently, we are maintaining our underweight stance in this sector.

SK: The communication sector is also facing upcoming debt maturities. Historically, due to its ability to generate consistent cash flows, it was able to sustain higher debt levels. However, the current secular challenges and looming maturity walls are causing investors to pay close attention to these companies’ credit histories, and to their ability to refinance and extend their debt maturities.

Which sectors are we more positive on?

BF: We have a positive outlook on capital goods, based on two sub-sectors, construction machinery and diversified manufacturing. Construction machinery has benefitted from stimulus spending on infrastructure, especially in the US. This sector has the flexibility to adopt a defensive stance if there is a downturn in activity by postponing fleet upgrades, making it relatively resilient. Diversified manufacturing tends to benefit from a strong economic environment and overall industrial activity.

Basic industries is another area where we are overweight. We have top picks within the paper and chemicals sectors, which offer higher yield for investing in more cyclical industries. Given our positive outlook on the macroeconomic landscape, we find these two sub-sectors attractive at the moment.

SK: A significant portion of the chemicals sector within high yield is comprised of commodity chemicals, which are highly sensitive to the economic cycle. The prevailing opinion is that this cycle may have reached its peak in terms of pricing and margins. However, our exposure leans towards specialised chemicals, such as those involved in water treatment, which are less cyclical and offer better margins.

In terms of quality, where are you allocating to now and how do you view the balance of risk and return in the lower-quality segment of high yield?

SK: Last year we witnessed a significant rally in triple-C rated debt, with a notable outperformance compared to the broader market: triple-Cs posted nearly 20 per cent in total returns, versus the market’s 14 per cent. This year, while the rally has been more subdued, it’s still notable.

We have increased our triple-C allocation by approximately 100bps. This adjustment reflects our analysis of financing conditions and spread ratios between triple-C and double-B rated debt, which suggests potential opportunities for compression, particularly from triple-C to single-B ratings.

However, the triple-C segment also harbours risks. While not anticipating a significant reduction in defaults, we expect them to stabilise at between four and five per cent over the next couple of years. Our approach aims to identify triple-C bonds with strong refinancing prospects, thereby capturing positive convexity (a dynamic whereby a bond’s duration rises, its yield falls and the price rises), while remaining cautious about the segment’s elevated default risks.

BF: Our increased comfort with triple-C investments stems from improved capital market access. In 2023, less than three per cent of all newly issued bonds were triple-C rated, indicating a relatively closed market for these issuers. This year, however, there has been a noticeable increase in triple-C companies successfully raising new capital – the “haves”, to return to our earlier description – enhancing our confidence in the ability of performing triple-C credits to refinance upcoming maturities without facing a constricted capital base that could lead to higher defaults.

Substantial amounts of US and European high-yield debt is due to mature over the next two years. Are you concerned about the market difficulties this could cause?

SK: Currently, double-B issuers entering the market face coupon rates roughly three times higher than the previous rates at which they issued debt, indicating CFOs and treasurers have maximized low coupon debt. Despite the double-B market shrinking by 20 per cent over the last three years, these issuers tend to maintain market access, albeit at higher costs. However, we don’t foresee excessive new-issue premiums.

Triple-C issuers, which make up about ten per cent of upcoming maturities, face more significant challenges, as many cannot afford higher yields. Innovative financing solutions, including issuing new debt at a discount or introducing new equity, may alleviate some pressure. Overall, while there is some concern over market indigestion from simultaneous issuances, it’s not an immediate worry.

BF: I agree the maturity wall is not too concerning. It’s worth noting the shift towards shorter-maturity high-yield bonds, primarily five years with a two-year call feature, as a response to higher interest costs. This strategy means we’ll continue to see a “recurring” maturity wall, but with potential for increased capital market activity should interest rates decline.