Investors are increasingly directing their fixed income portfolios towards passive Exchange-Traded-Funds (ETFs) and term deposits (TDs) for cost-efficiency. However, this move may undervalue the risks of passive funds and overlook the potential for higher income and returns offered by active management.

By Darren Langer, Co-Head of Fixed Income, Yarra Capital Management

Since the 2008 Global Financial Crisis, central banks globally have used quantitative easing (QE) to stabilise investment markets and boost risk-taking. Investors reaped rewards with little capital risk, believing central banks would stabilise markets. As central banks end QE, inflation globally starts to ease, and we enter a more normal economic cycle, income portfolios with high-risk exposure or passive index-tracking strategies will face diminished profitability and periods of underperformance.

In this article, we discuss why the same can’t be said for an actively managed fixed income portfolio.

The market is inefficient, allowing active managers to add alpha

The fixed income market has a greater diversity of market participants regularly buying and selling a significant number of different bonds, which makes it more inefficient than its equities counterpart. Unlike equities, securities can differ by sector, subsector, collateralisation, coupon, maturity, optionality, and expected secondary market liquidity. Each of these factors can materially impact the price of a bond.

Pricing inefficiency infers that the prevailing market price of a security may not match its intrinsic value. Active managers seek to profit on that market inefficiency by buying bonds that they view as underpriced and selling bonds they deem to be overpriced. In contrast, a passively managed portfolio is intended to replicate the exposures and the performance of a benchmark index and evolve with that benchmark in line with bond market issuance trends, which – as noted – may not reflect an active fund manager’s assessment of intrinsic value.

Active managers seek to outperform the benchmark and reduce risk

Experienced active managers conduct in-depth macroeconomic, fundamental, and quantitative assessments to every investment decision, aiming to outperform their benchmarks. Conversely, passive investment strategies seek only to match the return and risk of a benchmark index by attempting to mirror the characteristics of the underlying index and are limited to securities that meet the index’s inclusion criteria. Importantly, investors who passively invest in an index with no regard to its construction are at the mercy of issuance patterns and may not necessarily own the best bonds in the market.

Active managers utlise a toolbox of strategies to deliver excess returns

Because of the dynamic nature of the holdings of an active bond fund vs. a passive ETF, active managers can use multiple strategies aimed at enhancing total return in different market conditions, such as selling bonds that have appreciated in price due to rolldown or take advantage of or hedging against duration.

At Yarra, we use our proprietary system to capture and analyse the relative value between ~3,000 Australian interest rate structures, bonds and sectors. This process creates a large universe of opportunities, which our analysts and portfolio managers meticulously interrogate. They apply their investment methodology, experience and utilise economic statistics to reinforce their conviction and identify the best returning securities.

Understanding the true cost of your passive fund

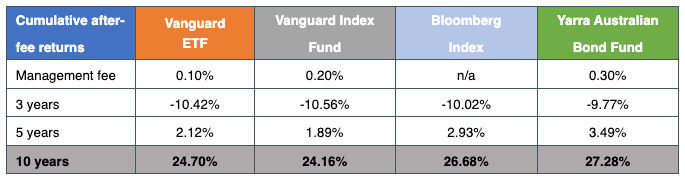

While Index funds may appear cost effective at first glance, over the long term their impact on returns relative to the benchmark, particularly compared to active bond managers, is often considerably lower after accounting for fees (refer Table 1).

Table 1: Cumulative returns of index funds (net of fees) over a 10-Year period

Source: RBA, Vanguard, Bloomberg, Yarra

Bonds outperform TDs over the long term

In addition to investors shifting towards passive ETFs, there is a noticeable increase in their allocation to TDs, driven by concerns about ongoing market uncertainty and a higher interest rate environment. In our view, investing in fixed rate active bond funds helps to deliver a more efficient portfolio outcome, particularly as we approach the cash rate peak.

Investors should consider the longer-term performance of bonds versus term deposits. As illustrated in Chart 1, bonds have significantly outperformed term deposits over the long term.

Chart 1: Bonds outperform TDs over the long term (10 years)

Source: Yarra Capital Management

Fixed rate bonds provide capital gains benefits that term deposits lack

Fixed rate bonds offer capital gains benefits that term deposits cannot provide. Similar to TDs, fixed rate bonds provide a known return (at maturity) from the investment date. However, TDs lack the potential for capital gains, which can increase the potential return to an investor when interest rates fall. It is essential to note that while the market value of fixed rate bonds can fall as rates rise, holding them until maturity ensures realising the initial yield without incurring any capital losses. Few other asset classes can offer such certainty.

While the past two years have been difficult for fixed income investors, it is important to recognise that these years are abnormal. Negative bond returns are still rare. Analysis of 1-year bond returns versus TDs demonstrates that, for the majority of time periods, bond returns have outperformed TDs (refer Chart 2).

Chart 2: Bond prices increase as yields fall

Source: RBA, Yarra Capital Management

It’s a good time to own active fixed rate bonds

The outlook for fixed income has become more positive, meaning now is an opportune time to hold active fixed rate bonds. The latest consumer price index report suggests inflation may have peaked. As the economy slows and different sectors and issuers diverge in navigating the contraction, disciplined active managers will successfully separate the winners from the losers, dynamically adapting to new information and conditions. Bonds currently offer more attractive yields than they have in several years and are well priced. Importantly, higher yields mean greater potential returns for investors.