There is more bearishness around but not a lot of asset (re)allocation. Having lived through the fall of the Berlin Wall, the 1991 Soviet coup, the Mexican peso ‘tequila’ crisis, the Asian financial crisis, September 11 and the subprime mortgage debacle, it would not surprise me if market volatility really got going. President Donald Trump has been quiet last week, but we are still heading towards a trade war and a dissolution of US-European relations.

Trumped

Bonds outperforming equities in the US, and equities outperforming bonds in Europe is the winning box trade that most investors would not have expected (or had as a strategy) at the beginning of the year. However, the belief that Trump’s policies would be good for US growth, and therefore equities, has been ‘trumped’ by concerns that the impending trade war will be bad for growth – in the rest of the world and in the US. The Citi Economic Surprise Index turned negative for the US in February and the perception is that the flow of monthly data has turned a bit stagflationary. Measures of consumer confidence have fallen; employment growth has eased, and the Federal Reserve (Fed) has cut its 2025 growth forecast (though it left rates unchanged on 19 March). At the time of writing, the S&P 500 index was 7.8% below its February peak and 10-year Treasury yields were nearly 60 basis points below the mid-January high point.

Unclear outlook

It is still not clear what level of tariffs will be imposed and when, with most of the proposed actions on Canada and Mexico delayed until early April. But it’s the not knowing that hurts. There is growing anecdotal evidence that businesses are becoming more concerned about the outlook. How will they cope with higher input prices? Will they be able to pass them on to consumers? How could that impact their own output and supply chains? And will company revenue streams be hit? None of this bodes well for hiring and investment.

On the consumer side, people don’t believe the Washington mantra that foreign companies will be the ones paying the tariff (taxes). The University of Michigan’s consumer sentiment survey, published on 14 March, showed one-year US inflation expectations jumping to 4.9%, the highest since the middle of the pandemic inflation surge. Expectations of inflation over five-to-10 years rose to 3.9%, the highest since 1991.

Also read: At Most One US Rate Cut

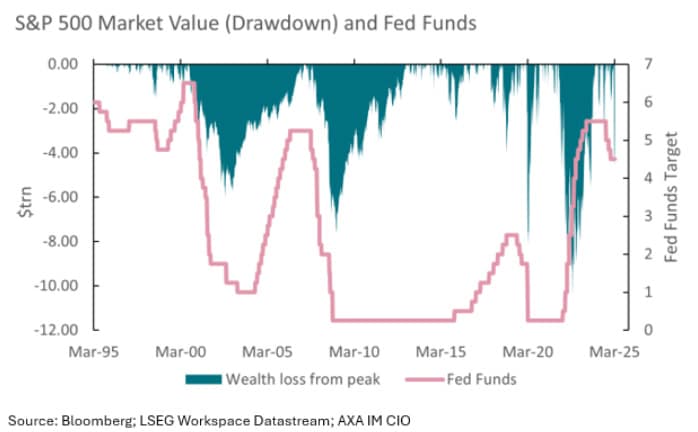

Big drawdowns will trigger the Fed

So far, the stock market wobble is manageable for the household sector. The six-month change in wealth is still positive. However, bearish arguments on US equities are well rehearsed (high valuations, slowing earnings growth, concentration, debt stability concerns and so on). Further growth and valuation adjustments could, under some circumstances, create a bear market in US equities leading to a large mark-to-market loss in household wealth. That would be a recessionary situation and would lead to the Fed easing more than is currently suggested. What the reaction from Washington would be to a prolonged move lower in share prices is anyone’s guess, but more pressure on the Fed to ease might be one of them (banning short-selling and taxing foreign investment flows anyone?)

There’s always a circular relationship between stocks and the real economy. Initial equity market falls are provoked by a change in the economic outlook and downward revisions to earnings growth expectations. As stock prices move lower, the behaviour of households that own equity and businesses changes. Spending and investment get cut, exacerbating the economic downturn. It’s a similar relationship between the central banks and the stock market. Sometimes monetary tightening causes markets to fall. If markets fall too much, central banks ease. In 2022-2023, the Fed increased rates, raising fears of a recession and changing the relative valuations between stocks and bonds. Markets subsequently fell. But there was no recession. The domestic economy was cushioned from the stock market correction by the high level of savings that had been built up during the pandemic. A market decline hitting household wealth today might result in a different outcome.

Foreign owners (ripe for taxing?)

I wrote recently about the role that foreign buying of US equities had played in financing the current account deficit. Again, using the Flow of Funds data, foreigners owned roughly 18% by value of US corporate equities at the end of 2024 and a further 7% of US mutual funds. Under the current economic and political environment, reduced foreign ownership of US equities is a risk (the relative performance of US markets versus European equities this year suggests rotation has already got underway). The bear scenario for US equities and the US economy is that foreign ownership is further reduced, confidence in earnings growth continues to fade as the economic data weakens, and lower equity prices hit household wealth even more. Any suggestion that foreign investors would face some tax penalty from trading US equities would accelerate the rotation out of the US.

Trump put (he practices every weekend)

It should not be surprising if there are more large market moves in the months ahead, even if investors appear to be mostly sitting on their hands. The upcoming S&P 500 reporting season will be very interesting. Company guidance will need to incorporate the uncertainties associated with the Trump agenda and, in the wake of DeepSeek, what makes a more competitive environment for generative artificial intelligence developers. The current 12-month consensus forecast for S&P 500 earnings growth is 12.3% – but it was 14.2% in December, and the gap between the up-down revisions ratio between Europe and the US is getting wider.

Bad things happen

Investors should think about the worst case because we have profound changes taking place in the world. I would think about a lower dollar, a higher level for credit-default swap indices, further gains in gold prices and further strengthening in the Swiss franc and even the Japanese yen.

(Performance data/data sources: LSEG Workspace DataStream, Bloomberg, AXA IM, as of 20 March 2025, unless otherwise stated). Past performance should not be seen as a guide to future returns.