Five bond strategies to help investors navigate evolving markets. From T. Rowe Price.

KEY INSIGHTS

- The pain of 2022 has reset bond yields to meaningfully higher levels that offer investors higher potential income and a margin of safety.

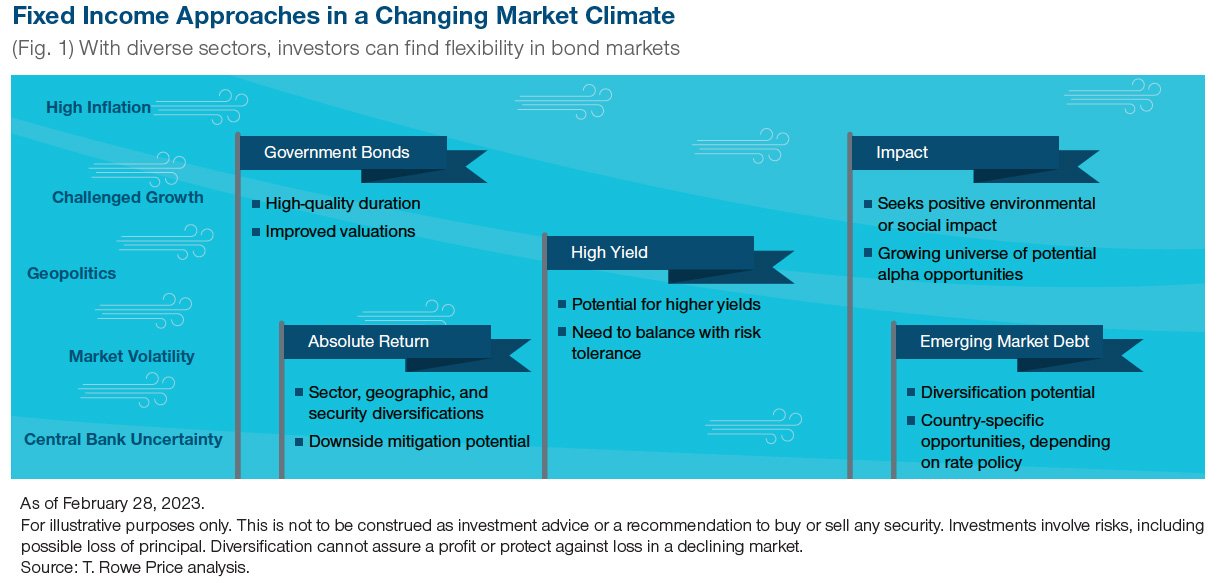

- With diverse sectors, fixed income markets offer solutions that can potentially help support investors with a range of goals and risk tolerances.

- For investors seeking diversification, absolute return bond strategies may help, while those with a higher risk tolerance and longer‑term horizon could find attractive opportunities in high yield corporate bonds at present.

Investors are grappling with a number of market and economic challenges at present, including high inflation, geopolitical risks, banking sector worries, and heightened uncertainty over the path of monetary policy.

These dynamics are challenging to navigate in portfolios, but the good news is fixed income has come a long way. The pain of 2022 has reset bond yields to their most attractive levels in many years. That means for investors there’s not only the potential to earn higher income from bond investing, but also a margin of safety to help protect investors should interest rates rise again.

A key pressure point for investors during 2022 was that the rise in bond yields coincided with stock markets selling off. This goes against the traditional tendency for fixed income to be a diversifying asset class that typically performs well when equity markets decline. Inflation has been the main driver of this, but that is showing signs of cooling. That together with a material slowdown in growth could help bonds potentially reassert themselves this year as a useful diversification tool for riskier assets. Also, with bond yields now at meaningfully higher levels, they simply have more room to rally should economic slowdown fears or a market shock put major selling pressure on risk assets.

“After a challenging period, bond markets are now much better priced for the new market realities,” says Amanda Stitt, a portfolio specialist at T. Rowe Price.

Why Fixed Income?

With diverse sectors, fixed income markets offer solutions that can help support investors with a range of goals and risk tolerances. A key appeal of fixed income investing is that there are opportunities for defense and offence. The asset class is more fragmented than others. What drives one sector of the market is different than what drives another, so there’s often a wide dispersion among sector returns. This provides investors with the flexibility to find a sector and/or combination of sectors that can suit their particular needs—whether that’s generating consistent income, defense against equity market volatility, or, in some instances, capital appreciation.

Five Bond Opportunities for the Current Landscape

1. Appealing opportunity in high‑quality government bonds

The stock of negative‑yielding debt has all but disappeared thanks to the significant repricing of bond yields this past year. This has led to improved valuations in high‑quality sovereign bond markets with yields at some of their highest levels in many years. Furthermore, with economic growth expected to continue slowing, high‑quality duration is likely to become increasingly attractive as the year progresses. Inflation is also showing signs of cooling and should this continue, it raises the possibility of positive real yielding sovereign curves going forward. This is potentially a compelling opportunity, but selectivity is key because to help finance fiscal deficits, some countries need to issue large amounts of debt this year at a time when central banks are either reducing buying or actively selling.

Also read: US Corporate Bond ETF Launched

2. Absolute return bond strategies can help with portfolio diversification

Absolute return bond funds can tactically adjust in response to shifting market conditions making them an appealing choice in a range of different environments, including volatile periods. These nontraditional fixed income strategies are typically benchmark agnostic and can cast a broader net, with the potential to invest in a wide range of geographies, sectors, and security types. However, investors should be aware that strategies within this category can vary significantly.

So for those seeking potential portfolio diversification, it’s important to look under the hood for an absolute bond fund manager that has either a low or negative correlation 1 with key market indexes, such as the S&P 500. Together with the ability to tactically respond to shifting market dynamics, strategies with these correlation characteristics give investors the potential to realize returns in a variety of different market environments.

3. High yield bonds offer attractive long‑term income opportunities

Many investors come to the fixed income market seeking a consistent income stream. And, while there are headwinds with growth slowing, the extreme volatility and significant rise in government bond yields has propelled corporate bond yields meaningfully higher. Indeed, they’re now at levels that offer potential attractive income opportunities for investors with a longer time horizon.

Some credit sectors, such as global high yield offer yields above 9.1% 2 — levels not seen since the global financial crisis. Importantly, even if the economic picture worsens, companies may be better placed to withstand it than in previous downturns as corporate balance sheets have strengthened since 2020.

But investing in credit markets comes with greater risk than government bond markets and the further down the credit scale the investor goes, the higher the risk. So, while corporate bonds may offer compelling opportunities, it’s important to undertake rigorous fundamental research. This helps to identify top opportunities and prudently manage risks.

4. Impact bonds offer the potential to invest in companies seeking positive impact

The environmental and social pressure points facing the world have never been greater, but so too is the opportunity to invest in the companies at the forefront of addressing these challenges.

So‑called impact investing is not a new asset class: It is a natural extension of environmental, social, and governance (ESG) that seeks investments made with an explicit intention to generate positive environmental or social impact and a financial return. These companies typically adapt better to changes in demand patterns, legislation, and regulation and should be well placed to deliver potential attractive investment opportunities.

But some aspects of the market, namely debt with an ESG label, has proven vulnerable to greenwashing— which is where some securities convey a false impression or provide misleading information about the environmental credentials of an organization’s products, services, and investments. This underscores the importance of fundamental research to help minimize this and identify potential positive impact companies. Also, choosing a manager that looks beyond the market of labeled bonds is important as impact can also be identified, captured, and measured by intentionally directing capital to issuers that seek to generate positive environmental or social impact through their end activities.

5. Emerging markets offer income potential and diversification benefits

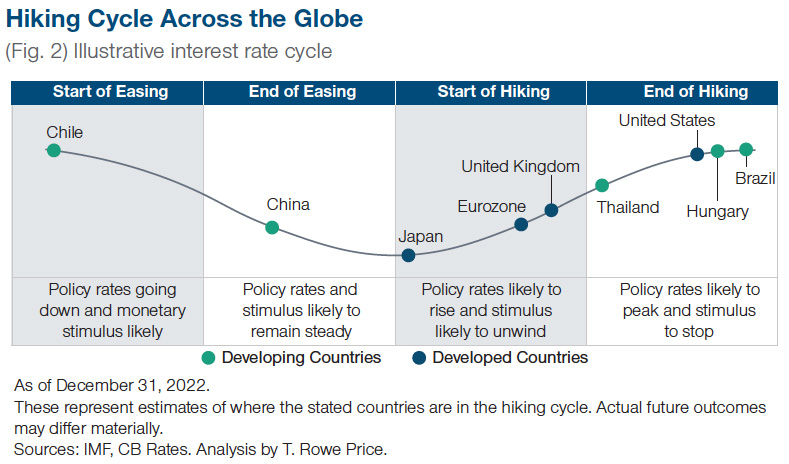

Emerging market debt is also a potential offensive strategy opportunity for investors with an appropriate time horizon. Similar to corporate bonds, yields on emerging market bonds have reached levels that offer potential attractive income opportunities for investors. There’s also a wider opportunity set and potential to diversify interest rate exposures. Indeed, several emerging market countries started hiking interest rates earlier, so they are further down the path. For example, Brazil and Hungary appear to have reached the peak and finished hiking. This could mark a good potential entry point for investors, particularly if a material economic slowdown leads to countries cutting interest rates.

Again, it’s important to note that emerging markets are subject to more credit risk than developed markets, so bottom‑up research is essential. This helps not only gain exposures to countries that offer different interest rate profiles, but also identify potential opportunities where prices have become dislocated from fundamentals.

Market Dynamics Demand Deep Research

Market Dynamics Demand Deep Research

Market dynamics have changed, and this may be unsettling for investors. But while the landscape is different, the need for fixed income as part of a diversified investment portfolio remains the same. Investors continue to seek ways to balance the need for both income and portfolio stability during these more uncertain times.

“In today’s fast‑paced, ever‑evolving landscape, fixed income offers investors a wide range of potential opportunities, whether they are seeking strategies for defense or capital appreciation purposes, or a combination of both. To tap in to this, choosing a global manager that prioritizes research is important and should help investors not only uncover potential opportunities, but also help manage risks,” says Ms. Stitt.

Footnotes

1 Correlation measures how one asset class, style, or individual group may be related to another. A perfect positive correlation means that the correlation coefficient is exactly 1. This implies that as one security moves, either up or down, the other security moves in lockstep in the same direction. A perfect negative correlation of ‑1 means that two assets move in opposite directions, while a zero correlation implies no relationship at all.

2 Yield to maturity as of February 28, 2023, for the Bloomberg Global High Yield Index.

Market Dynamics Demand Deep Research

Market Dynamics Demand Deep Research