The COVID-19 pandemic upended financial markets and delivered an enormous shock to the global economy. It forced a rapid transition from late cycle into the downturn phase of the global credit cycle. Here, U.S.-based, Loomis Sayles & Company shares its analysis of the credit cycle and key factors they’re watching.

Louise Watson, MD at Natixis Investment Managers, puts the U.S.-based article into context:

“Australian investors continue to navigate uncertain market conditions and fluctuating volatility as the global pandemic continues to play out. Investors searching for yield must assess new investment opportunities whilst being faced with increased volatility, unprecedented monetary policy and the long term prospect of these fiscal measures being dialled back.

“Global Credit Markets are one asset class where we continue to see mispricings. Credit spreads have significantly tightened since April, however, there are ways to rotate through sectors to capture returns, as evidenced in this editorial by our affiliate manager, Loomis Sayles & Company. As pockets of the economy recover, we look to position investors in the optimal phase of recovery along with avoiding the zombie companies that may likely be left over from the liquidity injection.”

What Is The Cycle Telling Us?

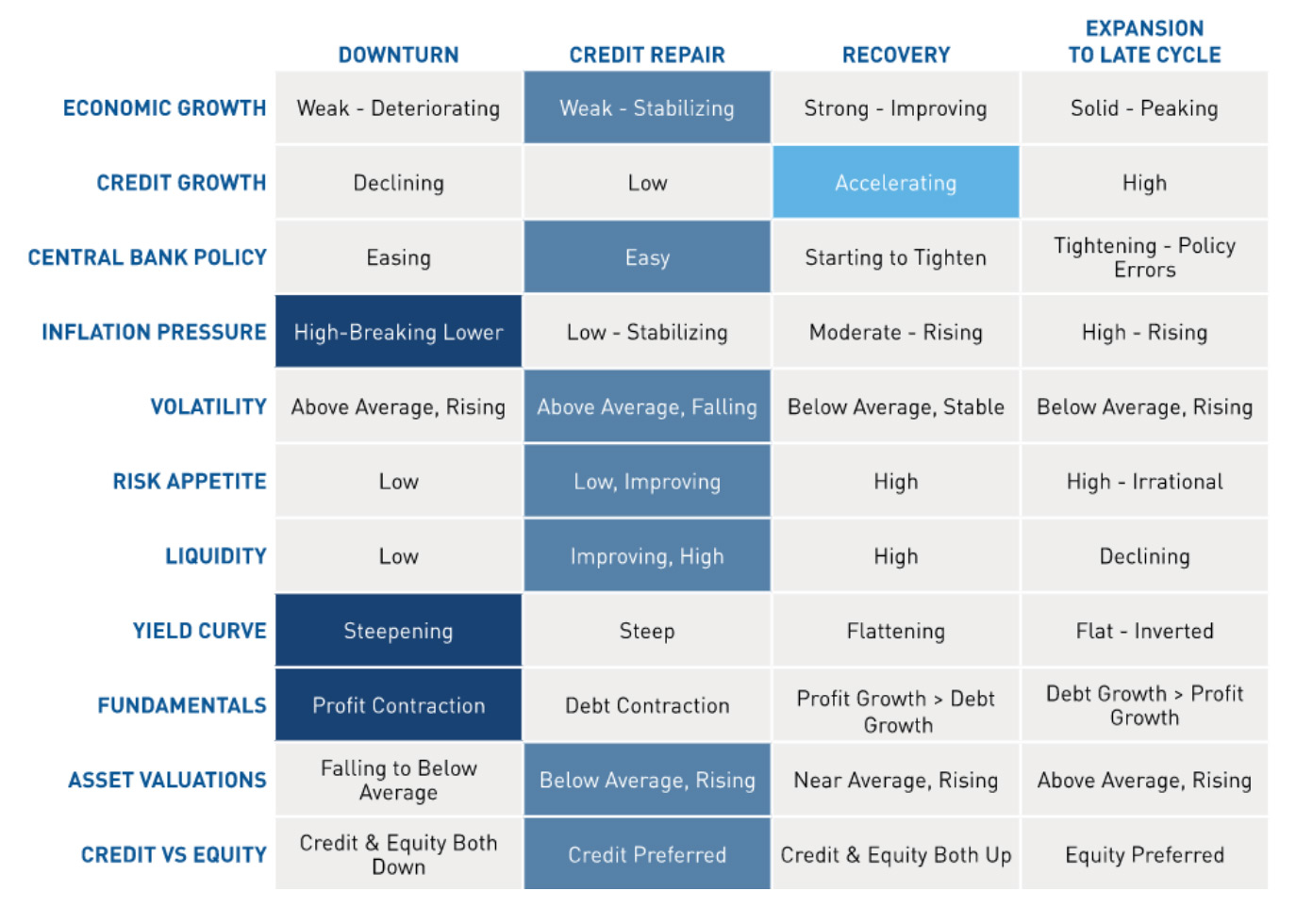

The signals we’re observing suggest the cycle is now in the credit repair phase. The table below displays typical attributes of the credit cycle and highlights the attributes we’re seeing now. While we’re seeing signals across three different phases, the majority are indicating credit repair, especially when we incorporate our forward-looking views.

Credit repair doesn’t imply that economic challenges are behind us. Instead, it highlights a behavioural shift toward saving and deleveraging, combined with easy central bank policy and above-average but declining volatility. It’s typically the sweet spot for credit as companies start to clean up their balance sheets. But deleveraging can also happen through rising bankruptcies and defaults, so we believe credit selection is critical.

The depth of the downturn has been incredibly severe. It will take time to recover, but markets are forward-looking. Importantly, we believe risk appetite generally improves in credit repair as investors begin to anticipate a recovery, which can drive credit spreads tighter and reduce global risk premiums. We are often asked how long it will take to recover the previous peak in global GDP, reached in the fourth quarter of 2019. While it remains highly uncertain, our base case assumption is that it will happen sometime in late 2021 or early 2022. Thankfully, powerful monetary and fiscal policy should help strengthen the social safety net, although they won’t prevent some painful social and business failures.

What Are We Watching?

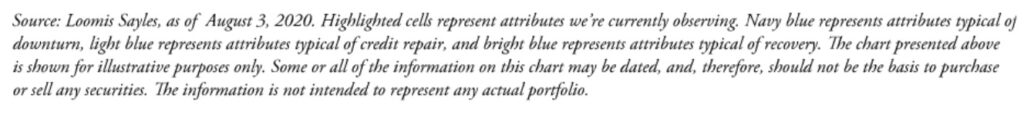

As we consider our progress through the credit repair phase, we’re focused on the signals in the table above. But we’re also considering some variables specific to our current circumstances that could influence our progress through the cycle. We believe no one variable is likely to single-handedly shift the cycle, but it could ignite a chain of developments that ultimately rotates the cycle. Here’s a snapshot of these special factors:

Courtesy of The Loomis Sayles Macro Strategies Team, as of August 3, 2020.

Since 1926, Loomis, Sayles & Company has helped fulfil the investment needs of institutional and mutual fund clients worldwide. The firm’s performance-driven investors integrate deep proprietary research and integrated risk analysis to make informed, judicious decisions. Using foresight and flexibility, Loomis Sayles looks far and wide for value – across traditional asset classes and alternative investments – to pursue attractive, sustainable returns for clients. Assets under management USD310.9 billion as at 30 June 2020.

Louise Watson is Managing Director and Head of Distribution for Australia & NZ at Natixis Investment Manager. Loomis Sayles is an affiliate of Natixis Investment Managers. Natixis Investment Managers serves financial professionals with more insightful ways to construct portfolios.