Alternative fixed income manager CIP Asset Management (CIPAM) publish a quarterly market review and outlook across a range of sub sectors. It’s got some great insights, which we condense in this article.

1. Corporate (Credit) excluding Financials

Summary: Public investment grade market spreads at post-GFC tights with extremely low spread volatility, high yield less so. Private markets look considerably better value with illiquidity premiums near the wides.

“Carnival Said to Prep Bond Sale for Next Week to Buy Back Debt”

This recent headline sums the state of play in global risk markets right now. Carnival, an operator of cruise ships which is currently rated B1(neg), B(neg) by Moody’s and S&P, respectively is issuing bonds to buy back debt. The cruise ship industry has yet to recommence at any scale and Carnival is still burning through liquidity (US$500 million a month in 1H21) and yet they look likely to be able to issue unsecured debt at around a 4.5% yield in order to retire secured debt issued at the height of the pandemic at an 11.25% yield.

Also read: What Is A Credit Spread?

Despite the global pandemic being far from over, stories like this are becoming increasingly prevalent and reflect the easy financial conditions right now.

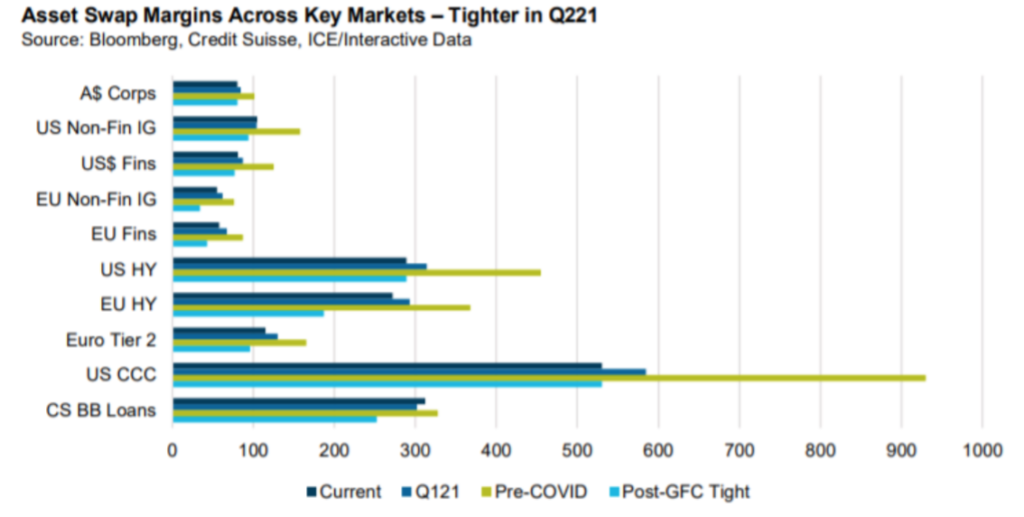

Over the quarter spreads tightened modestly with all indices below except for US leveraged loans having already more than retraced pre-COVID levels.

Domestically, spread ranges were tight despite strong corporate issuance. At $4.8 billion for the quarter and $9.8 billion for H1, issuance levels are well above historical averages but with still no meaningful financial issuance to speak of, spread levels have continued to grind tighter.

REITs have been the strongest net issuers this year and there is certainly some risk of indigestion from that sector and certainly risks to wider spreads if financial issuance surprises to the upside.

Fundamentally, corporate balance sheets seemed to have improved, or at least stabilised.

2. Financial Credit

Summary: Financials remain expensive. Lockdowns create more technical and fundamental uncertainty across the capital structure.

Offshore markets suggest that when issuance comes back, it will be significant. The ongoing lockdowns in Australia plus the ongoing global challenges in managing the more reproductive delta variant strain of the COVID-19 pandemic make the questions around bank funding needs a difficult one. Last year during the initial lockdowns, banks received strong deposit inflows and cheap funding from the Term Funding Facility (TFF). Loans were repaid with the support of government programs such as JobKeeper, JobSeeker and the superannuation access scheme. With the TFF over and federal programs both the banks themselves and their underlying customers are already exposed to lower levels of support. Our base case is that the longer the lockdowns last, the more accommodative government support will be, thus mitigating the tail risks to bank supply.

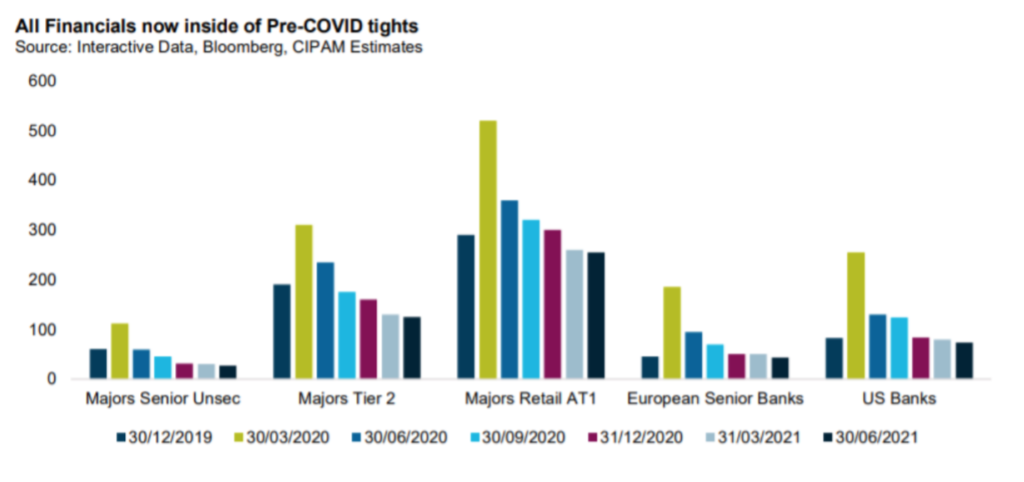

As the chart below shows, spreads across both domestic and offshore financials are now inside pre-COVID levels. Domestically, Tier 2 debt is now 65 basis points inside pre-COVID levels while riskier retail Additional Tier 1 markets are “only” 35 basis points tighter.

3. Real Estate Loans

Summary: Private real estate markets look attractive for stabilised assets but recent lockdowns create uncertainty. Public markets have lagged due to consistent issuance and weaker fundamentals.

For more information, see CIP Asset Management: What We’re Watching.