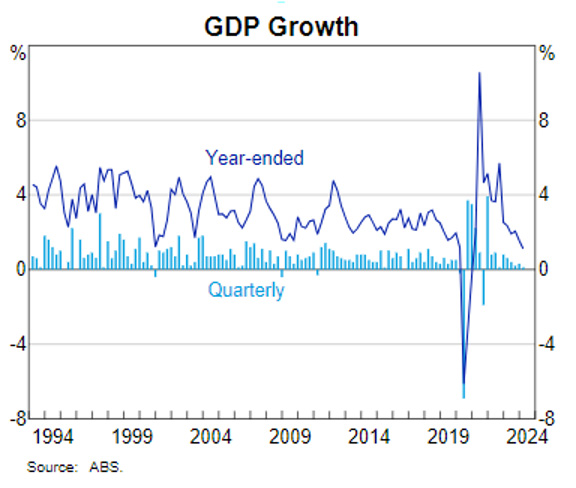

Gross Domestic Product (GDP) grew 0.2% in the quarter ending 30 June 2024 and just 1% for the 2023-24 year, the lowest since 1991-92, excluding the pandemic. The ABS attributes the weak growth to subdued household demand propped up by 0.3% government spending, the same rate as the previous quarter. Yet inflation persists. What a predicament.

Logic dictates that with such weak growth and household spending, inflation should recede further, yet the RBA rightly holds its ground and the current 4.35% cash rate. Andrew Canobi from Franklin Templeton shares his views on GDP.

There is plenty going on in fixed income markets and with four good article submissions last week, we decided to publish today and Thursday instead of our usual Wednesday morning mail-out.

First, a quick round-up of new corporate bond action:

- AMP has mandated a three-year, senior unsecured floating rate note (FRN) issue, price guidance is to come

- Auswide printed a $60m three year senior unsecured FRN. The coupon was set at 3 month BBSW + 133bps

- Scentre Group printed a $900m dual tranche 30-year, non-call 5 subordinated bond:

- $300m fixed rate with a coupon of 5.875%

- $600m floating with a coupon of 3 month BBSW + 230bps

- Woolworths printed a $200m extension to its senior unsecured April 2031 line with a 5.762% coupon.

Our lead article today is from Chris Iggo of AXA Investment Management. Iggo provides a well-rounded view of global fixed income markets and his outlook for corporate bond yields.

It seems the lines are getting blurred between developed and emerging market economies according to Alan Siow from Ninety One. He argues there are some excellent emerging market companies that should not be ignored including Samsung and Volvo, then goes on to show us the numbers.

Principal Asset Management argues now is the time to add duration before the Fed starts cutting interest rates, which is widely expected this month.

Have a good week.