The US and Australia are at very different interest rate junctures. A US rate cut looks almost certain, with markets expecting a cut to the Fed target 5.25 – 5.50% rate in September. While at home, there’s still talk of a rate hike to the 4.35% cash rate.

That means to take advantage of the two markets, you might need to extend duration for US investments, while keeping short duration for your domestic portfolio. If you’ve invested in ETFs, you may want to reassess the portfolio manager’s strategies to make sure they align with your own views. It’s important to remember, near term expectations are already built into markets.

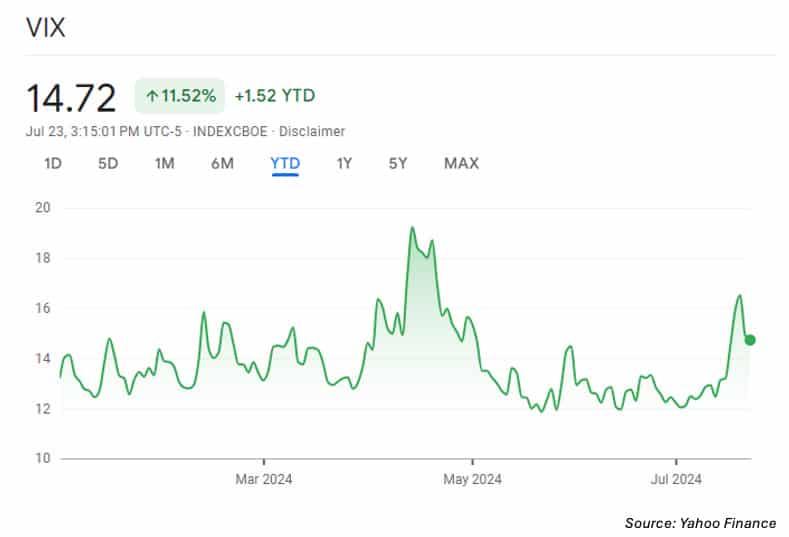

There’s plenty of uncertainty on the US election outcome, fiscal spending and alternate investment landscapes, depending on who is elected president, which is adding to volatility. The VIX has been climbing over the last week as investors look to add protection to their portfolios.

Read more about the investment strategies based on the US election from Saira Malik of Nuveen and how the upcoming US election is affecting markets.

In other interesting global news:

- BlackRock expects actively managed exchange-traded funds to reach $4 trillion from current $900 billion by 2030, driven by higher demand for active management

- Ukraine has reached a preliminary agreement with private creditors to restructure over US$20 billion of international debt. The deal involves bondholders accepting nominal losses of 37%, saving Ukraine $11.4 billion over three years through lower coupons and maturity extensions. The agreement, which includes major investors like Amundi and BlackRock, needs approval from at least 66.6% of bondholders

- The US government’s budget deficit is projected to climb to US$1.9 trillion for fiscal 2024, an increase from US$1.7 trillion last year, according to the Congressional Budget Office.

We report on how ANZ’s recent sub-debt issue broke records and showed insatiable appetite from investors.

Our lead article this week is an explanation of the current correlation between equities and bonds from Benoit Anne of MFS Investment Management and strategies to make the most of global markets.

Finally, we have a more technical article on private credit and the growth of non-bank lending from Arif Husain of T. Rowe Price.