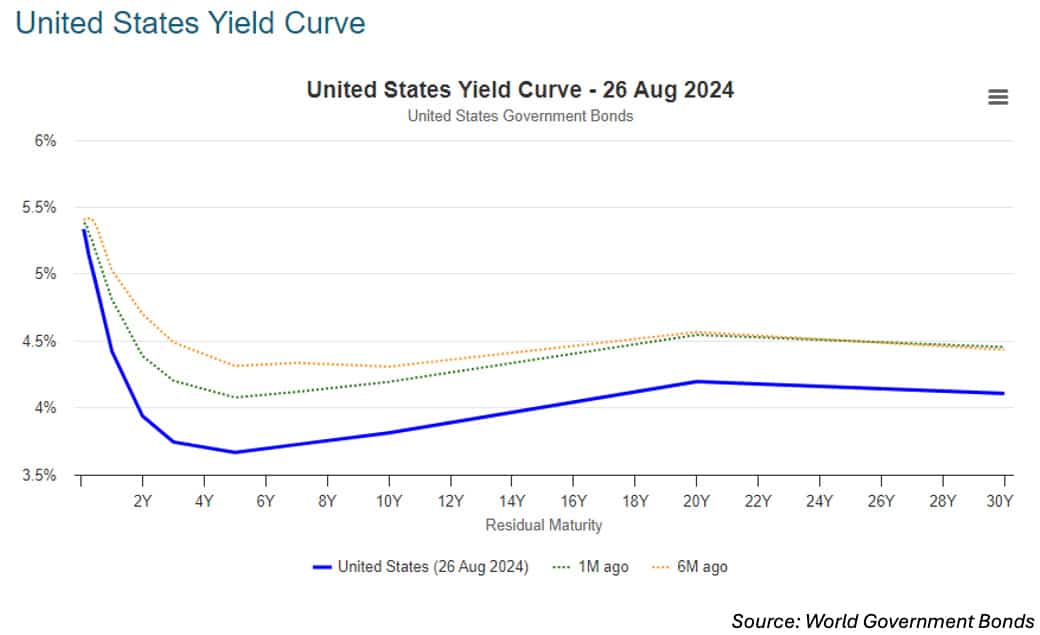

According to US Federal Reserve Chair Jerome Powell, the “time has come” for the central bank to reduce the benchmark rate from a 20-year high, noting progress on inflation. The comments that interest rate cuts were on the way were welcomed by the market with government bond yields rallying and the S&P500 up on the day. See the US government bond yield curve, in the solid blue line as at 26 August 2024, below. It’s fallen significantly from a month ago, the green spotted line. 10-year yields are now around 3.8%, down from circa 4.2% a month ago, with more dramatic falls at the shorter end.

Markets are now considering the size of the first reduction and the path of monetary policy. See last week’s article by Sonal Desai from Franklin Templeton.

In an insightful article, the Franklin Templeton Institute has taken a look at what’s happened to shares and bonds over the last 50 years, going back to 1972, when the Fed cut rates.

Blackrock has just announced a new iShares 20+ year US Treasury Bond ETF, which will compete with Betashares’ US Treasury 20+ Year ETF (Currency Hedged).

But if you are thinking rates here will be higher for longer, floating rate bond ETFs might suit. We put three under the spotlight – FLOT, QPON and SUBD.

In more global news, a feared junk bond maturity debt wall has been diffused with corporates issuing more than $170 billion to cover expiring debt maturities due in the next two years, according to Bloomberg.

Last week’s private credit podcast with Frank Danieli from MA Financial whipped up a bit of a frenzy with subscribers eager to learn more and other fixed income participants eager to comment. Paul Miron from Msquared Capital, is calling for additional scrutiny.

Did you know you can invest in catastrophe bonds? Yes, they are as they sound, an insurance against climate change sort of events. Learn more from Gareth Abley of MLC and how they invest in this unusual market.

Finally, a technical piece from Steven Boothe from T. Rowe Price on the growing inelasticity of the share and bond market with higher percentages being invested in passive funds.

Today, we’ll learn more about how our domestic economy is going with its inflation fight.

Have a good week.