Treasurer Jim Chalmers handed down the budget last night with the Libs stating they will honor many of the policies. So, no matter who wins the election, we are looking at higher sovereign debt levels.

Australian debt is climbing at a clip, and we need to accept there’s going to be some pain in getting it under control, but neither side looks like stepping up. I am all for spending money on much-needed infrastructure, but blanket fuel bill measures aren’t targeted enough to help those that really need it and are a waste. Still, Australia’s debt position is manageable.

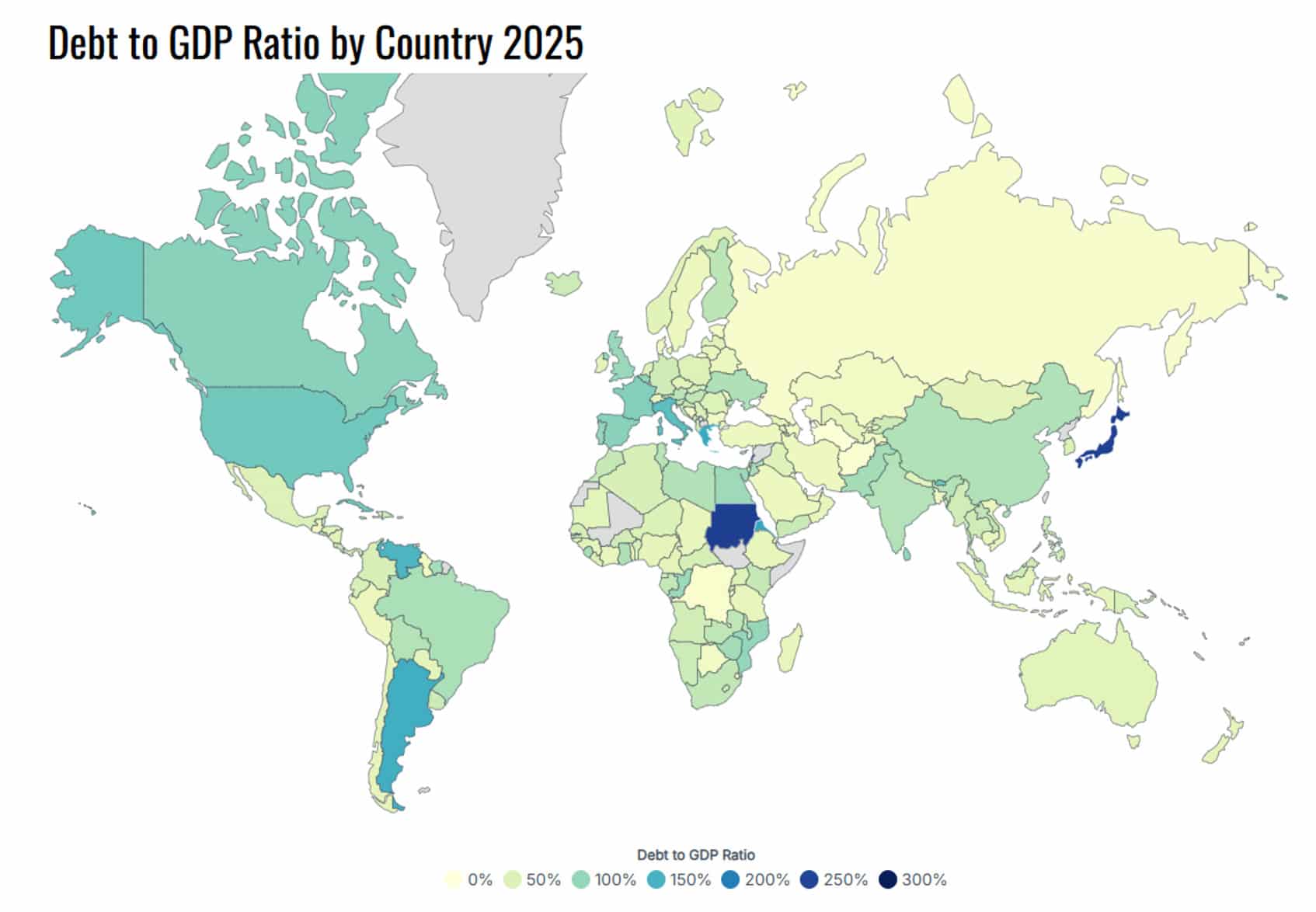

Have a look at this debt to GDP map from the World Population Review. If you click on the link to its website, you can play with the interactive version.

Lebanon has the highest ratio at 283%, followed by Sudan at 256% and Japan at 255%. Some of the others with rates over 100% include: Singapore with 168%, Greece 162%, Argentina 155%, US 122%, France 111%, Spain 108% and Canada 108%. Australia is well down the list at 43.8%.

According to the Institute of International Finance, total global debt has peaked at 326% of global GDP, adding $12 trillion in the last three quarters of 2024.

Rising global debt to GDP means more sovereign bonds competing for investment and may mean yields will rise with ever-increasing supply.

The US Fed left rate cuts unchanged last week wanting to see inflation at 2% from its current 2.8%. Chairman Powell said he expects two cuts this year. Sonal Desai from Franklin Templeton argues that indicators show just one cut. She says the longer the uncertainty in markets, the higher the risk.

Interestingly, a Deutsche Bank survey places the probability of a US recession at 43% in the next 12 months, reflecting growing concerns about an economic slowdown despite low unemployment and continued growth. The Federal Reserve lowered its 2025 GDP growth estimate to 1.7%, the second slowest since 2011, and raised its core inflation forecast to 2.8%, fueling fears of stagflation.

Chris Iggo of AXA IM takes a good look at successful trades this year, and while still positive, the declining outlook for S&P earnings growth and US equities this year.

Curve Securities has a new investment platform for not for profits managing multiple deposits and we publish a very interesting article from Robert Almeida at MFS Investment Management about navigating investment uncertainty and cognitive biases.

Two new corporate bond issues this week were:

- Scentre Group raised $650m in a 30NC6.5 (30-year maturity with first call after 6.5 years) subordinated bond. A $300m fixed to floating tranche with a 5.9% coupon or 200bps over semi quarterly swap and a $350m floating rate tranche at the same rate

- Australian Gas Networks raised $250m in an 8.5-year senior secured deal at 143bps over semi quarterly swap.

Have a good week!