A combination of higher brent crude oil prices and stronger than expected US jobs data has the market concerned about inflation once again.

Global benchmark 10-year US Treasury bonds have sold off with yields back up over 4%, as were 2-year Treasuries. Australian government 10-year yields were higher at yesterday’s close at 4.22%.

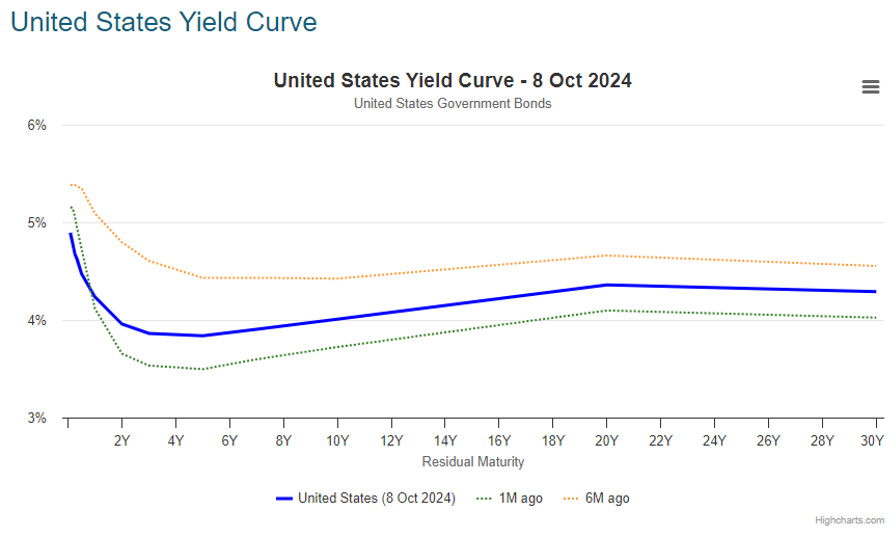

The whole US Treasury yield curve has moved up from a month ago, with the solid blue line above the dotted green line in the chart below. Also, notice how relatively flat it is than its recent past, a sign that the market expects a shallow rate cutting cycle.

US investment grade corporate bond spreads reached their lowest level in over three years last week, with the average bond spread falling to 83 basis points, the tightest since September 2021. While investors are selling Treasuries, they’re continuing to hold onto corporate bonds.

The minutes of the last RBA board meeting were released yesterday, showing a step down from its previous guidance, saying rates would be cut if the economy was weaker or if inflation was less persistent than expected.

Andrew Canobi from Franklin Templeton discusses ways to manage the transition to a rate cutting cycle.

I was fortunate to interview Mike Della Vedova from T. Rowe Price last week, to talk about the global high yield market. Its composition has changed with US exposure much lower than has traditionally been the case. He explains why expected defaults are lower than what the market anticipates and why they think it’s attractive even though spreads have narrowed.

Emma Lawson from Janus Henderson is back with her excellent monthly wrap on Australian fixed income.

We have a very interesting article about dynamic duration, where Andrew Lakeman from Atlantic House sets out how they use derivatives and gear strategies, while minimising credit risk in order to outperform.

Have a good week!