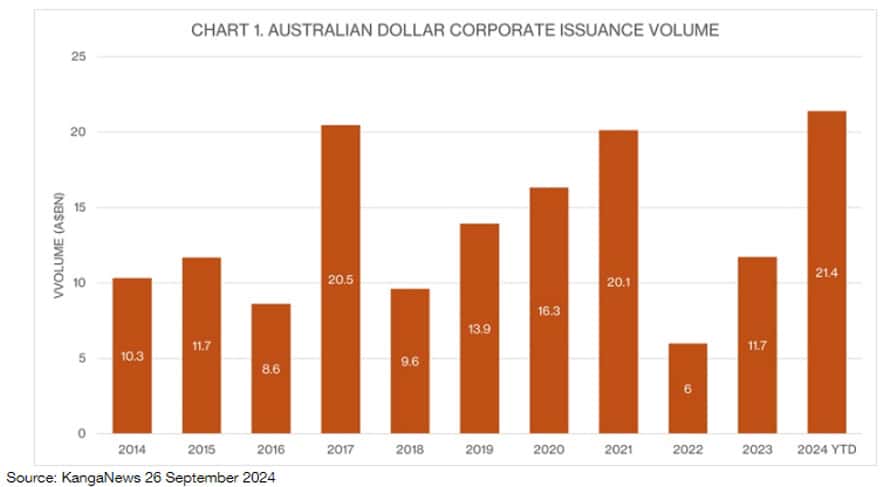

Did you know there’s been a record set for annual Australian corporate bond issuance this year? KangaNews recently announced issuance of $21.4 billion, topping strong 2017 and 2021 years.

The top three deals, excluding financials, were NBN $1.75 billion, Telstra $1.2 billion and Nestle, which also issued $1.2 billion. It’s thought issuers were keen to tap the market before any potential volatility leading up to the US presidential election. Consequently, it’s anticipated there will be less new issuance leading into the calendar year-end.

China’s new stimulus measures have taken the pressure off lower global growth projections with commodity prices and the Chinese stock exchange up significantly since the announcement. Janu Chan from Bite-Sized Economics gives us her take, suspecting there could be more stimulus to come.

Chris Iggo from AXA IM assesses what’s in store for bond investors with the US Fed’s 50 basis point cut. He argues the risk premium in US Treasury yields could widen further – a reason not to invest in the long end of the curve. While Paul Mielczarski, from Brandywine Global looks at what happened to long duration bonds after past Fed rate cuts.

The Australian economy is often compared to the Canadian economy, so I found Betashares’ Chamath De Silva’s article comparing the two and the case for investing in bonds compelling.

MFS IM’s, Robert Almeida’s latest article, To Find the Bust, You need to find the Boom, had me fully engaged right until the end. I won’t spoil it, but take the time to read it, it presents a different way of thinking about cycles and may help with other parts of your portfolio.

Sadly, escalating Middle East tension is taking the headlines this morning, along with planned protests at home. Let’s hope world leaders can find a way to de-escalate. As uncertainty rises, perhaps it is a time to be more risk-off at the moment?

Have a good week!