S&P Global Ratings has warned that Australia’s prized AAA credit rating may be in danger of a downgrade if the government doesn’t address large structural deficits in coming years. Debt funded spending looks set to increase no matter who wins the election on Saturday.

Why do credit ratings matter?

Australia is one of only a handful of countries that has the highest AAA credit rating. Importantly, a number of other sovereigns and global investors have mandates that requires minimum allocations to AAA-rated holdings, so losing the AAA-rated status may lead to a sell-off of government bonds as well as other Australian securities. In short, yields on government bonds would likely rise, as would interest expense. State and territory bonds as well as major bank bonds are also tied to the sovereign credit rating, so they would likely be downgraded and face rising interest costs as well.

In reality, credit rating downgrades for sovereigns, take time. The agencies would usually place credit ratings on ‘negative outlook’ before inflicting a downgrade.

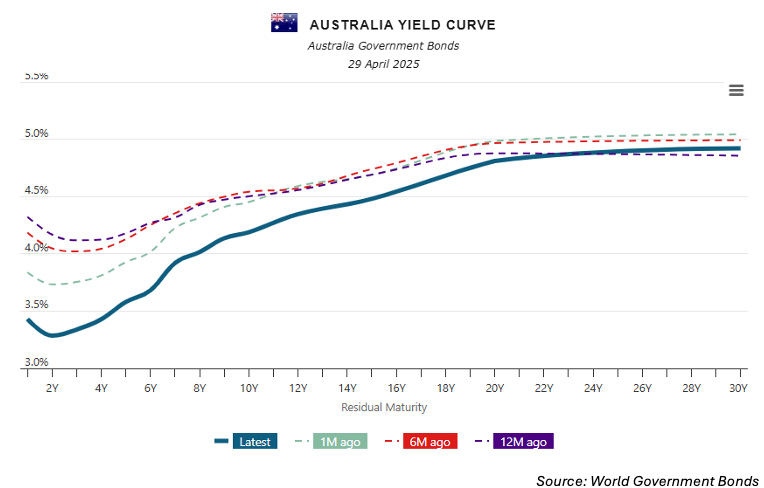

Meanwhile, the government bond yield curve, which plots yields of different maturity bonds over time, is steepening. The current curve, shown in the solid line below is materially lower than the curve a month ago, shown in the pale green dotted line. Lower front-end rates imply near-term cash rate cuts. The two-year rate is down 90 basis points over the last year to 3.25%, and the 10-year was trading at 4.15% at close of business yesterday.

This morning, the ABS announced annual inflation to 31 March 2025 had stayed flat at 2.4%. However, the all-important trimmed mean has finally fallen to 2.9%, down from 3.3% in December, meeting the RBA’s Monetary Policy Board’s 2-3% target range. The rate supports the expected cash rate cut next month.

Benoit Anne from MFS Investment Management puts the US dollar and treasury market into perspective. Its sheer size, relative to other markets and liquidity, means it’s unlikely to be challenged as the global reserve. He argues global bonds have outperformed and tells us where he’s buying.

We have an excellent article explaining duration and its role in your portfolio right now from Lukasz de Pourbaix of Fidelity International.

The private credit market continues to gather momentum. Nehemiah Richardson, of Pengana Credit argues diversification is key.

Invesco’s monthly fixed income strategy report used some excellent charts to explain why the high yield market is better quality than it used to be. If you are chasing income and outright yield, this article is well worth a read.

Contrary to Invesco’s positive view on high yield, Janus Henderson Investors thinks the sub sector is too expensive. Delving into fixed income, equity and alternative sub sectors, Janus Henderson has reviewed global markets.

Have a great week!