The ASX 200 is down almost 16% from its recent mid-February high. Investors are selling down equities looking for defensive assets, unsure of how long the decline will last.

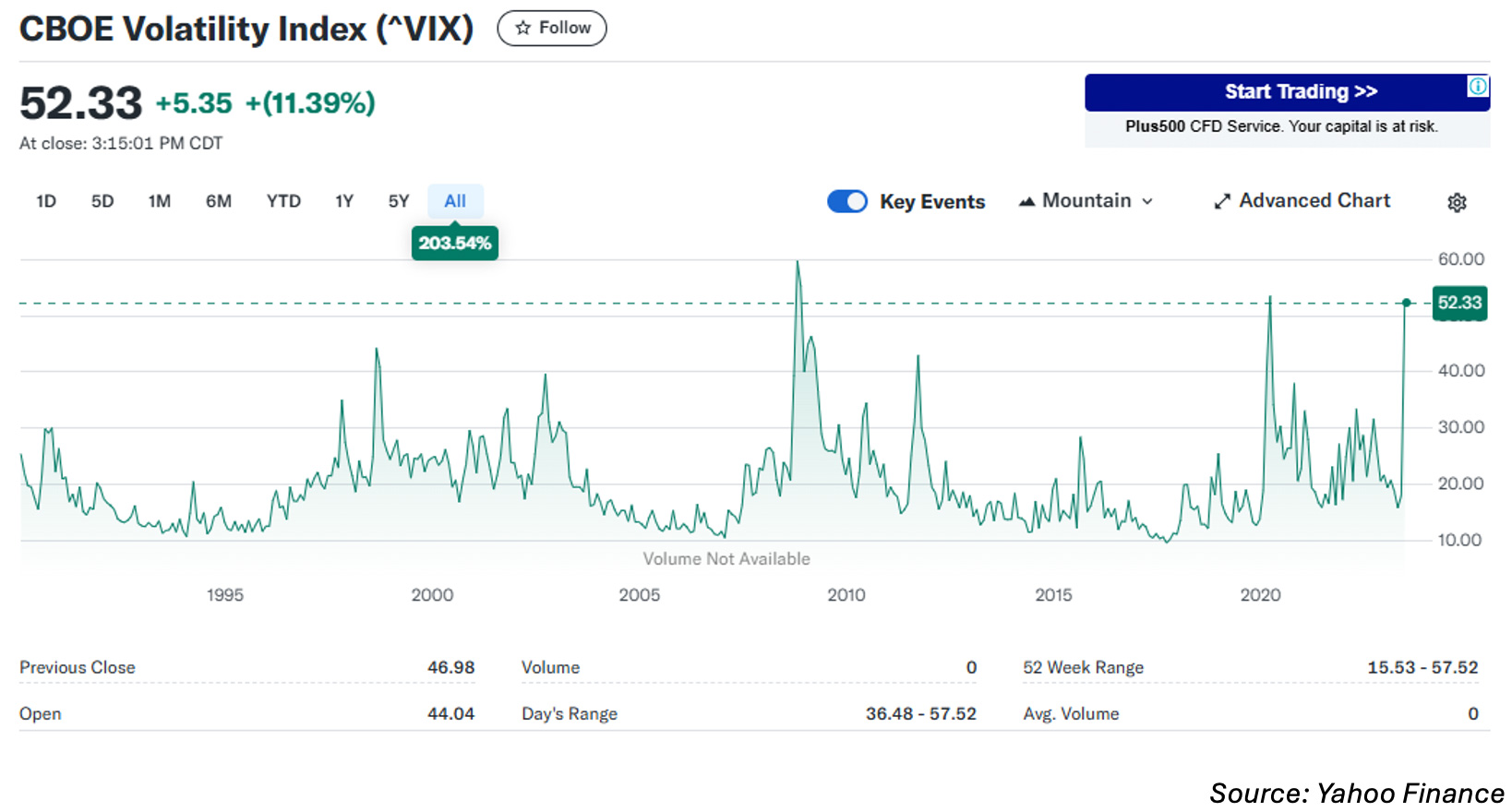

It’s been a while since we’ve seen this sort of correction but, unlike COVID where we found a vaccine, there doesn’t seem to be any obvious solution. Neither the US nor China look likely to relent. No wonder the market is panicking with so much uncertainty, fear, the promise of higher costs, and the threat of stagflation. The Volatility Index (VIX) has spiked to over 50 points, the third highest recording since the index began in the early 1990s, making this correction similar to the global financial crisis in 2007.

We have many excellent articles on what we’re seeing in fixed income markets. Benoit Anne from MFS Investment Management says, US equities are pricing in a recession while fixed income spreads are well short of recessionary warning levels.

Chris Iggo from AXA Investment Managers says that investors need to protect their wealth and more defensive safe-haven asset classes will likely better perform than equities.

In this topsy-turvey market, US 10-year treasury yields fell, delivering a gain for investors in that part of the curve, while the 2-year rose according to the Blackrock Institute. Interestingly, Adam Marden from T. Rowe Price says we need to rethink traditional safe haven assets.

Seema Shah from Principal Asset Management believes inflation pressures are set to intensify and that the US Fed may not be able to provide the monetary support the growth picture needs and could even bind them from cutting rates at all.

The Franklin Templeton Institute discussed with investment leaders implications for investors and what to anticipate moving forward.

Updated ETF Finder

If you’ve been selling down your equities and looking for risk-off assets, our Fixed Income News Australia website can help. We’ve updated our ETF Finder to help you in your search for fixed income investments. There are now 85 ETFs available with very different characteristics. We have classified them by sector and by geography and listed a few positives and negatives as well as past performance and yields. In my article, I also outline the best and worst performers over the year and what I found interesting.

Have a good week!