As a new investor in fixed income securities, understanding bond credit ratings is essential for assessing risk and making informed investment decisions.

What Are Bond Credit Ratings?

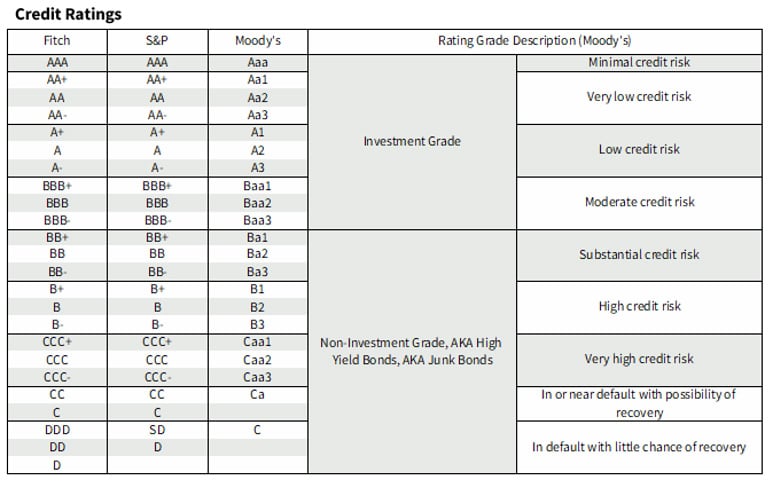

Bond credit ratings evaluate the creditworthiness of bonds issued by corporations, governments, or other entities. They are expressed in letter grades (e.g., AAA, BBB, C) and assess an issuer’s ability to meet their financial obligations. Higher ratings indicate lower risk, while lower ratings suggest higher potential risk of default.

While an issuer may receive a specific corporate credit rating, individual debt issuances can carry different ratings based on their structural characteristics, with senior debt typically rated higher than subordinated debt due to its priority in payment hierarchy and stronger recovery prospects during financial distress.

These ratings directly impact interest rates, with lower-rated bonds offering higher yields to compensate for increased risk. This risk-return trade-off is fundamental to fixed income investing.

Major Rating Agencies and Their Scales

The primary credit rating agencies are Moody’s, Standard & Poor’s (S&P), and Fitch, with each controlling significant portions of the market. These agencies analyse financial statements, industry conditions, credit history, and external factors like regulatory environments to determine ratings.

Ratings of BBB- (Fitch and S&P), Baa3 (Moody’s) and above are considered “investment grade,” while ratings below this threshold are classified as “non-investment grade,” “high yield,” or “junk bonds”.

Understanding Default Risk by Rating Category

Credit ratings are directly correlated with historical default rates. The default risk increases significantly as you move down the rating scale and as time horizons extend.

For example, S&P’s historical data (1981-2022) shows that AAA-rated bonds have had a cumulative default rate of just 0.52% over a 10-year period, while B-rated bonds show a 23.89% default rate over the same timeframe. This dramatic difference illustrates why ratings matter so much to investors.

Also Read: Explore ETFs With Our Fixed Income Finder

Investment grade bonds (BBB- and above) consistently demonstrate much lower default rates than non-investment grade bonds. After 5 years, BBB-rated bonds have shown approximately a 1.42% default rate, while BB-rated bonds jump to about 8.37%, and B-rated bonds reach 21.43%.

An important consideration in credit risk management is understanding the Probability of Default (PD) and Loss Given Default (LGD). PD measures the likelihood that a borrower will fail to meet their debt obligations within a specified period, while LGD estimates the percentage of the loan amount that a lender expects to lose after accounting for recoveries through asset liquidation or other means. Together, these metrics help lenders and investors evaluate potential credit losses more comprehensively.

Key Considerations When Evaluating Bond Investments

- Creditworthiness: Evaluate the creditworthiness of bond issuers by examining their credit ratings from reputable agencies. Remember that these ratings are opinions about relative risk, not guarantees.

- Yield and Maturity: Consider the yield to maturity (YTM)—the total return anticipated if the bond is held until maturity—when comparing bonds. Lower-rated bonds typically offer higher yields to compensate for increased risk.

- Diversification: Avoid over-concentrating investments in a specific type of bond or issuer to spread risk effectively. Diversification across different ratings, sectors, and maturities can help manage default risk.

Pitfalls to Avoid

- Over-Reliance on Ratings: Investors may overly depend on ratings without conducting independent analysis. Always perform your own due diligence beyond the rating.

- Sudden Downgrades: Rating downgrades can destabilise markets or portfolios, as seen during financial crises. These can occur rapidly when economic conditions deteriorate.

- Conflicts of Interest: Agencies are paid by bond issuers, potentially leading to biased assessments. This structural conflict has been a subject of criticism following past financial crises.

Making Informed Investment Decisions

Credit ratings are a valuable tool but should be used alongside broader financial analysis for informed investment decisions. Consider your risk tolerance, investment time horizon, and financial goals when incorporating ratings into your decision-making process.

For new fixed income investors, starting with higher-rated bonds can provide a safer entry point, while more experienced investors might allocate a portion of their portfolio to higher-yielding, lower-rated bonds for enhanced returns.

Remember that ratings facilitate bond trading in capital markets by standardising credit risk assessments. They help investors quickly evaluate relative risk, but they’re just one piece of a comprehensive investment strategy.

By understanding credit ratings and their implications for default risk, you’ll be better equipped to navigate the fixed income market and build a bond portfolio that aligns with your investment objectives.