Hybrids have long been sought after for high income and franking credits. The Australian market mostly consists of bank and financial institution securities that have similar features.

The international market is much more diverse and offers some really interesting options, but the investments can also be much higher risk.

Daintree recently made its global Hybrid Opportunities Fund available through the ASX. The fund invests in up to 50% of international securities. Aside from investing $500,000 through a broker in separate securities or access through other even more diverse managed funds, there’s been few ways to access this market.

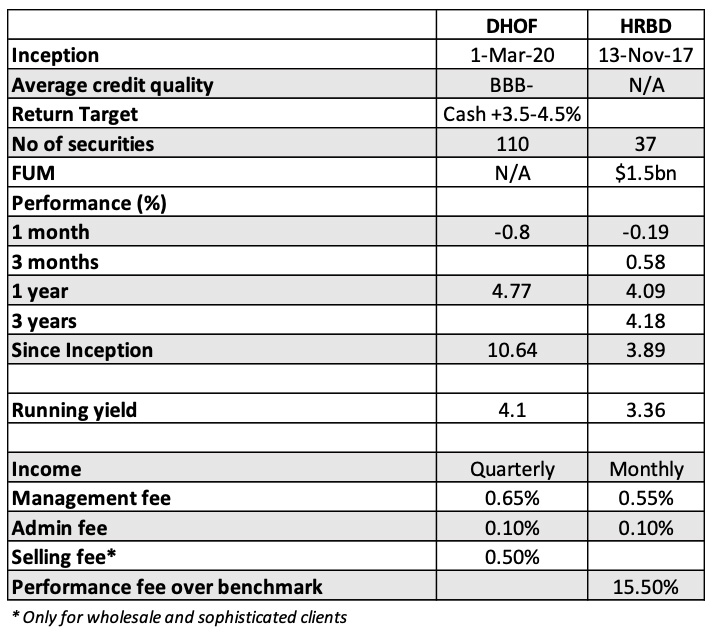

I thought it would be interesting to compare the successful domestic BetaShares Active Australian Hybrids Fund against the newer Daintree fund.

Daintree Hybrid Opportunities Fund (ASX:DHOF)

DHOF invests in Australian and international hybrid securities and commits to hold at least 50% in the domestic market. International investments not domiciled in Australian dollars are hedged back into AUD.

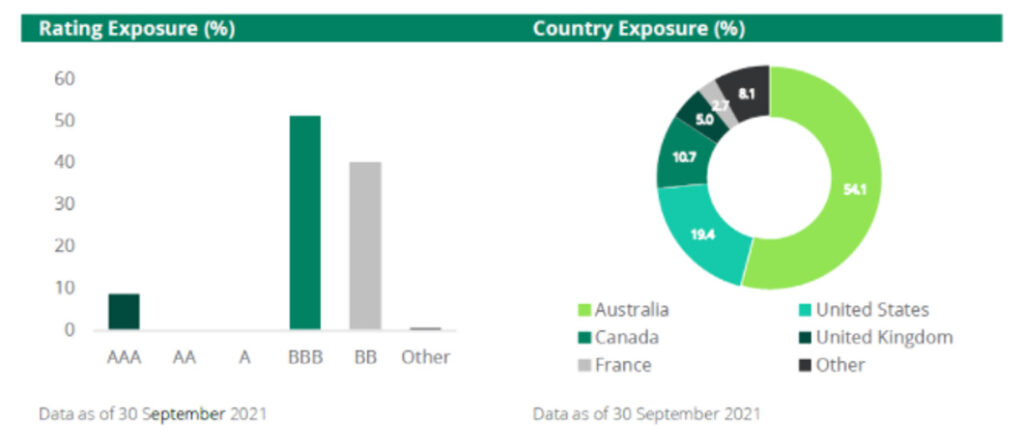

As at end of September 2021, DHOF comprised 54% of Australian hybrids, followed by 19.4% from the US and 10.7% from Canada, showing reasonable global diversity.

We don’t have an understanding of the structure of the securities and this can be quite diverse but we do know approximately 40% are sub investment grade, rated in the BB range or lower.

The fund doesn’t list individual securities in its portfolio, making it difficult to understand the types of international companies it invests in.

The fund targets a 3.5 to 4.5% return over cash, and states its objective is to provide a total return after fees that exceeds the RBA cash benchmark.

Also read: Capital Notes – What Are They and Should You Invest?

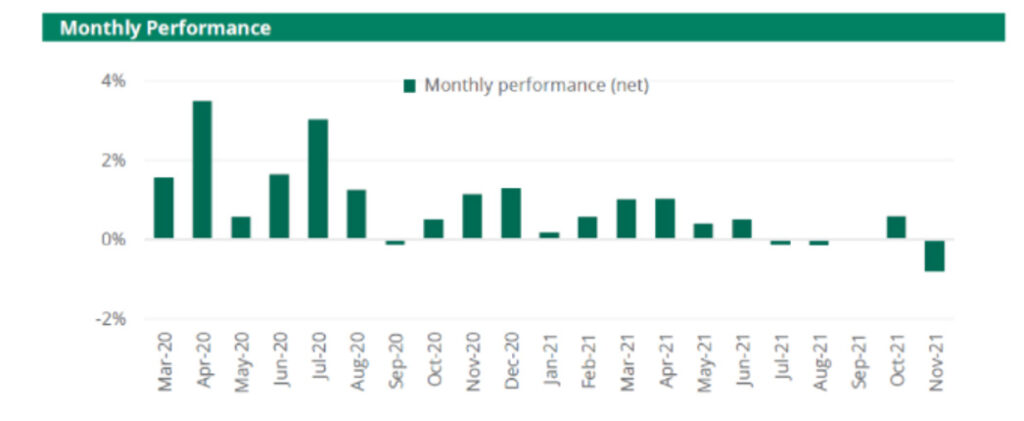

The inception date for DHOF was 1 March 2020, which was opportune as this was close to the low point in financial markets due to the COVID pandemic. So, the fund can show some very good early returns, see the monthly performance chart below.

More recent returns have been lower with the one month November return -0.8%, which the fund manager attributes almost entirely to movements in the US.

Currently, DHOF invests in 110 securities with an average portfolio yield of 3.95% p.a. It also hedges currency and other risks to help smooth returns.

Fees include a management fee of 0.65% plus a 0.10% administration fee, which includes GST. There are no performance fees.

BetaShares Active Australian Hybrids Fund (ASX:HBRD)

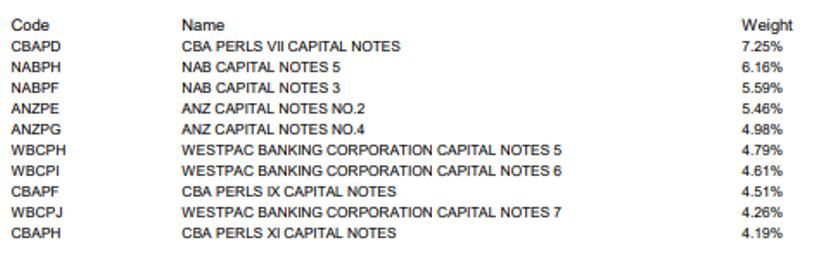

HBRD has grown substantially since inception in November 2017 and now has an impressive $1.5 billion in funds under active management. Unlike DOHF, HBRD is much more concentrated and invests in 37 domestic hybrid market securities, as at 30 November 2021.

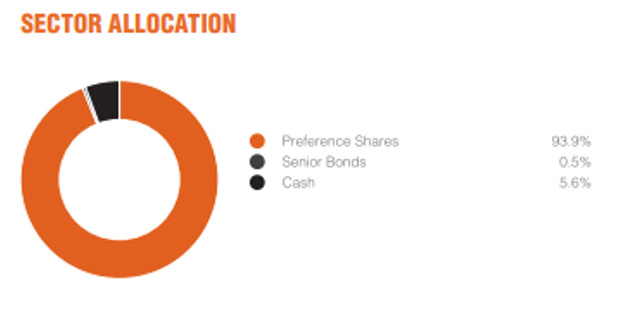

Circa 94% of the fund is invested in hybrids (preference shares).

At 30 September 2021, the fund’s top ten holdings included circa 15% to three CBA securities with the CBA PERLS VII the top holding with 7.25% of the portfolio.

On a gross basis, the fund has consistently outperformed its Solactive Australian Hybrid Securities Index, however after fees, returns are lower. Since inception, the fund’s gross return was 4.83%, net 3.89% (0.94% taken in fees) against the index at 4.06%.

While the fund doesn’t disclose the credit ratings of its portfolio, it would be substantially investment grade and would likely have lower credit risk when compared to DOHF.

Fees include a management fee of 0.55%, an administration fee of 0.10% and a performance fee of 15.5% of performance above the benchmark.

Summary of DHOF and HBRD side by side

Even though DHOF and HBRD are both active hybrid ETFs, they are quite different.

Domestic hybrid terms and conditions are quite similar, although some of the terms to maturity have been getting longer.

International hybrids come in many forms. Terms and conditions can vary greatly and an international portfolio would take more work in understanding each individual security.

Income investors might prefer HBRD for its track record of beating its index and monthly payments.

DHOF offers a broader range of securities.

Part of your analysis if you are deciding between the two funds should be whether you expect they would perform similarly in a downturn or not and how liquid your holdings might be if you wanted to access your capital.

Note: This article is for general information purposes only and is not a recommendation for either fund. Historical returns are not a guarantee of future performance.