Most investments have risks and before you invest it’s best to know and understand how the risks could impact your investment.

Fixed income investments can be into companies you already know, such as Commonwealth Bank, BHP or Apple, so if you already follow a high profile company, may overcome an initial hurdle about business operations and profitability etc.

One of the key risks when investing in shares is future performance. You need to ask yourself if the company will continue to grow and its share price increase? If you are an income investor, you’ll need to consider if dividends are sustainable and if you think they will increase as well?

Investing in fixed income and particularly individual corporate bonds, you should be thinking about survivability rather than growth. As bonds are legal obligations, the companies are going to make interest payments and repay principal at maturity if at all possible.

So, ask yourself, will the company continue to operate for the term of the bond until it matures? Also, where does the investment sit in the capital structure?

Two quick measures to help you assess risk

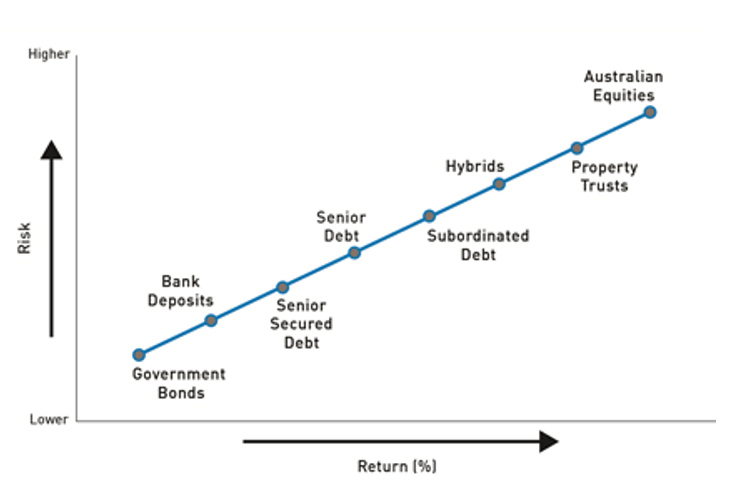

The return on offer is usually a good indicator of risk, the higher the return, the higher the risk. Towards the end of 2021, in a very low interest rate environment, a higher risk, high yield investment would be considered to be earning circa 3% plus.

Basic risk versus return graph

The second indicator, which isn’t always available, is a credit rating. Investment grade credit ratings (AAA to BBB- on the S&P Global rating scale) imply low risk and low chance of default, that is of you not receiving income or principal at maturity. Lower, sub investment grade credit ratings (BB+ and below down to D) imply greater perceived risk of default. For more on credit ratings see Interpreting Credit Ratings – What Do They Mean For Fixed Income?

Three key fixed income risks

Understanding risks will help you understand if you are being rewarded properly for the risk you are taking. If possible, look at similarly rated investments and the yields on offer, other investments in the same company, or if you are investing in funds, check performance over comparative periods to similarly invested funds and the current running yield and yield to maturity of the funds.

Also read: In-Depth Look At Fixed Income With ABX Co-Founder Markus Mueller

Here are my three key risks:

- Credit or default risk

This is the risk that the company cannot afford to pay you interest owing or return principal at maturity, which is known as a default and there are a wide range of possible outcomes if this happens. For some companies, it’s a temporary hitch and they go on to pay money due. For others, in a liquidation scenario, it can take years for investors to get money back, which can be all of the outstanding owed, right through to zip, zero, zilch – a very poor outcome.

A recent example of a default was Virgin Airlines, where an ASX-listed bond was offered with an 8%p.a. return. The company went into administration and last I heard, unsecured creditors including bondholders were expecting to get back 9-13 cents for every dollar invested.

- Interest rate risk

This type of risk can be both positive and negative.

A large proportion of bonds are ‘fixed rate’, that is pay a fixed rate of interest for the life of the bond. Fixed rate government bonds, in particular, can be very long dated 20, 30 or even 50 years until maturity. As you can imagine a lot can happen in markets over time and interest rate expectations of what is a satisfactory rate of return will change.

The only way fixed rate bonds can reflect interest rate expectations and issuer specific shifts is through the changing price of the bond. All things being equal, fixed rate bond prices will go down when the markets expect interest rate to rise. The opposite is also true, when interest rates are expected to decline, fixed rate bond prices will rise.

‘Duration’ is a measure of the sensitivity of the price of a bond to a change in interest rates and is often quoted for bonds and fixed income funds, giving you insight into the risk you are taking.

- Illiquidity

Liquidity is a measure of how easily an investment can be sold without a change in price. Australian government bonds have been very liquid assets even in stressed markets. Major Australian bank corporate bonds have also been highly liquid.

Higher risk investments, such as hybrids and sub investment grade, high yield bonds have tended to be illiquid in stressed markets.

Liquidity can change quickly and it’s important to have ready access to funds.