Are we nearing the top of the interest rate cycle?

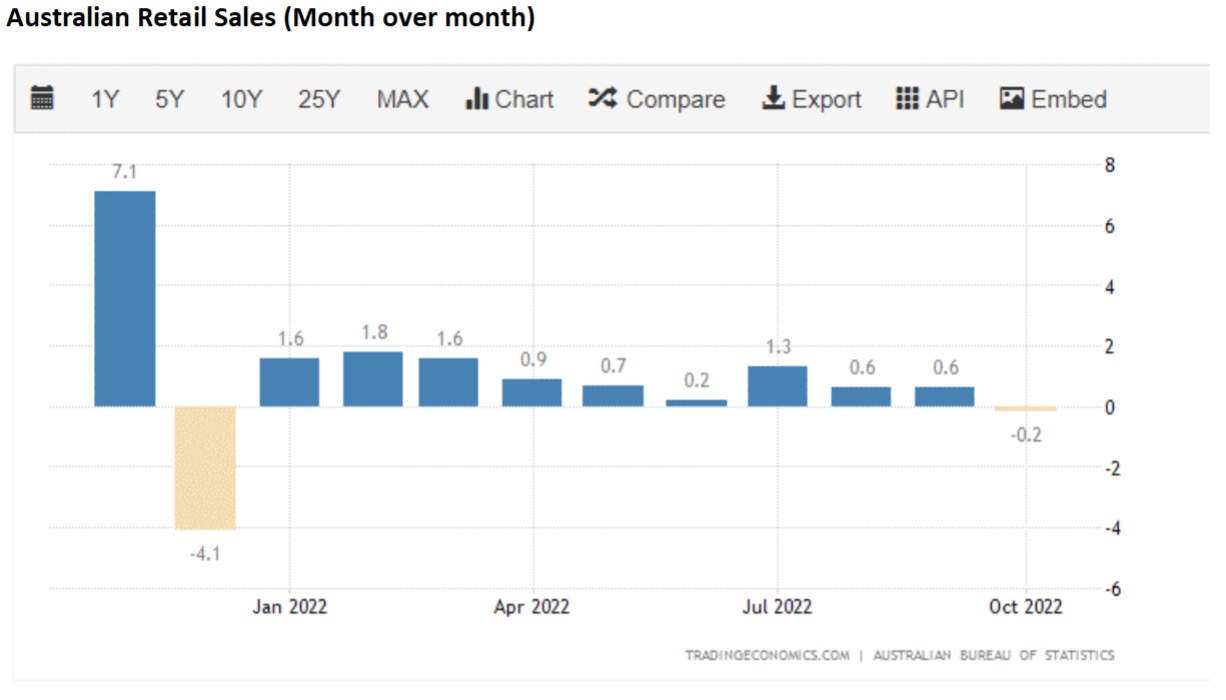

Perhaps. One sign that might suggest we are close was this week’s announcement of October’s retail sales rates. Rates declined unexpectedly with spending down 0.2%, when it was projected to increase by 0.6%, perhaps a signal that the RBA’s cash rate increases are starting to take effect.

Citing the lower spending as a definite signal, economist Stephen Koukoulas has stated he only sees one more rate hike of 0.25% to take the cash rate to 3.10%.

“Consumers are responding to higher rates. The RBA doesn’t need to hike, clearly inflation is abating, but that said probably will, then we are near the end of the rate hikes.”

Investors looking to lock in high returns should consider we may be nearing the high point of the interest rate cycle and consider locking in current high fixed rate yields.

Whether that’s through direct investment in Australian corporate bonds or through an active managed fund or ETF, there are many options available. See our Bond Portfolio Examples for some direct investment options, but note, prices change constantly. If you are interested, it’s best to ring a broker and find out what’s available.

This week I’ll look at three fixed-rate ETFs and next week some managed funds. By all means, have a look at past performance of the funds, but over the last year, they all reported negative returns. Three fixed-rate, investment-grade ETFs that currently offer high yields to maturity include:

1. BetaShares Australian Investment Grade Corporate Bond ETF (ASX:CRED)

CRED has a high yield to maturity of 6.07%p.a. as at 29 November 2022, the return you would receive if you held all the bonds in the portfolio until maturity. Income is paid monthly and running yield, the amount you would expect to earn to earn in the next 12 months is 3.68%. Positively, when interest rates are expected to decline, the bond prices should rise, leading to

higher prices and improved performance. The fund has $460m in funds under management (FUM) and charges 0.25% management fee. Average credit rating is BBB+ and the fund is long modified duration at 6.14 years.

2. VanEck Australian Corporate Bond Plus ETF (ASX:PLUS)

PLUS is a smaller fund with $226m in FUM that includes global securities although, as at 31 October 2022, 71% was allocated to Australian corporate bonds. Yield to maturity is 5.59% as at 25 November and running yield 3.54%. Modified duration is 4.43 years and fees are slightly higher than CRED at 0.32%. The portfolio is slightly lower risk with an A- credit rating.

3. Vanguard Australian Corporate Fixed Interest Index ETF (ASX:VACF)

VACF is the largest of the three ETFs with $554m in FUM, but also has the largest number of investments at 408. VACF invests in government-related and global bonds, but has 67% allocated to corporate bonds and 56% of the portfolio is Australian. It’s the lowest risk of the three with weighted average credit quality of A+ and effective duration of 3.3 years. Yield to maturity as at 31 October 0222 is 5.04%.

Please note that duration is a measure of sensitivity to interest rates, the higher the figure, the greater the sensitivity.

Please see these additional educational articles for more information:

1. Want to Invest in Bonds? We’ll Show You How

2. Interest Rate Risk and Duration

3. Understanding ETF Liquidity

This article is for educational purposes and none of the funds mentioned are recommendations. Please do your own research and if you are uncertain speak to a financial adviser before you invest.