The Reserve Bank of Australia, in conjunction with the government implemented a range of measures designed to provide a ‘bridge’ to an expected economic recovery after the COVID-19 crisis.

The RBA cut the cash rate to 0.25 per cent and committed to buy government and semi-government bonds without a ceiling to keep rates low across the yield curve. They committed to target 0.25 per cent on three year Australian Commonwealth Government and semi-government bonds via secondary market purchases.

The RBA measures also included a $90 billion term funding facility for the banking system – read money for banks to on-lend to businesses and Treasury promised the Australian Office of Financial Management (AOFM, the Australian Office of Financial Management, which ensures that the Australian Government’s financing needs are met cost effectively) would be provided with $15bn to invest in asset backed securities from small banks and non bank financial institutions, helping to keep credit lines open.

The AOFM will issue bonds to help fund these initiatives. State governments may also tap bond markets to deliver their support programmes.

If you add other sovereign government commitments, trillions of government bonds on a global basis, will be issued to fight the economic impact of coronavirus.

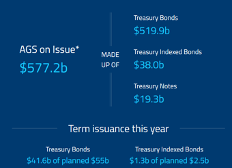

AOFM Australian Government Securities on Issue (Face value as at 20 March 2020)

Source: AOFM

More Information: Government Bond Basics