FIIG Securities recently published its 2024 Macro Strategy Outlook. Here we republish its Lock Investment Strategy designed to maximise medium term profits while minimising risk. The article suggests 12 bonds that fit to help meet its strategy.

The LOCK strategy involves positioning your portfolio to capitalise on the higher yields for however long the current plateau in yields lasts, but also simultaneously preparing for a rally in prices should the economy slow. We are entering a riskier period for the economy, so it is important bond portfolios are reviewed now to ensure they are in solid shape should a slowdown begin.

The LOCK Investment Strategy

L – Lock in fixed returns

Although we are not sure that rate cuts from the RBA are coming soon, we’re fairly confident that the run of rate rises is either over or will end very soon. There will likely be a period of a plateau in rates while markets prepare for the next downturn. That plateau might be six months, or it might be 18 months.

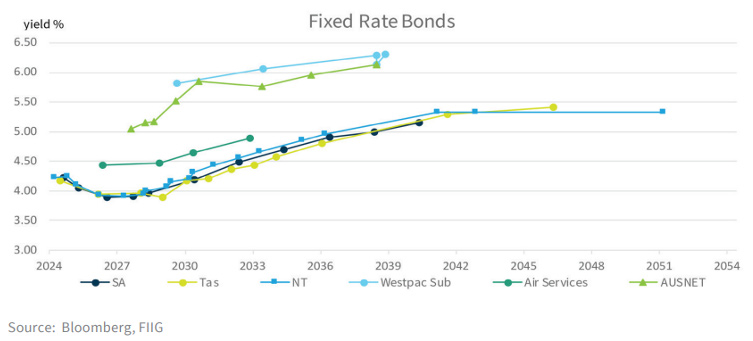

However, in our view, the risk of sharply rising yields is now behind us. There is only limited risk to extending bond duration and locking in fixed rate returns now that apply for a longer period.

When the downturn comes, it will likely trigger a substantial fall in bond yields and a rise in bond prices. Investors need to be ready for that well in advance. But with yields still relatively high in a medium-term assessment and with the yield curve still steep, the risk – such as it is – for extending duration too early is to receive high yields while we wait for the large upward movement in capital prices. There is some risk of a small increase to even higher yields that might be missed if yields are locked in now. To put it another way, we don’t really see much of a downside to extending duration here.

In contrast, the risk of failing to lock in higher yields and being surprised by a rally that comes earlier than anticipated is to lose the capital gains of the initial move (there has already been a moderate-sized rally with some movement in capital prices that those who haven’t locked in yields have missed).

The risk to this strategy is that should the RBA embark on a series of rate rises, longer yields might rise materially, but that seems a remote risk. We don’t necessarily think the RBA will cut rates as quickly as the market is pricing, but the risk of further rate rises is only small.

Also read: The High Yielding Recession Is Coming

If the sell-off has finished and the question is when the rally starts, we can start preparing now by buying longer-duration bonds.

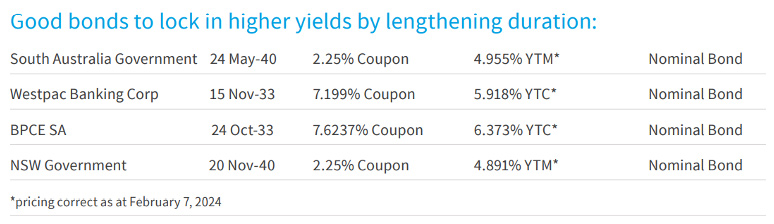

We’ve looked for some longer-duration bonds with relatively low credit risk and still reasonable yields. The state government market provides some opportunities, as do some of the lower-risk corporate bonds. The state bonds are mostly rated AA or sometimes higher, depending on exactly which issuer. For clients who are happy to buy 16-year bonds, the South Australia Government May-40 offers a yield of around 5.051% at present.

The state government bonds offer reasonable returns with very low risk. Higher returns can be found by looking at corporate bonds, with subordinated bank bonds offering particularly high yields.

O – Obtain real returns

The market is already assuming that the RBA will cut rates soon because inflation will fall sharply. But there’s a risk that inflation remains stubborn.

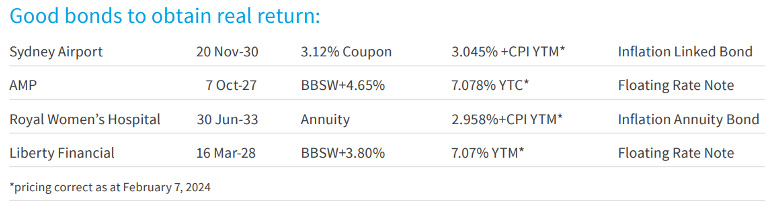

A period where longer yields are likely to be falling, but inflation remains high, is one where inflation-linked bonds should do well. Inflation-linked bonds have both an interest rate component (which does well when yields fall) and an inflation exposure. If a slowdown does begin, but inflation remains higher than anticipated or is forced higher by a food price effect or a climate investment effect, then inflation-linked bonds should perform well. Real returns can be found in the government market, which is very safe but has comparatively low yields. By judiciously accepting some higher risk, it is possible to achieve much higher real returns.

As a general rule, because the entities that issue in inflation-linked format have inflation-linked revenue, they are often utilities or other structural features of the economy. So, even the riskier forms of inflation-linked yields usually are lower risk and provide a substantial pick-up above inflation. For example, Sydney Airport and the Royal Women’s Hospital both have these features. Because these organisations are core features of Australia, they are well placed to weather a downturn, should one occur.

Investors should also consider selectively adding higher-yielding bonds that would be resilient in an economic slowdown. While we are expecting a cooling in economic conditions in 2024, we are anticipating a soft landing and, therefore, believe higher-yielding bonds should be considered to help deliver real returns. With inflation likely to remain elevated over 2024, investors should ensure they are generating a portfolio yield above inflation, thereby maintaining their portfolios’ purchasing power. With this objective in mind, investors could consider seeking higher-yielding bonds or other investments like RMBS and ABS bonds, sub-investment grade regulated banks like AMP and other investments that provide high enough returns to offset inflation.

C – Check your portfolio risk

We are approaching a turning point, and while we don’t expect there to be a serious problem in Australia, it’s always worth checking that your portfolio matches what you want it to do. During a boom, it’s relatively easier for companies to perform well. As the saying goes, it’s only when the tide goes out that you discover who is swimming naked.

Now, before there is too much of a downturn, is the best time to consider the elements of your portfolio and make sure they match what you want.

A key consideration as things get more difficult is diversification. Ideally, your investments should be complementary but different. If the investments are too similar, then one unexpected event could impact all your investments at the same time. By diversifying your investments, you can prevent an unexpected event from having too great an impact.

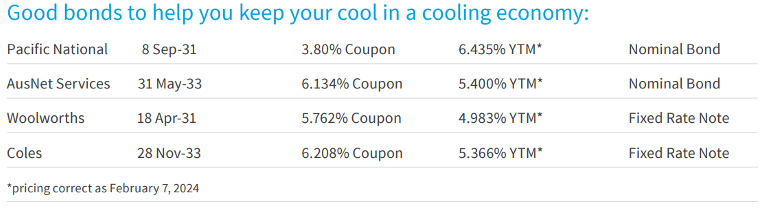

K – Keep your cool as the economy cools

The economy in 2024 is likely to be cooler and weaker than an admittedly very hot 2022 and 2023. If you’ve made the effort to prepare your portfolio, this shouldn’t be a problem. Most Australian companies will be fine during a slowdown, but investors should review their portfolios for excessive concentration or bonds likely to be exposed to a weakening economy.

They should replace any excessive concentrations or bonds overly exposed to an economic slowdown identified during this review with bonds that are more resilient to downturns in the economy. The other consideration when investing for a downturn is how integral the company or organisation is to the economy. During a downturn, particularly one where the consumer is cutting back, sectors that are integral to the economy are likely to perform best.

We like Pacific National (the railway group) on this score since the company is involved in transportation. Solid physical assets are a great way to ensure performance during a downturn. Another option is AusNet Services. This company is exposed to utilities and utilities installation directly. We suspect that in any downturn scenario, there will likely be Federal Government assistance, if required. Given the way the climate is progressing, we suspect that Federal assistance may well be linked to the climate changeover – much like the US Inflation Reduction Act was.