Undoubtedly, the easiest way to invest in bonds is by trying to find a fund that mimics your desired outcome. The fund could be a low cost, passive ETF that tracks an index or an actively managed, listed, or unlisted fund.

The fund manager manages the investments, deciding when to buy and sell, and in return, you pay them a fee.

If you chose to invest in a fund, you lose one of the biggest benefits of the asset class – the defined maturity date of each bond.

Funds continue indefinitely. When a bond matures in a fund, the fund manager simply reinvests the proceeds.

A fund will provide a target rate of return and may have professional oversight. Some funds pay monthly distributions and these can be very useful especially if you are retired.

Depending on your goal – strategies vary greatly – you can choose a fund that meets your requirements with a single transaction.

For example, one of the main reasons investors chose fixed income is for its diversification away from more volatile, growth assets such as shares and property. If that is the case, and you hold significant allocations in your share portfolio to the major banks, then you wouldn’t want to invest in a fund that predominantly invests in those same banks.

[Also Read: Interpreting Credit Ratings – What Do They Mean For Fixed Income?]

You would also need to think about how you might define diversification, for example: 50, 100, or 1,000 holdings?

I’m much more comfortable investing in an Australian Commonwealth government fund with a lower number of issues compared to a sub-investment grade high yield fund. The higher the risk of the underlying investments, the greater the diversification needed to limit losses.

So, assuming I’m looking for an investment-grade portfolio, that is diversified with at least 100 issuers and investments and I don’t mind if it is an ETF or Managed Fund, what can we find?

Using Fixed Income News Australia’s ETF and Managed Fund finders, I come up with many funds that have over 100 investments, nine even have over 500 investments, with the largest the Vanguard Global Aggregate Bond Index ETF (ASX:VBND) having over 9,000 investments!

Most of the big providers such as Aberdeen Standard Investments, Pimco and Vanguard have a range of portfolios that go from 100% government securities to a mix of government and corporate investment grade and continue out along the risk spectrum to include allocations to high yield securities.

So, in some cases, you may be better narrowing your search to just one provider and looking at their range of portfolios and performance before extending the search to other providers.

Aberdeen Standard Investments example

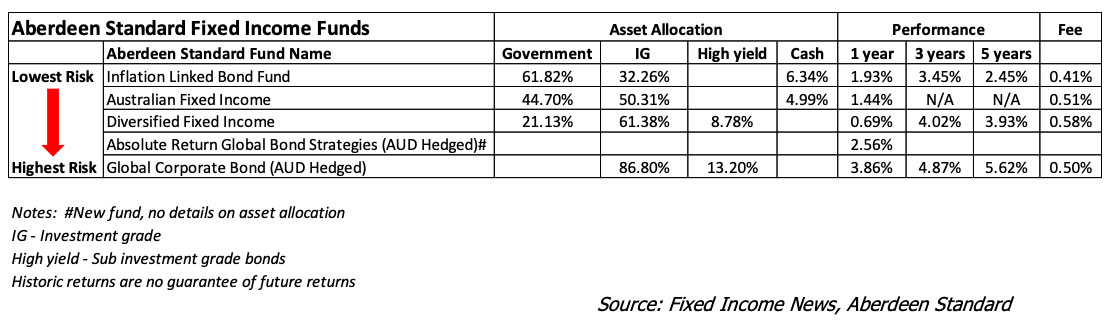

Below is a summary of five Aberdeen Standard fixed income funds. The lowest risk fund is an inflation-linked bond fund. This is a very high quality fund with 60% invested in AAA rated investments and no investments below the single ‘A’ rated band. Since inception in July 1997, its net return has been 6.7%.

[Also Read: Hitchhiker’s Guide to the Debt Universe]

Second on the list, the Aberdeen Standard Australian Fixed Income Fund, is also a 100% investment-grade portfolio, but has a higher weighting to investment grade compared to government bonds, but it’s one year return is less and that is probably because government bonds have done very well as interest rate expectations have continued to decline.

Moving down the table, you can see the asset allocation changes and the funds take on more risk. Performance over the 1, 3, and 5-year timeframes also show higher returns for higher risk funds. The last two on the list allocate to global bonds but are hedged back into AUD.

If you wanted to take risk up another notch, you could look for non-hedged global funds with exposure to high yield securities or just higher allocations to high yield bonds.

You would expect correspondingly higher returns and want to see a greater number of investments to mitigate the risk of any one security defaulting.

Summary

With over 130 fixed income managed funds available to Australian investors as shown in our Fixed Income News Finder, there are many options available to access a bond portfolio in a single transaction. Of course, you can also select more specialist funds to invest in and allocate to each fund to build a portfolio.

The article is for education purposes only and investments are not recommendations. This article focuses on credit risk and does not include sector, interest rate or geographical risk, to name a few.