By RJ Gallo, Senior Portfolio Manager, Fixed Income at Federated Hermes

With the Fed expected to begin its easing cycle later this year, bond markets appear poised to generate income to a degree not seen since before the 2008-09 financial crisis.

While expectations around the size of cuts this year have been reined back, the US Federal Reserve remains likely to begin its easing cycle this year – with one 25bps cut in 2024, followed by potentially four further cuts in 20251.

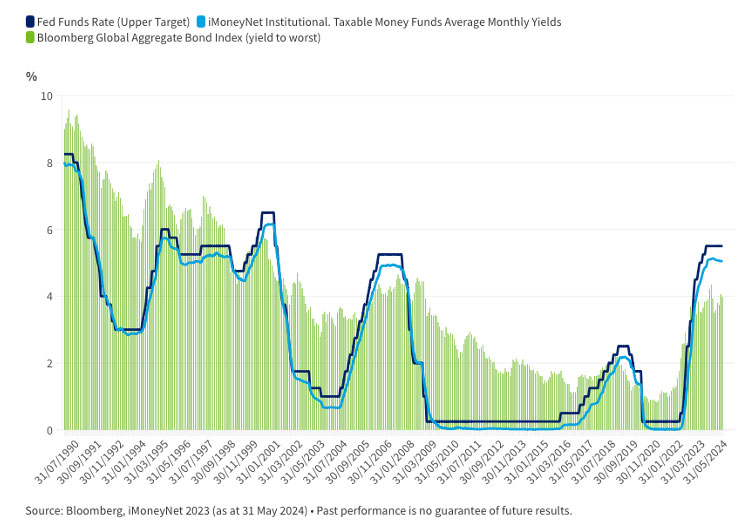

Should this scenario play out, then bond markets appear poised to generate income to a degree that has not been seen since before the 2008-09 global financial crisis – which was the last time the Fed held its policy rate above zero for a sustained period of time. The US federal funds rate currently stands at 5.25%-5.5%.

While short-term yields have been higher than long-term yields since mid-2022, ‘inverted’ yield curves ultimately normalise. And although bond yields have been up and down recently, yields on US Treasuries and other fixed-income investment types are at levels not seen for more than a decade.

Bonds traditionally play a valuable role, providing both portfolio diversification and income, with negative total annual returns a relative rarity.

Figure 1: Bonds historically maintain higher income levels following federal funds rate decreases

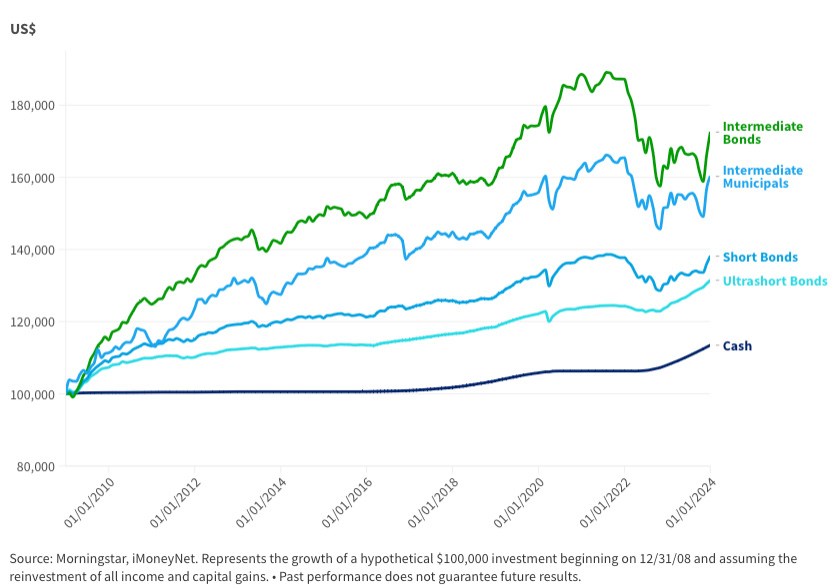

Extending duration can offer a more consistent income stream over time

Bonds with longer maturities typically offer a higher yield. Duration is a measure of a security’s price sensitivity to changes in interest rates. Securities with longer maturities have longer durations and are more sensitive to changes in interest rates than securities of shorter durations, but also typically provide a higher return for longer than shorter duration securities.

Also read: Investors are Seeking the Right Answers to the Wrong Questions

Bonds can also play an important role in a portfolio as a source of income and diversification, but also as a form of portfolio stability during weakening economic conditions and stock market volatility.

Holding bonds of longer duration can benefit investors when:

- The US Federal Reserve and other central banks lower interest rates to stimulate the economy.

- Stock markets fall due to slowing earnings.

- Bond yields fall (bond prices rise).

Figure 2: Historical total return growth of US$100,000 (trailing 15 years)

Conclusion

Rather than focusing on timing and perfection, we advocate for maintaining a fixed-income allocation and adjusting durations to meet specific investor and portfolio needs. While the current rate-hiking cycle has been unusual in its scope and rapidity, and in its effect on total returns during 2022, the outlook for bond total returns going forward is positive in our view. This is an important time for investors to reconsider their portfolio allocations.