The big local development last week was the higher than expected trimmed mean CPI outcome, with annual growth pushing up to 2.1%. Although in large part this appears to reflect the same supply bottlenecks afflicting the world (especially with local wage growth still fairly subdued), it does mean that annual underlying inflation will likely now hold at or above 2% over 2022, undermining the RBA’s case to leave rates on hold until 2024.

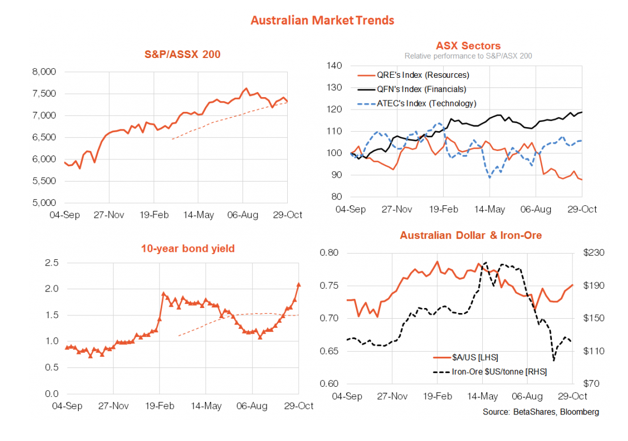

Indeed, the RBA also gave up last week on trying to holding the yield on 3-year bonds at 0.1% – which in turn led to an upside explosion in yields of 40bps over the week. This likely means the RBA will jettison its yield curve control policy at Tuesday’s policy meeting. I suspect it will simply revert to less precise language – suggesting rates will remain on hold for as long as it takes to get a meaningful sustained lift in wage growth. After inching higher for most of the week, the local equity market took the lurch higher in yields on Friday especially badly, dropping 1.4%.

To my mind, due to benign wage growth, it still seems unlikely the RBA will raise rates next year and in any case most likely not before the Fed – despite the aggressive rate hikes now priced into the market. That suggests there’s value in local bonds – especially compared to those globally, and our equity market may recover some lost ground once the RBA provides better clarity on its policy outlook. Apart from Tuesday’s RBA policy meeting, there’s also the RBA’s updated set of forecasts in Friday’s quarterly Statement on Monetary Policy. Rising bond yields have not helped the local equity market in recent months, which has pulled back even as the U.S. market has scaled new heights.

But provided Wall Street holds up, our market should also soon start to grind higher again, albeit likely with a continued underperforming bias – not helped by weaker iron-ore prices and a potential slowing in credit growth due to heightened regulatory scrutiny of the home lending market. I have long held the view of local equity market underperformance.

Read David Bassanese’s full article here.