Opinion piece taken from Nuveen’s Global Investment Committee mid-year outlook.

The following outlook includes directions to investment destinations where the water may prove warmer and more inviting than in others — provided swimmers exercise caution and stay aware of their surroundings.

Many wary market participants are sitting on high levels of cash and cash equivalents. Their rationale: Better to stand safely on shore — and earn what looks like a decent yield in today’s higher interest rate environment — than risk swimming in choppy and uncharted waters. But when does an abundance of caution turn into missed opportunity? How long is too long to wait for a return to “normal”? And what, exactly, will normal look like across economies and markets?

Inflation stands front and centre in this discussion. Historic rate hikes from the U.S. Federal Reserve and other central banks have helped bring inflation down considerably from its 2022 peaks. Even so, inflation in most areas of the world still exceeds the long-term 2% target set by policymakers — potentially signalling that inflation has become structurally higher.

The era of ultra-low interest rates is also clearly behind us. Rates continue to hover at relatively lofty levels, and the Fed is not yet poised to pivot from its tightening trajectory. Staying the Fed’s hand is a resilient labour market with persistently solid wage growth and what may be structurally lower unemployment. Meanwhile, the Fed’s still-hawkish tone has many investors assessing if and when the U.S. will fall into a recession. Growing concern that the dominance of high-flying technology stocks has made this year’s U.S. equity market rally too narrow for comfort is also fostering reluctance to participate.

Investors daunted by this uncertain environment needn’t — and in our view, shouldn’t — stay on the sidelines indefinitely. We suggest a judicious approach to putting cash back to work, focusing on these key tenets:

Dip a toe in first. Water safety specialists recommend gradually wading into a body of water versus diving right in. The same principle applies to investment markets that appear too murky or volatile for full immersion. Investors seeking a yield advantage without plunging into full risk-on mode should consider select areas of the broad bond market, including municipals.

Explore international waters. We continue to see opportunities in emerging markets equities given attractive valuations, the weaker U.S. dollar and looser monetary policy in China. In credit markets, Europe may provide an edge over the U.S. given the strength of the region’s banking system. We’re also identifying ample investment ideas in infrastructure, real estate and other real assets across the globe.

Find an oasis in real estate. The harsh glare of headlines about the beleaguered office sector has created the mirage that all real estate assets should be avoided. But closer scrutiny reveals true pools of potential, particularly in the industrial and multifamily sectors.

Also read: Australian Economic View – July 2023: Janus Henderson

Asset Class Heat Map

Our cross-asset class views indicate where we see the best relative opportunities within global financial markets. These are not intended to represent a specific portfolio, but rather to answer the question: “What are our highest-conviction views when it comes to putting new money to work?” These views assume a U.S. dollar-based investor seeking long-term growth and represent a one-year time horizon.

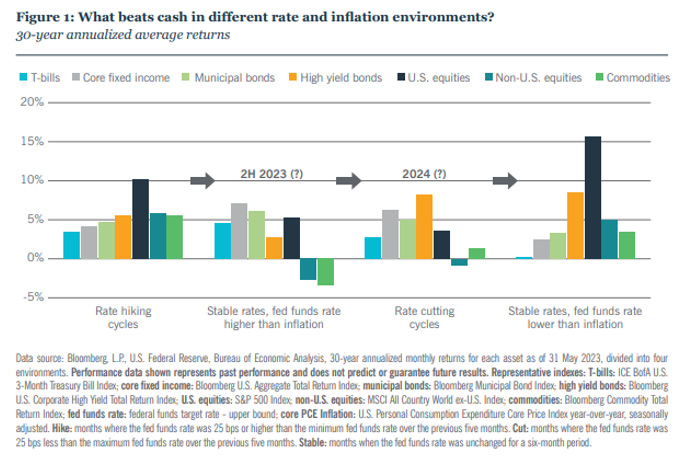

For those looking to increase yield without moving into full risk-on mode, we think it makes sense to explore areas of the broad bond market, including municipals. Figure 1 shows the returns of various asset classes during different rate and inflation environments. And while the past doesn’t guarantee the future, history suggests that core fixed income and municipals are solid “cash off the sidelines” candidates (1) in periods following rate hikes (when their effects are working through the economy) and (2) when rates are being cut amid economic weakness.

A close look at credit

- Public markets fixed income should fare well once it becomes evident that a recession is getting under way and that rates are going to fall.

- We think private credit stands to benefit amid prospects for only a mild recession. In fact, current private credit vintages could be especially attractive, as today’s financial conditions make them more defensively constructed.

- Lastly, a word on preferred securities, which we’ve downgraded a notch in our heat map. While preferred valuations have improved given the selloff related to bank failures, the banking sector and the asset class as a whole remain challenged.

Our highest-conviction views

- Infrastructure (+) has long been a favoured area for us. Still-high inflation helps the asset class on a relative basis, and infrastructure tends to be resilient in the face of slowing economic growth. We have a modest preference for publicly listed over private infrastructure, which still might experience price lag effects as privates catch up to what public markets experienced last year.

- Private credit (+) faces some slowing in new deal issuance, but fundamentals remain sound. These investments tend to focus on more resilient areas of the market such as health care, software and insurance brokers — all of which are relatively well-positioned to withstand economic downturns.

- Municipals (+) remain a favoured area where we think it pays to take on credit risk. Fundamentals are strong, demand has returned to the market and valuations look reasonable.

Nuveen is a global asset manager that has been managing assets designed for income for 125 years. It is ranked as one of the top 20 largest global assets managers and has more than 950 institutional clients in 30 countries. As of 31 Mar 2023, Nuveen has $1.1 trillion in assets under management and operations in 27 countries.