Global Asset Allocation Viewpoints and Investment Environment by T. Rowe Price Australia Investment Committee, as at 31 January 2023.

MARKET PERSPECTIVE

While evidence of slowing inflation and moderating central bank tightening have reduced the probability of a hard economic landing, global growth is still expected to slow as tighter financial conditions flow through the global economy.

- The U.S. Federal Reserve struck a dovish tone as they acknowledged that inflationary pressures have eased but remain elevated, warranting a data dependent approach in determining the extent of future rate increases.

- The European Central Bank (ECB) reaffirmed its commitment to its rate tightening path until inflation moves toward its 2% target. The Reserve Bank of Australia stroke an hawkish tone despite evident slowdown in economic activity. After the surprise move of easing yield curve control, the Bank of Japan (BoJ) defied speculation for another policy adjustment amid decades-high inflation levels.

- Moderating pressures from higher rates and a stronger U.S. dollar continue to benefit emerging market economies and offer a reprieve for their central banks. While uncertainty remains, sentiment toward China has improved as the country rapidly shifts away from its stringent COVID policies, providing a boost to the global economy.

- Key risks to global markets include central bank missteps, resilient inflation, steeper growth decline resulting in a hard landing, and geopolitical tensions.

Also Read: Why and What If Inflation Falls Faster Than Expected?

MARKET THEMES

Two in a Row?

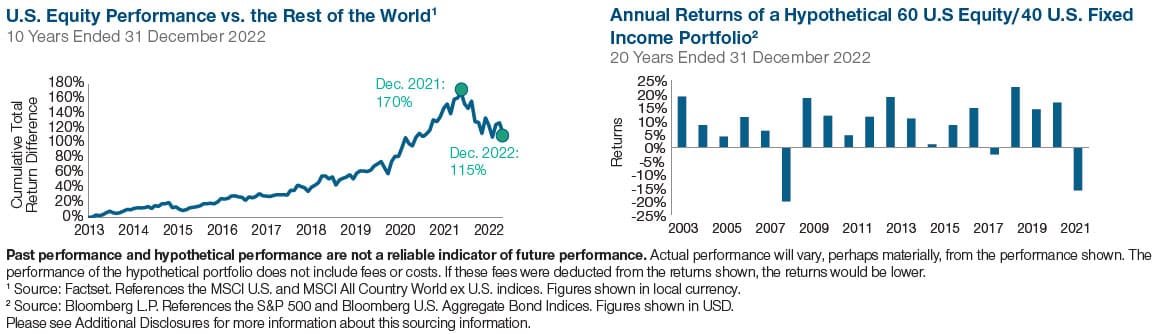

After outpacing the rest of the world by more than 170% over the past nine years between 2013 and 2021, U.S. equity markets notably lagged the rest of the world last year. Despite deeply negative returns across global markets in 2022, markets outside the U.S. broadly outperformed in both local currency and U.S. dollars, even with a persistently strong U.S. dollar. Perhaps this was not unsurprising as some positive tailwinds appeared on the horizon late in the year, including growing evidence of slowing inflation pressures leading some central banks to hint at moderating their pace of interest rate hikes. In Asia, China surprised the world in early December with reopening from COVID lockdowns, while at the same time Europe seemed to avert an energy crisis by benefiting from warmer weather and aggressive steps to control energy usage. Lower yields in the U.S. on the back of falling inflation are also contributing to a lower dollar, providing further support for markets outside the U.S., particularly emerging markets. While much uncertainty remains around the trajectory of global growth for 2023, markets outside the U.S. could be up for a second year of outperformance as they are supported by still attractive relative valuations, higher dividend yields, and more cyclical exposures that could benefit from China’s reopening and a less dire outlook for Europe.

I’m Back!

In a rare year with both equity and bond markets down by double digits, much noise was made about the death of the U.S. traditional 60/40 balanced portfolio and the need to include allocations to less correlated sources of return. Last year’s high inflation and rising interest rates led to increased correlations between stocks and bonds as both fell in unison, leaving bonds unable to fulfill their typical role of providing ballast, particularly during risk-off periods. Despite correlations between stocks and bonds remaining elevated, noise around the death of the 60/40 portfolio has been silenced as strong returns in both stocks and bonds have led to a more than 5% return for the 60/40 in just the first month of the year. The rally in both asset classes has been supported by evidence of falling inflation and lower rates. Our analysis has shown that, in historical periods like today when inflation is declining from elevated levels, correlation between stocks and bonds can remain elevated. While perhaps still not providing diversification, if the disinflationary trend continues, the two asset classes could perform well, bringing back the 60/40 portfolio from one of its worst years ever.

PORTFOLIO POSITIONING

- We trimmed our underweight to stocks on a more balanced outlook following evidence of improving trends, including lower inflation, the easing pace of central bank tightening, China reopening, and Europe staving off an energy crisis. While risks have moderated, valuations remain challenged by expectations for slowing economic and earnings growth ahead.

- We remain modestly overweight cash relative to bonds, earning attractive yields and providing liquidity should market opportunities arise.

- Within equities, we are overweight Japan and Emerging markets on attractive relative valuations and improving sentiment surrounding China reopening. We also reduced our underweight in Europe given the improved outlook for Europe having dodged higher energy prices on a mild winter.

- Within fixed income, we pared back the overweight in high yield on recent outperformance. Yields still offer reasonable compensation for risks.

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.