A Sukuk is an Islamic financial certificate not unlike a bond in western terms, though there are some key differences. Sukuk bonds are not only preferred by Sharia-compliant investors but are also attracting interest from conventional investors around the world.

With five Gulf Cooperation Council countries (Saudi Arabia, Qatar, Kuwait, UAE and Bahrain) being included in the JP Morgan Emerging Market Bond Index, this has enhanced the visibility of Global Sukuk in the international market.

Here, Crescent Wealth CIO Jason Hazell talks to Fixed Income News Australia about this rapidly growing market, how they differ from conventional bonds and the opportunity for Australian investors.

Can you describe the differences between Sukuk and conventional bonds?

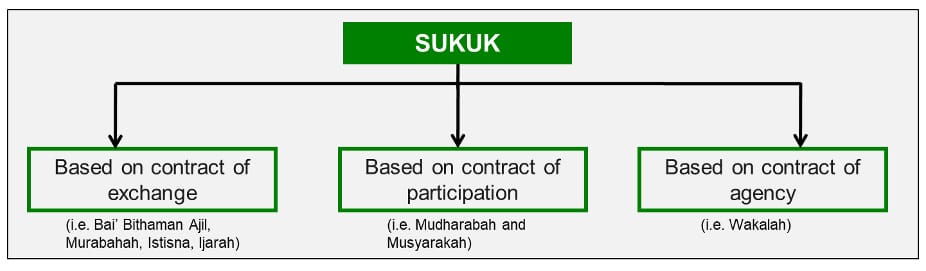

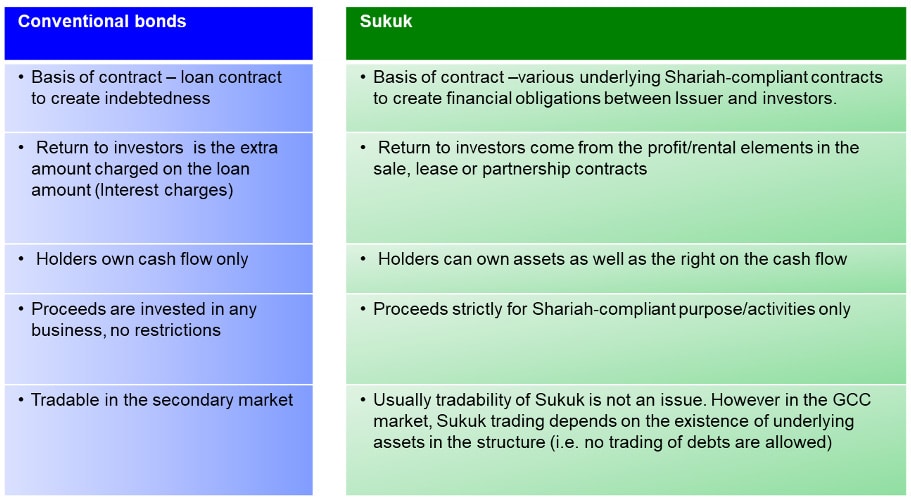

Sukuk (Arabic: صكوك, plural of صك Sak, “legal instrument, deed”) refers to certificates which evidence indebtedness or ownership, or investment in underlying assets structured using Shariah principles approved by a Shariah Committee. Sukuk can be structured in a number of ways to offer the issuing entity greater financial flexibility and options to meet its funding requirements.

This differs from conventional bonds, which is based on the exchange of paper for money (or debt owing) with interest imposed to measure returns and liabilities. The differences between Sukuk and conventional bonds can be summarized as follows:

Is there a growing appetite for this sort of investment in the Islamic world?

Yes, there is a growing appetite for Sukuk not only from Shariah-compliant investors but also conventional investors globally, e.g. from Taiwan, Korea, Europe and the United States. Notable issuers of Global Sukuk include GCC countries such as United Arab Emirates (UAE), Saudi Arabia, Kuwait and Qatar, as well as Asian countries such as Malaysia and Indonesia. These countries are highly rated by the three major international rating agencies i.e. Moody’s, S&P and Fitch. For example, Kuwait is rated AA by Fitch, Abu Dhabi (largest emirate in the UAE) is rated AA by S&P, Saudi Arabia is rated A1 by Moody’s, while Malaysia is rated A3 by Moody’s. Meanwhile corporate issuers in the Global Sukuk space are not limited to local market operators, but also include regional market leaders, while some companies are very well recognized on a global scale. An example of such issuer is Dubai Ports (DP) World, one of the largest port operators in the world with operations in over 30 countries across Europe, Australia, Dubai, China, India and Latin America.

The USD-denominated Global Sukuk space is a very liquid market, and has been growing rapidly by around 30% over the last few years (28% in 2018, 23% in 2019), with outstanding sukuk totaling USD167 billion as of end-November 2020. Primary issuances are typically well oversubscribed by 4-8 times, due to strong global demand from a diversified base of investors such as fund managers, banks, insurance companies and institutions.

One of the catalysts of the rapid growth in the Global Sukuk space is the inclusion of five GCC countries (Saudi Arabia, Qatar, Kuwait, UAE and Bahrain) in the JP Morgan Emerging Market Bond Index in January 2019. This further enhances the visibility of Global Sukuk in the international market and amplifies demand for Global Sukuk assets, driving prices higher. Following the inclusion, GCC countries now constitute about 17% of the JP Morgan EMBI index.

Given that Global Sukuk is also a subset of Emerging Markets, it has strongly benefitted from continued fund inflows into Emerging Market assets. The spread compression theme that has pushed Emerging Market bonds and Sukuk prices higher is expected to remain intact, driven by investors’ hunt for higher yields in a “lower for longer” interest rate environment.

How can Australian investors access this type of product? What is the minimum amount to invest?

There are currently no retail offer funds in Australia that allow direct access into Sukuk. The Crescent Wealth Super fund has a dedicated allocation to Sukuk, so exposure to Sukuk can be gained through this fund, with no minimum. Crescent Wealth has a segregated account for Sukuk, managed by the Principal Islamic Asset Management team, part of the Principal Asset Management group.

Which companies are issuing these bonds, and how big are they?

The issuers of USD-denominated Sukuk comprise government, government-related entities such as local authorities and public authorities, corporates as well as supranational entities located globally. Sovereign issuers include the governments of Saudi Arabia, Indonesia, Hong Kong, Malaysia, Qatar, Bahrain, Oman, as well as the Emirate of Dubai and Emirate of Sharjah in the UAE.

Corporate issuers include DP World (one of the world’s largest port operators), Emaar Properties (the developer of Dubai Mall, world’s biggest shopping mall), Majid Al Futtaim (the operator of 306 Carrefour hypermarkets in 37 countries across Middle East and Africa), Aldar (one of the largest diversified real estate companies in the Middle East and majority-owned by Mubadala, Abu Dhabi’s sovereign wealth fund), Almarai (one of the largest F&B companies in the GCC), Tabreed (UAE-based public listed regional utility leader, partly-owned by Mubadala), Saudi Electricity Company (Saudi Arabia’s national electricity company), and Qatar Islamic Bank (largest Islamic Bank in Qatar).

What currencies do they issue in? Are they predominantly USD? Can investors hedge?

Sukuk can be issued in USD and local currencies e.g. Malaysian Ringgit, Indonesia Rupiah and Saudi Riyal. Investors can hedge their investment by investing in a fund that offers hedged share class. However, the Crescent Wealth Sukuk portfolio is investment is in USD-denominated Sukuk and fully hedged back to the Australian dollar.

Are there any additional covenants compared to bonds issued here?

Generally, Sukuk covenants i.e. positive covenants, negative covenants, financial covenants and events of defaults are the same as conventional bonds, as these covenants are not driven by Shariah principles. The additional covenants or terms for Sukuk issuances mainly relate to Shariah aspects e.g. the issuer must ensure that the utilisation of proceeds is only for Shariah-compliant purposes, and cash balances must only be placed with Shariah-compliant financial institutions.

Do the credit rating agencies rate the bonds and do they cover the full credit rating spectrum?

Similar to conventional bonds, Sukuk also consist of rated and unrated issuances. For rated USD-denominated issuances, the Sukuk are rated by the three major international credit rating agencies i.e. Moody’s, S&P and Fitch, who cover the full credit rating spectrum. Sukuk issued in local currencies may be rated by domestic rating agencies.

What are the current typical rates of return?

Typical rates of return are 4.0-6.0% p.a. on average. In 2019, our Principal Global Sukuk Fund delivered outstanding returns of 10.6%.

Why should Australian investors invest in this niche sector, or are you trying to appeal to a specific target market?

Global Sukuk should form part of an Australian investor’s allocation to emerging markets debt. Further, Global Sukuk provides additional diversification opportunities, as Global Sukuk has lower risk and volatility, relative to conventional Emerging Market fixed income assets. By investing in Global Sukuk, investors are able to participate in a rapidly growing market and gain access to strong sovereign and corporate issuers in the GCC and Asian region.

In addition, Global Sukuk is a responsible and ethical investment instrument. There is significant overlap between ESG and Islamic Finance. Islamic Finance is equity-based, asset-backed, ethical, sustainable, environmentally and socially responsible finance. Islamic Finance promotes risk sharing, connects the financial sector with the real economy, and emphasizes financial inclusion and social welfare.

The outlook for Global Sukuk remains positive as a result of continued fund inflows into Emerging Market assets, which offer higher yields relative to developed markets. Global interest rates are expected to stay low for longer, until there are signs of sustained improvements in the global economy. Flush liquidity, coupled with expectations of slower global growth, will continue to drive demand for fixed income assets. This provides a conducive landscape for Global Sukuk to continue to do well.

Valuations for Global Sukuk continue to be attractive, with ample room for credit spreads to compress further, which would propel prices higher. Any market correction will present opportunities to re-enter at cheaper levels. Against this backdrop, we expect Global sukuk to continue to provide attractive returns.