From Income Asset Management

While yields have improved in the Australian BBB space, it’s also nice for investors to know their money is relatively safe.

S&P release a report every year looking at default rates per credit ratings over time. The 2022 report will be released in 2023 but the most recent report provides some good illustrations and commentary.

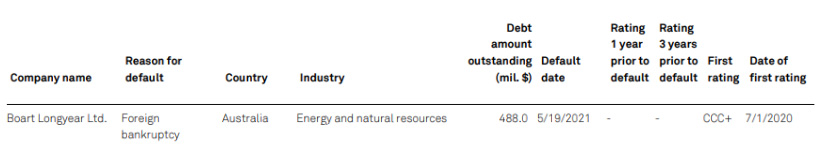

In 2021, 72 global corporate issuers defaulted but most of these were in the CCC/C/B categories. The only default in 2021 from an Australian corporate was from Australian-drilling services provider Boart Longyear Ltd and this had been well flagged.

The majority of defaults were in the US, reflecting the breadth of the bond market over there.

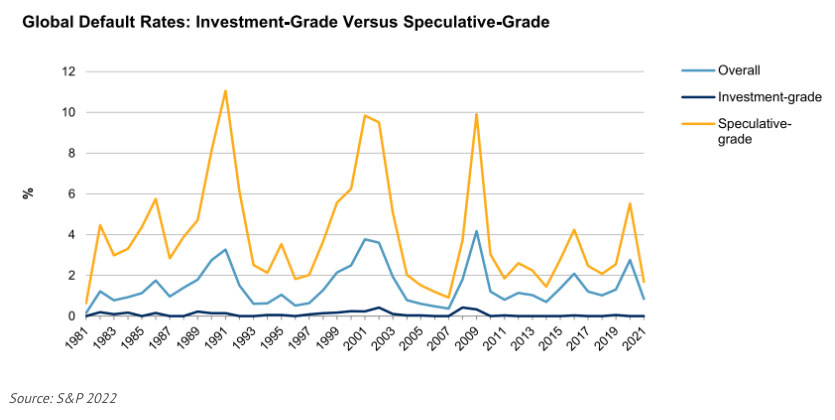

The statistics show that global default rates in investment-grade have been extremely low over time.

Historically, the Australian default statistics are lower than the Global default statistics, in part due to it being a largely investment-grade market but also a concentration towards the major banks (all rated AA-).

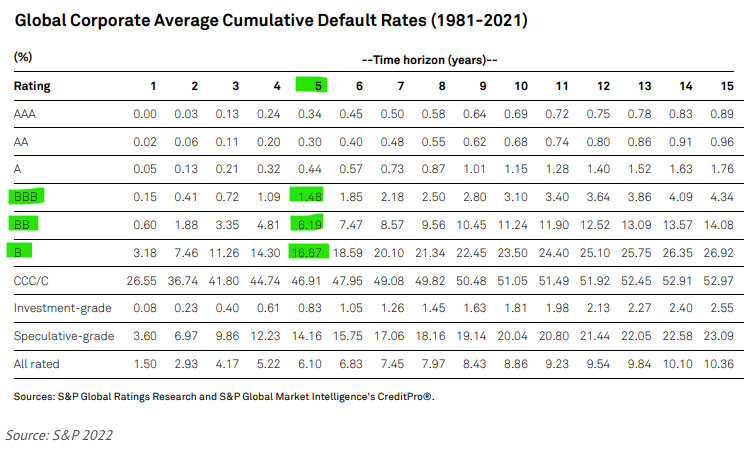

Over the 30 year study period, investors should take confidence in investment-grade bonds. The table shows the probability of default for AAA rated to CCC/C rated, including average default rates of investment-grade, speculative grade and all rated.

For example, a BBB rated bond has a probability of default over five years of 1.48%. This increases to 6.19% and 16.67% for a BB and B rated bond. If you want to dig deeper, a US BBB rated bond has a probability of default of 1.83% implying that an Australian BBB rated bond would have a probability of default over five years of significantly less than 1.48%.

Again, this shows the safety net of the Australian corporate bond market.