By Bruno Bamberger, Senior Solutions Strategist at AXA IM

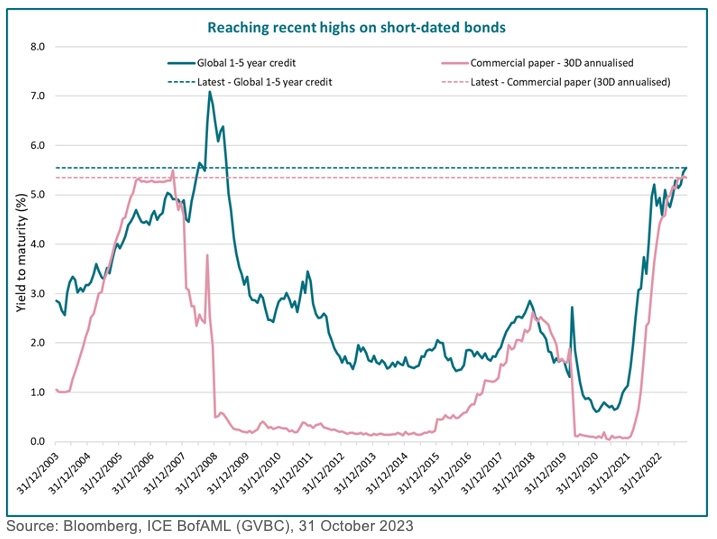

Money market and short-dated (one-to-five-year) bond yields are the highest they have been since the end of the 2008/2009 global financial crisis (see chart below).

Institutional investors may understandably be tempted to allocate more to these strategies – not just because of their attractiveness versus recent levels but also because they can offer an equal or even higher yield than longer-dated equivalents.

Part of the attraction is also a hangover from the recent and ongoing pain caused by the once-in-a-generation yield unwind – from record lows to highs – as central banks scrabble to combat rising and sticky inflation. It appears that lower duration may equal lower risk, at least when looking at recent history.

The other aspect is the relatively flat credit spread curve – credit spreads being the difference in yield between government and corporate bonds of the same maturity. This relatively flat credit spread curve means investors are not paid any more (sometimes less) for lending for a longer period for the same level of issuer risk – this seems counterintuitive given the additional and unforeseen risks which could emerge over time.

Also read: November’s Economic Moves Drive Australian Bond Surge Amid RBA Rate Hike

However, this does not necessarily mean that longer duration bond strategies are less compelling for investors. We present three reasons why we believe longer duration bond strategies could be equally, if not more, compelling than their short-dated counterparts.

Reinvestment risk

Reinvestment risk is faced when the proceeds from investments can’t be reinvested to achieve the same return. This impacts short-dated bond strategies more than longer-dated ones, as a greater proportion of the portfolio matures in each year. In the example of a zero-to-five-year bond portfolio, some 20% of the holdings will mature each year while for longer-dated strategies it is likely to be less than half of this.

This risk materialises in a falling interest rate (or credit spread) environment – exactly where we see ourselves today, as markets expect central banks to start cutting rates in 2024. If those expectations come true, or if rates fall faster than currently expected – for example in a hard-landing scenario – short-dated strategies may struggle in reinvesting at the current, higher rates.

In contrast, longer-dated strategies by their very nature lock in those longer-term spreads and rates, thereby reducing the impact of any potential future yield declines on reinvestment returns while simultaneously benefitting from their exposure to longer-dated bonds.

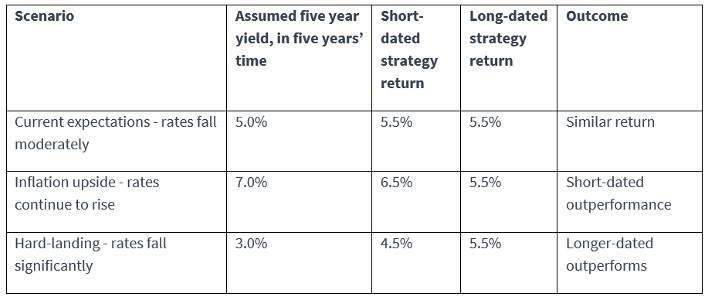

The table below gives an illustration of what this could mean for investors assuming the prevailing yield levels for five-year bonds and 10-year bonds are 6.0% and 5.5%, respectively. It shows how different re-investment rates can impact the total returns achieved over the total holding period.

Locking in those spreads can help mitigate some of the uncertainty caused by volatile market conditions, potentially providing a more reliable source of income for investors.

Of course, market expectations for falling rates are priced in for longer-dated bonds, so the real question is around how markets perform relative to these expectations. If institutional investors believe overnight interest rates will fall more than is priced in the yield curve, then longer-duration fixed rate bonds will be more attractive.

For investors looking to reduce the impact of reinvestment risk on their returns, long-duration bond strategies can offer an effective solution.

A total portfolio approach

One of the attractions of short-dated strategies is the high ratio of credit spread risk to interest rate risk. Looking at the strategy or portfolio level, this is likely to lead to lower losses from rising yields and less volatility from day-to-day macroeconomic news flow such as central bank guidance on the future path of monetary policy.

However, when looking at a total portfolio approach across multiple asset classes, having exposure to interest rate risk (duration) can be an important part of targeting better risk-adjusted returns. This is because bonds often have a low or negative correlation to growth (i.e. equity) returns. While this was not true for 2022, it has generally been the case historically.

As such the higher relative spread risk from short-dated strategies suddenly looks to be increasing market risk at a total portfolio level, while taking interest rate risk in longer-dated strategies can reduce it.

The different roles of shorter- and longer-dated bonds

Short- and longer-dated bonds can often play markedly different roles in investors’ portfolios.

As an example, short-dated strategies are often used as a source of liquidity for many investors during market downturns, such as the COVID-19 crisis. These periods of intense selling pressure to raise liquidity caused short-dated bonds to underperform their longer-dated counterparts. This is not a problem – unless the investor is aiming to sell at the same time.

Investors seeking to avoid this kind of volatility and who are unlikely to need immediate liquidity at the same time as others may tilt their portfolios more towards longer-dated strategies or seek other methods to enhance their portfolio liquidity.

Institutional investors with liability cashflows are likely to have different objectives from the bonds they hold. These investors will frequently use longer-dated strategies to hedge their liability cashflows and reduce asset-liability risk. While this could be achieved by pure government bond exposures, the credit spread achieved over government bonds with longer-dated credits can provide a source of additional return to improve funding levels or generate capital growth.

Balancing risk

Undoubtedly, given the current backdrop of high yields, elevated volatility and uncertain market environment, short-dated strategies can potentially be an important yield enhancer and risk reducer for many investors, as well as an important source of liquidity.

However, the decision between short- and longer-dated strategies isn’t clean cut and depending on total portfolio construction, appetite for reinvestment risk and the role that bonds play for each investor type, there is arguably a place for both in portfolios.