Higher for longer is not a new narrative (FOMC) – Seema Shah, Chief Global Strategist, Principal Asset Management.

At today’s Federal Open Market Committee (FOMC) meeting, despite choosing to keep the benchmark policy rate on hold at 5.25%-5.50%, the Federal Reserve (Fed) still managed to deliver a hawkish message. The updated Summary of Economic Projections maintained an additional rate hike this year and removed two rate cuts next year, ramming home the message of higher for longer.

Economic assessment

Fed Chair Jerome Powell opened the press conference with a couple of victory laps, noting that inflation has moderated, inflation expectations are well-anchored, the labor market is rebalancing, participation is up, nominal wage growth is showing signs of easing, and, as a result, the Fed is now “in a position to proceed carefully” on its rate path. It’s undoubtedly true—economic growth has consistently surprised to the upside, and inflation has decelerated significantly, so the Fed should pat themselves on the back.

Yet, despite the success, the Fed believes it needs to be cautious about the next steps. That also rings true—as long as economic growth is above trend, there is a risk of inflation resurgence. As such, the Fed remains prepared to hike again if appropriate, and data dependency remains their approach to policy decisions.

Updates to the Summary of Economic Projections

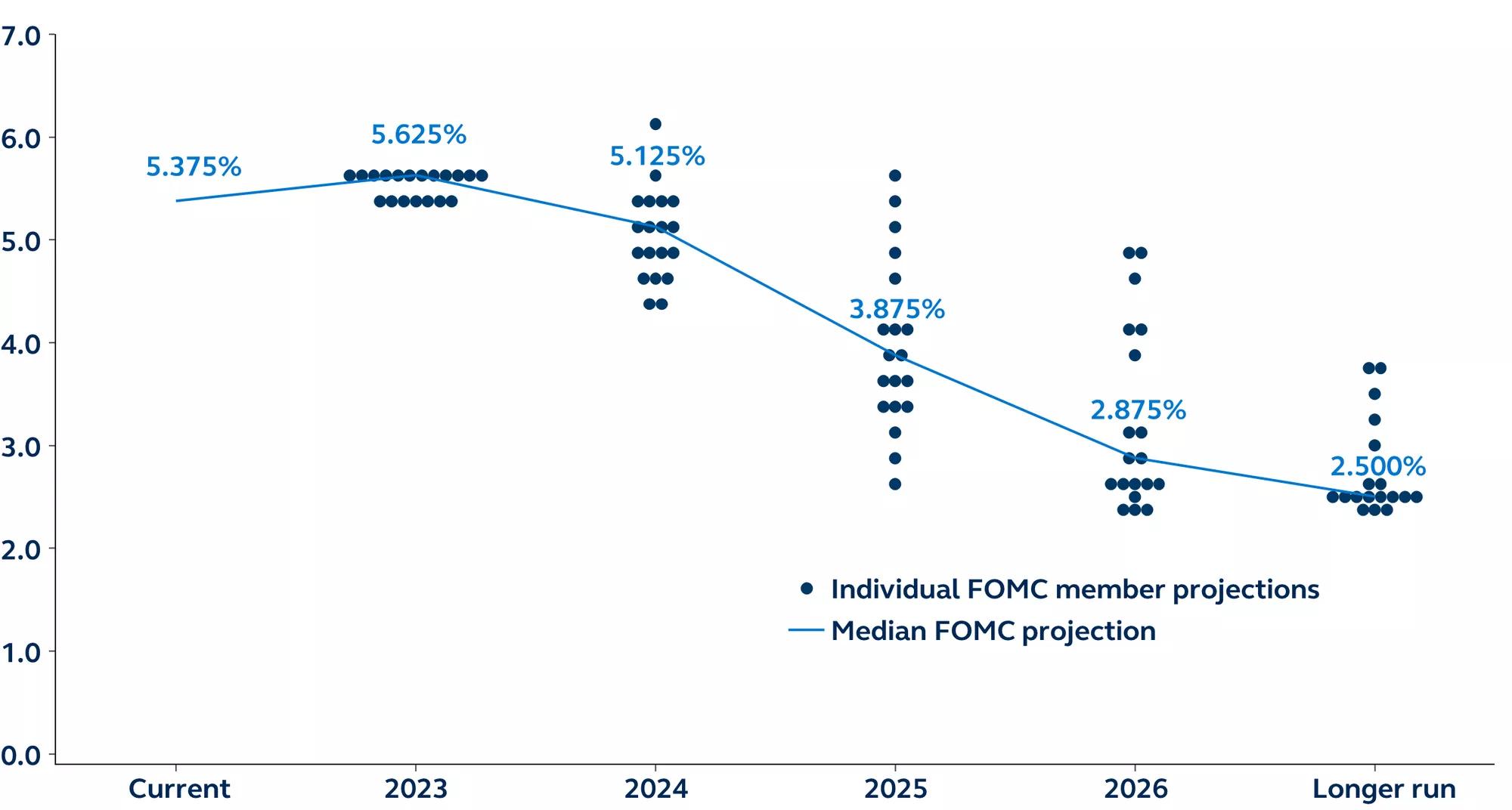

The new dot plot and Summary of Economic Projections indicate that the FOMC possesses a fairly high degree of confidence in a soft landing, as well as the need to maintain policy rates higher for longer:

- The median projection still has rates ending this year at 5.6%. This equates to one more 25 basis points (bps) hike this year.

- 12 of the 19 participants believe that policy rates need to rise again this year; the remaining 7 project no further hikes in 2023.

- In 2024, the median dot plot sees rates falling to 5.1%, equivalent to 50 bps of cuts next year. This is 50 bps fewer cuts than shown in the June dot plot and 25 bps fewer cuts than in the broad market consensus.

- The median projection then falls to 3.9% in 2025, equivalent to a further 125 bps of cuts. Overall, the new dot plot sees a total 175 bps of cuts in 2024 and 2025 combined, 50 bps less than in the June projections.

- The median dot falls further to 2.875% in 2026—still above the median longer-run dot, which remains unchanged at 2.5%. Following ample discussion in recent months about a higher neutral rate, there had been some expectation of an upward revision to the longer-run dot, so this was a slight surprise.

Also read: Is Australia a Matrix Economy?

Source: Federal Reserve, Clearnomics, Principal Asset Management. Data as of September 20, 2023.

- The GDP forecast was revised significantly from 1.0% to 2.1% this year, and from 1.1% to 1.5% next year. These revisions suggest that the Fed feels some confidence in its soft landing expectation, although Powell did sound a few notes of caution during the press conference.

- The unemployment rate forecast for 2023 was revised down from 4.1% to 3.8% (its current level), and from 4.5% to 4.1% next year. The Fed expects a very small upward move in the unemployment rate, reflecting its soft landing projection.

- The core PCE inflation forecast for 2023 was revised down from 3.9% to 3.7%, left unchanged at 2.6% for 2024, and revised marginally higher to 2.3% in 2025. Core inflation is projected to finally reach the Fed’s 2% target in 2026.

How do these forecasts compare to our own? Although economic data is undoubtedly strong today, the improved inflation path will likely keep the Fed from hiking again this year. Our view of GDP growth next year is more pessimistic, anticipating two-quarters of modest contraction around mid-year as consumers buckle under the pressure of higher mortgage payments, modestly rising job losses, higher energy prices, reduced fiscal support, and without the cushion of excess savings. Against that backdrop, we see inflation continuing to decelerate, which opens the door to policy easing in late 2Q, and a total of 75 basis points of cuts in 2024.

Outlook

In light of the still strong economic data, the hawkish pause and lingering threat of a November hike should not be a surprise to anyone. Indeed, although rates have already peaked, the uncertain economic and inflation path suggests the Fed should keep its options open.

Beyond the question of an additional 2023 rate hike, the main theme of today’s FOMC meeting was that a soft landing implies less space for rate cuts next year. It’s an important reminder for investors: higher for longer is not a new narrative, but without recession, it will be even higher for longer.