Residential Mortgage Backed Securities (RMBS) are securities that help financial institutions fund operations.

Simply, residential mortgages are pooled together and sold through a special purpose vehicle to investors in the over the counter fixed income market. The funds are then funneled back to the institution, so it can on-lend to other borrowers.

What makes RMBS interesting is the large pool of loans is divided into different risk and return tranches, enabling investors to target an investment that best suits their risk profile.

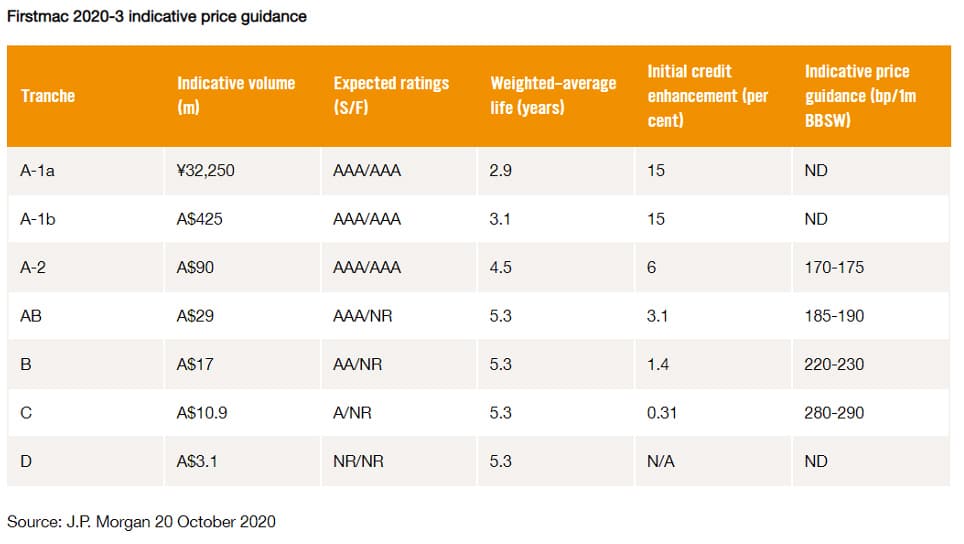

For example, non-bank lender Firstmac recently issued a $1 billion RMBS with a Japanese Yen tranche. See the details below. The top two tranches have the same credit ratings and equivalent initial credit enhancement of 15%, although the expected term until maturity, known as the weighted average life, is slightly different.

Running your eye down the table, you can see risk increases, as does the indicative margin over 1-month BBSW, but all tranches except the lowest equity tranche are rated investment grade.

Government support for RMBS

In stressed markets, the government has stepped in to support RMBS and bought the securities to ensure liquidity and continuation of the market.

In late March 2020, the government announced that it will again invest in the sector, up to $15bn in wholesale funding markets via the Australian Office of Financial Management (AOFM), specifically for ‘smaller lenders that provide consumer and business finance, investing in rated term securitisations and in rated and unrated securitisation warehouses’.

This time, funds will support the whole RMBS structure, not just senior tranches and applies to both RMBS and Asset Backed Securities (ABS). This is a fantastic outcome for the sector and investors. To learn more please see the AOFM website.

Key features of RMBS

-

They are secured

The underlying investment of an RMBS is a pool of first-ranking rights over residential mortgages in Australia, which include full recourse against the borrower if there is a shortfall on sale of the property. The underlying mortgages are a ‘closed pool’, meaning no new mortgages can be added to the RMBS following issuance.

-

Underlying mortgages are unique to each RMBS

It is important to understand the make-up of the underlying mortgages in a pool including assessment of any concentrations by geography, property type, loan interest type or seasoning.

Some geographic locations will be higher risk than others. Seasoning or the length the loan of time the loans have been in place is important. Assuming the loan is for principal and interest, the longer it has been going, the greater the equity that has been built up and the owners have proven their ability to repay, making longer seasoned loans lower risk.

The rating agencies pay specific attention to pool collateral when assigning required subordination and ratings for a tranche.

[Also read: What Does Enormous Fiscal Stimulus Mean For Government Bonds? – Part 2]

-

Capital structure and which tranche you invest in, matters

More senior tranches of an RMBS, offer more downside protection than the junior ranking notes. In the Firstmac example used above, circa $150 million of subordinated securities sit below the top two tranches. The whole structure has to lose $150 million before investors in either of these tranches would lose money. Losses after using reserves and insurance are applied to the lowest tranche first and work up the structure. The lowest level is typically unrated and considered the ‘equity’ tranche in the transaction.

-

Waterfall repayments

RMBS notes are floating rate with monthly coupons. Each month, the interest and principal received from the mortgages are paid to investors in a ‘waterfall’ structure. Principal is first paid to the most senior tranches and then may be pro-rated to more junior tranches if certain conditions are met.

-

Multiple protections for your investment

The main protections offered to investors are:

Hard subordination – this is represented by the proportion of the RMBS (the lower tranches) that sit below a specific note

Excess spread – excess spread is the difference between the income and the expenses of the special purpose vehicle (SPV) that administers the RMBS. Any losses to noteholders are remediated out of the excess spread on an ongoing monthly reconciliation before it is paid to the originator of the deal

Insurance on underlying loans known as Lenders Mortgage Insurance (LMI) – if a mortgage is covered by LMI then any claim from the LMI will be applied to losses before losses are allocated to the securities

Any reserves – most transactions typically have a liquidity reserve or other reserves that can be used for payment shortfalls or losses for a period of time

Floating rate securities, so little interest rate risk

-

Risk reduces over time

RMBS investments naturally de-risk as they repay principal over time. At issuance, the notes follow a sequential payment structure, where the most senior note receives all of the principal until certain triggers are satisfied at which point the structure diverts principal to all notes (except the equity tranche) of the RMBS in a pro-rata fashion.

-

Long final maturity that includes call options

These securities generally have a legal maturity longer than 30 years to match the term of the underlying mortgages, however, all RMBS have an embedded call option which allows the issuer to call the transactions when the pool reaches a certain size or on a specific date.

-

Many banks and other financial institutions issue RMBS, understanding the issuer and the types of loans it offers is important

Prime mortgages are loans that meet a bank’s and LMI’s lending criteria, whereas the non-conforming loans do not meet these standards and are higher risk, meaning interest charged is higher. For non-conforming RMBS, credit rating standards are higher and require higher levels of subordination.