From the BlackRock Investment Institute

• We see more pressure on risk assets in the near term given the major escalation in global trade tensions. We trim our short-term tactical horizon and reduce risk.

• Last week saw a risk asset rout akin to major shocks like the pandemic. U.S. stocks plunged. U.S. 10-year Treasury yields fell, and two-year yields rebounded.

• We eye U.S. CPI this week to see how inflation is evolving before new tariffs take effect. Core inflation is running too hot to fall back to the Fed’s 2% target.

The sharp escalation in global trade tensions and extreme trade policy uncertainty has triggered a broad risk asset selloff. It is less clear if uncertainty will cloud the outlook for a little or a lot longer, so we reduce our tactical horizon to three months. That means giving more weight to our early view that risk assets could face more near-term pressure. We reduce equity exposure for now and allocate more to short-term U.S. Treasuries that could benefit as investors seek refuge from volatility.

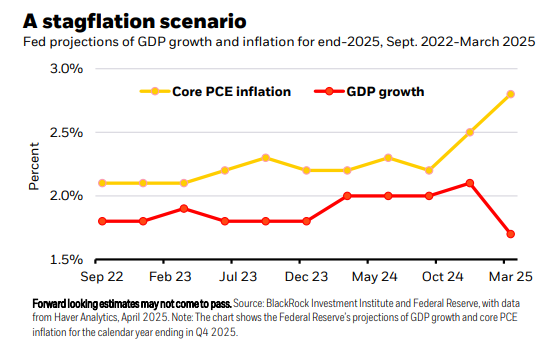

The escalating trade conflict sparked the worst one-week selloff in the S&P 500 and U.S. high yield bonds since the 2020 pandemic shock – even as U.S. economic conditions remain solid, as seen in strong U.S. jobs data. We expected risk assets would remain under pressure until uncertainty starts to dissipate – and it’s now less clear over how long or short a period policy uncertainty could cloud the outlook. We now see a bigger growth drag and inflation boost. The Federal Reserve also expects a bigger impact than it did in March. See the chart. Many countries are preparing responses to U.S. tariffs. China has kicked off with 34% tariffs and other measures. Yet the full set of international responses and country-specific negotiations with the U.S. will take time, making it hard to have visibility on when and how this will settle. Major wealth destruction could hurt sentiment and consumer spending.

Also read: Haven’t We Heard Enough?

We still believe U.S. stocks will eventually reclaim global leadership due to mega forces – like the buildout and adoption of artificial intelligence. But for now, we shorten our tactical horizon to three months and reduce risk. A shorter tactical horizon means giving more weight to our early view that risk assets could stay under near-term pressure until uncertainty starts to dissipate. That’s why we reduce equity exposure, including to U.S. and Chinese stocks, and allocate more to short-term U.S. Treasuries that could benefit as investors seek refuge from volatility. If clarity comes quickly, we would up risk-taking again.

While we are more cautious about broad benchmarks, sharp selloffs are creating opportunities for security selection. U.S. policy shifts are spurring fiscal spending globally. In Europe, Germany’s €1 trillion package for defense and infrastructure investment is creating opportunities in the defense sector. We don’t think the growth and earnings outlook yet supports sustained European equity outperformance but a broader macro opportunity could emerge if the European Union finds a way to jointly issue bonds to fund investment across the bloc, as it did in the pandemic.

Overall, we think plans for a new wave of U.S. tariffs and responses from other countries reinforce that we will be in a world where interest rates – and long-term bond yields – stay higher than pre-pandemic. Tariffs and looser fiscal policy in some parts of the world will likely push up on inflation. We lean against market pricing of four to five quarter-point rate cuts by the Fed this year: U.S. core inflation is tracking well above the Fed’s 2% target, even before the impact of new tariffs.

We stay underweight long-term Treasuries given persistent U.S. deficits and sticky core inflation. We expect investors to demand more term premium, or compensation for holding long-term bonds given sticky inflation, higher-for-longer interest rates and a tough fiscal outlook. That could put upward pressure on long-term U.S. Treasury yields. We think gold can serve as a better return diversifier in this environment.

Bottom line: Trade tensions have triggered a risk asset selloff. We see volatility persisting for some time, so we shorten our tactical horizon to three months and reduce risk-taking, turning neutral on U.S. equities and preferring short-term Treasuries.

Market Backdrop

The S&P 500 slid 9% last week and shed 10.5% in just two days – the sharpest such move since the pandemic hit in 2020 – after the news of broad U.S. tariffs on global imports. Europe’s Stoxx 600 closed down more than 8%, taking the index into negative territory for the year. U.S. 10-year Treasury yields fell to 4.00% but bounced from a six-month low of 3.86%, partly after Fed Chair Jerome Powell ruled out any near-term rate cuts. Two-year yields rose to 3.65% from a low of 3.47%.