The Reddit mania that catapulted GameStop shares has “reverberated through to the bond market”, according to global equity manager Eaton Vance.

Eaton Vance put AMC Entertainment, one of the largest movie theatre operators in the US and a prominent player in the European market, under the microscope.

Portfolio managers at Eaton Vance Stephen Concannon and Donal Kinsella said there were certain instances where the impact of what occurred with Reddit and Gamestop had reverberated through to the bond market.

“AMC is a long-time issuer of high-yield corporate bonds, with a combination of bonds and loans currently outstanding,” they said.“Coming into 2021, the bond and loan prices were trading at levels indicating significant stress.

“In our opinion, the company faced a reasonable probability of default or restructuring — despite raising a combination of public and private debt and equity capital throughout 2020 to add much needed cash to its challenged balance sheet.

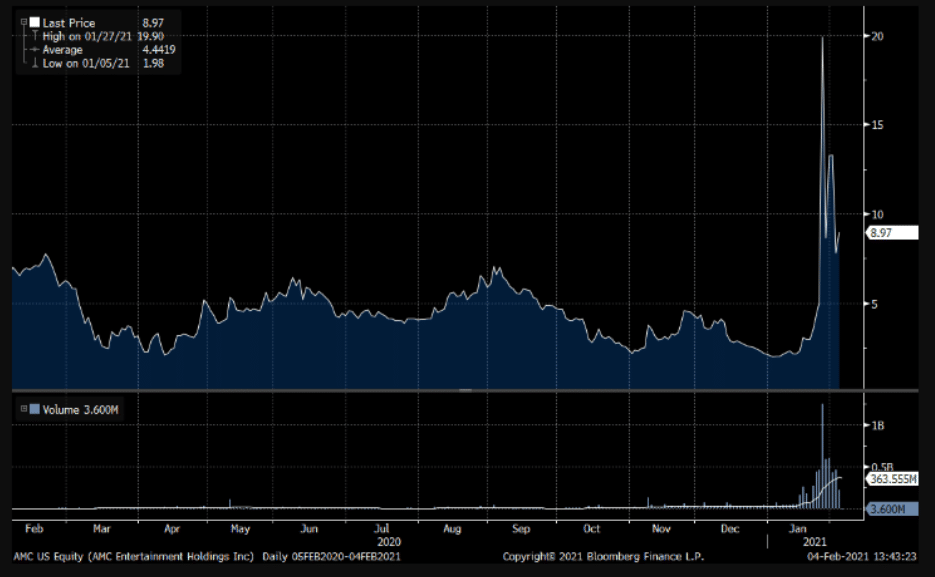

“As expected for a business whose revenues have been decimated throughout the pandemic, the stock price had fallen precipitously from pre-COVID levels. That was before the Reddit-inspired drama unfolded before our eyes, with the company’s share price experiencing a rapid rise — then a deep decline in the first week of February.

Here’s Eaton Vance’s take on the story behind the chart:

- As a heavily shorted stock, AMC Entertainment became a buying target for a large number of retail investors, and the stock price rose sharply in what we might describe as a frenzy.

- With the share price going up, the company issued additional equity to strengthen the balance sheet. They were able to execute the transaction at a much higher price than would have been possible just a few days earlier.

- When the stock price climbed further, one large institutional investor converted a $600 million loan to the company into equity and sold this equity hundreds of percentage points higher than where the stock was trading at the start of the year.

- Now the company has less debt on the balance sheet and a larger equity cushion sitting underneath the remaining debt, along with more liquidity to address cash needs as it attempts to ride out the rest of the pandemic.

- Consequently, all outstanding debt tranches have rallied significantly in price.

“What makes the situation so interesting is that the fundamental health of the issuer improved without anything changing in the company’s core operations,” Mr Concannon and Mr Kinsella said.

“As a result, we think it is much less likely to default on its debt or enter into a restructuring arrangement.

“We suspect that may not be what those retail investors had in mind. But this is just one example of what experienced investors already know: Often the unintended consequences of large-scale actions can reverberate through financial markets in hard-to-predict ways.”