From Seema Shah, Chief Global Strategist, Principal Asset Management:

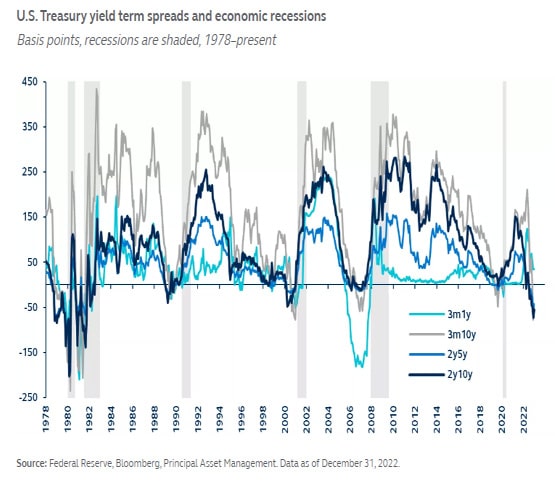

Several characteristics of the U.S. Treasury yield curve highlight the heightened risks to the economic outlook in 2023. With the 2y10y yield curve at its most inverted point since the 1980s, and the U.S. Federal Reserve determined to further tighten monetary policy, recession is creeping ever closer.

While economic resilience last year has led some to believe the U.S. will avoid recession in 2023, key market indicators say otherwise. Yield curve inversion, when shorter-term Treasury maturities begin yielding more than longer dated issues, has occurred ahead of every U.S. recession since the 1950s—and today, nearly every yield term spread has inverted. While not every instance of inversion has led to a recession, several features of the current yield curve are sending a very strong recession signal:

1. Deeper inversions are a more telling indicator than shallow inversions. The 2y10y curve is its most inverted since the early 1980s.

2. Similarly, a sustained inversion gives a stronger signal of impending recession than a brief inversion. The 2y10y curve has been inverted since early July.

3. The lead time between 2y10y inversion and recession tends to be long and variable, sometimes extending to four years. Today, however, other segments of the yield curve which are typically consistent with high recession risk within a 12-month period, including the 3-month/1-year and 3-month/10-year curves, are also inverted.

Starting 2023, many investors have been reassured by the strength of the U.S. labor market. Yet, as yield curve inversion is demonstrating, the Federal Reserve is determined to tighten monetary policy until that strength is eradicated—the recession clock is ticking.