Private credit continues to garner the headlines. Rest Super announced yesterday it is strengthening its position in private credit. The fund has increased investment in Australian asset manager Metrics Credit Partners’ Real Estate Debt Fund (REDF), further diversifying Rest’s private markets and whole of fund exposures.

We are pleased to bring you three private credit articles this week. First, from Craig Brooke of KeyInvest explaining how the market has grown in Australia and why he thinks it deserves its own asset classification.

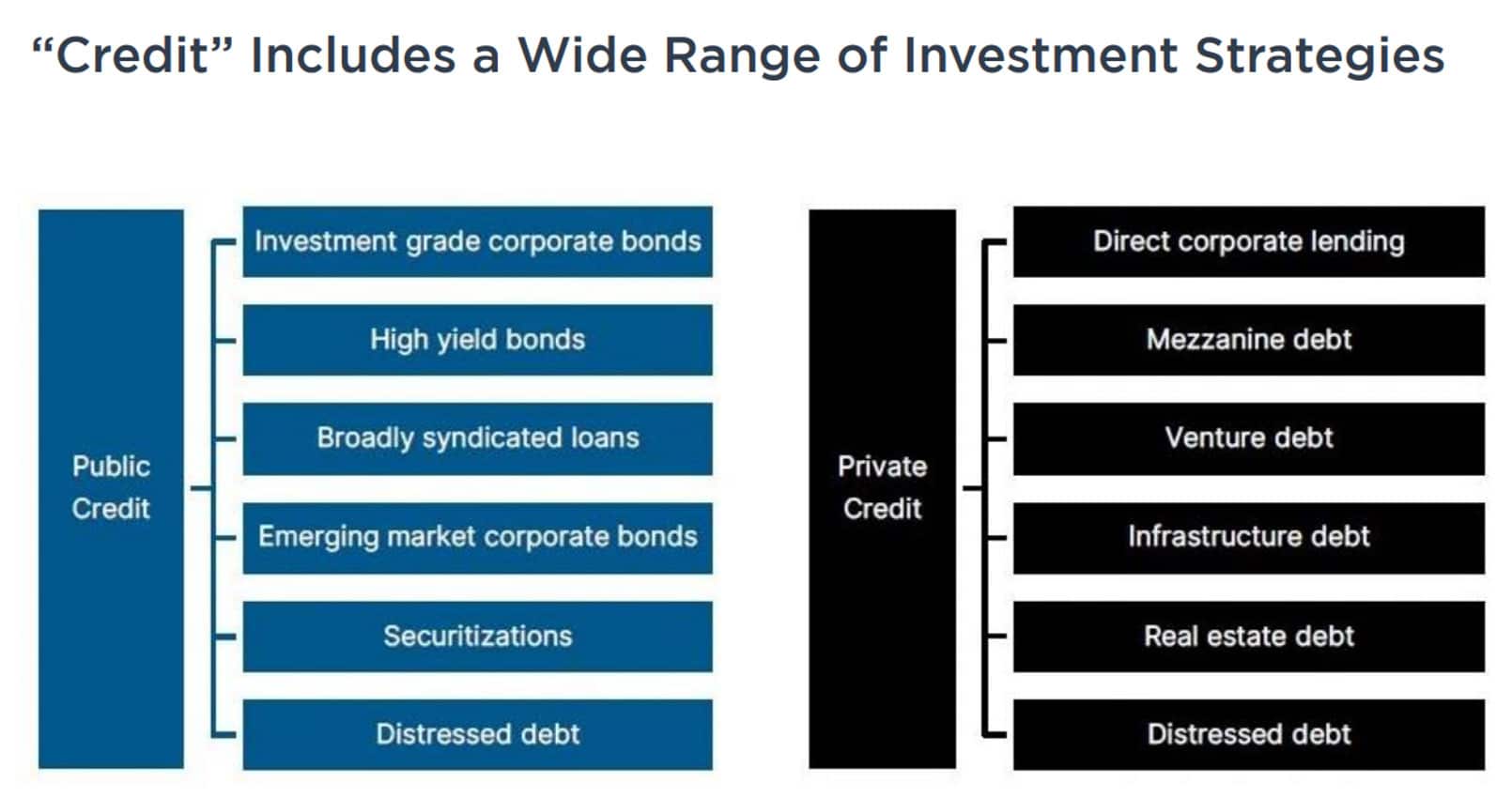

Second is from US firm, Mawer Investment Management explaining some of the issues they see with private credit in the US, a more mature market. Mawer defines Private Credit as:

…sometimes referred to as private debt, entails privately negotiated financing arrangements. The terms and conditions of the financing are privately negotiated between the lender and the borrower (“bilateral agreement”) or a small group of lenders and the borrower (“club deal”). Borrowers are typically private companies or small to medium sized public companies and like public credit, lending is done on either a cashflow or asset basis.”

I liked this table from the article so much I wanted to include it here. It really shows significant differences in investments.

Third, Patrick Marshall from Federated Hermes visited Australia and comments on the potential here for private credit and an outlook for the market in the second half of 2024.

Pete Robinson from Challenger wrote a much-read article a few weeks ago asking ‘Does Private Credit still have the Rizz Factor?’

This week’s lead article is a shock contrarian view on interest rates from T Rowe Price. Those dedicated readers will know my view on interest rates, but I really liked this article and its explanations – well worth a read.

Finally, an article about the continued growth of the Australian ETF market, now worth more than $200 billion.

Banco Santander is in the market for new Australian dollar Tier 2 subordinated debt 10NC5 (10 year final maturity and non call 5 years) issue with indicative pricing of 245 bps over swap, resulting in an initial yield of around 6.7%. Rabobank has launched a five year senior unsecured floating rate note with a margin of 98bps, or a coupon of around 5.1%.