VanEck recently published a detailed Credit and Fixed Income review. Here are some of the highlights.

Executive summary

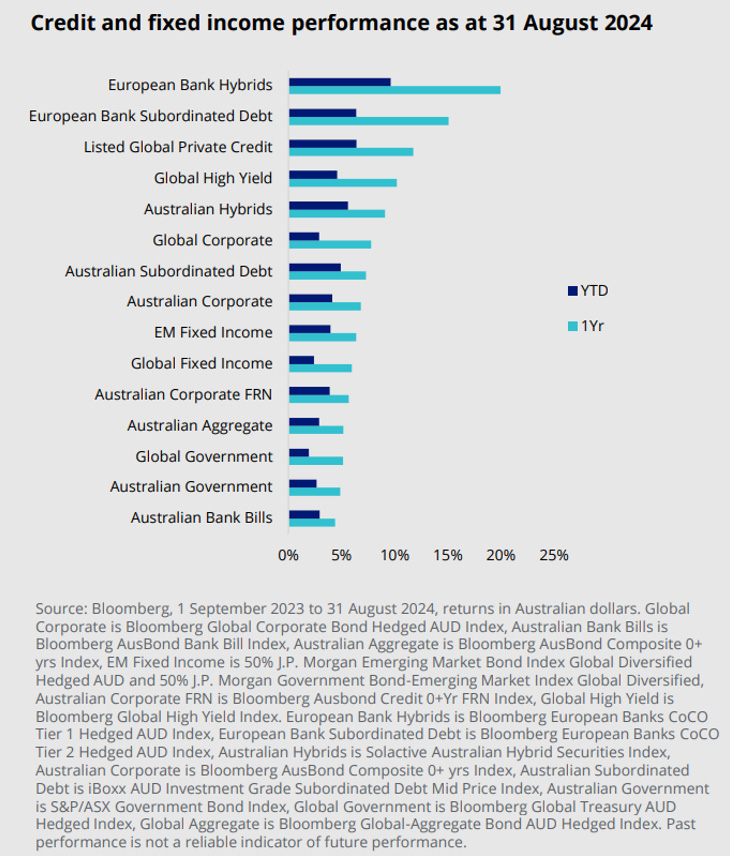

If the past 12 months taught investors anything, it’s that being selective and diversified is key to riding the economic cycle. Had investors avoided risk assets on the back of many economists calling the “most anticipated recession” that never happened, they would have missed the stellar markets run led by higher yielding fixed income asset classes.

Looking ahead, VanEck’s latest portfolio compass dissects our observations on inflation, policy rates, economic growth, exogenous risks and exposures considerations.

In Australia, credit spreads may tighten due to favourable market dynamics, particularly in subordinated debt. Extending portfolio duration becomes increasingly attractive as the Reserve Bank of Australia (RBA) edges closer to an easing cycle.

Globally, seeking quality exposures is prudent in a tight spread environment. Striking the optimal balance between yield enhancement, diversification and managing volatility is essential to navigate these conditions effectively. This approach ensures that portfolios are well-positioned to capitalise on opportunities while mitigating risks associated with market fluctuations.

Global Macro Observations

The pace of US disinflation may accelerate

- The unwinding of services inflation may accelerate with unemployment near the non-accelerating rate of unemployment (NAIRU).

Shallow US easing cycle

- The market’s optimism for substantial rate cuts in 2024 appears excessive.

Australian rate cuts seem a distant prospect

- ‘Services’ inflation remains persistent, with business costs picking up speed again.

Exogenous risks

- US government debt trajectory could push long term yields higher.

Credit and Fixed Income Observations

1. Australian government bonds

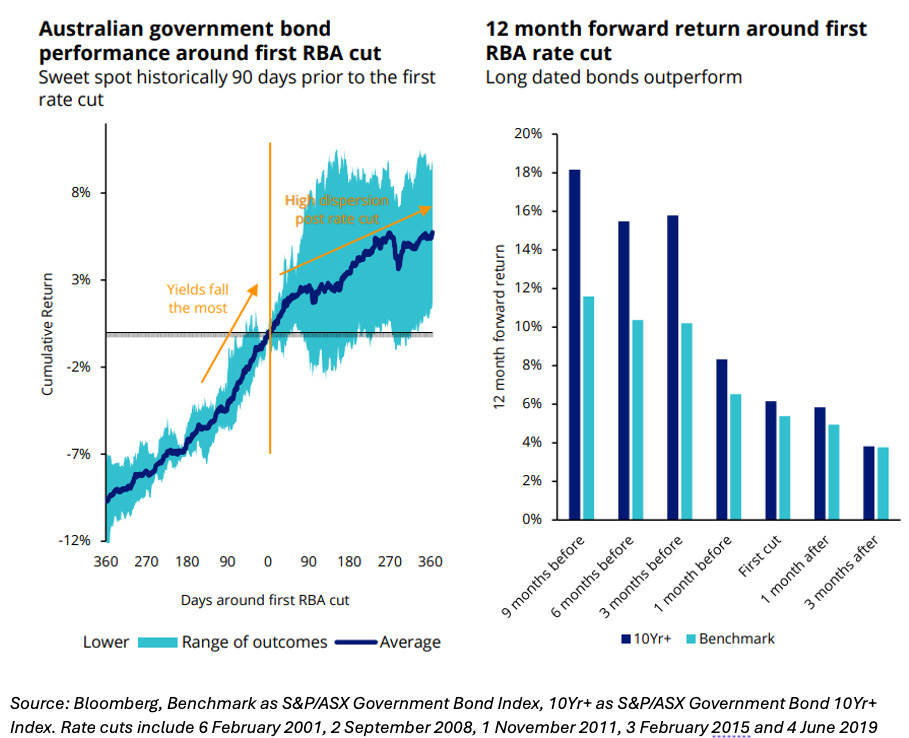

Extending portfolio duration becomes increasingly attractive as the RBA approaches an easing cycle, even if it appears a distant prospect.

Additionally, this strategy serves as a crucial defensive measure, allowing investors to benefit from falling government bond yields should economic conditions unexpectedly deteriorate.

In the past, bond investors have been rewarded for anticipating rate cuts, with long-dated bonds experiencing the most upside.

The optimal timing for this upside has typically been around 90 days before the first rate cut, when yields tend to significantly decline.

However, it’s worth noting that performance outcomes have shown higher dispersion after the initial rate cut.

In the past, bond investors have been rewarded for anticipating rate cuts, with long-dated bonds experiencing the most upside. The optimal timing for this upside has typically been around 90 days before the first rate cut, when yields tend to significantly decline. However, it’s worth noting that performance outcomes have shown higher dispersion after the initial rate cut.

2. Australian semi-government bonds

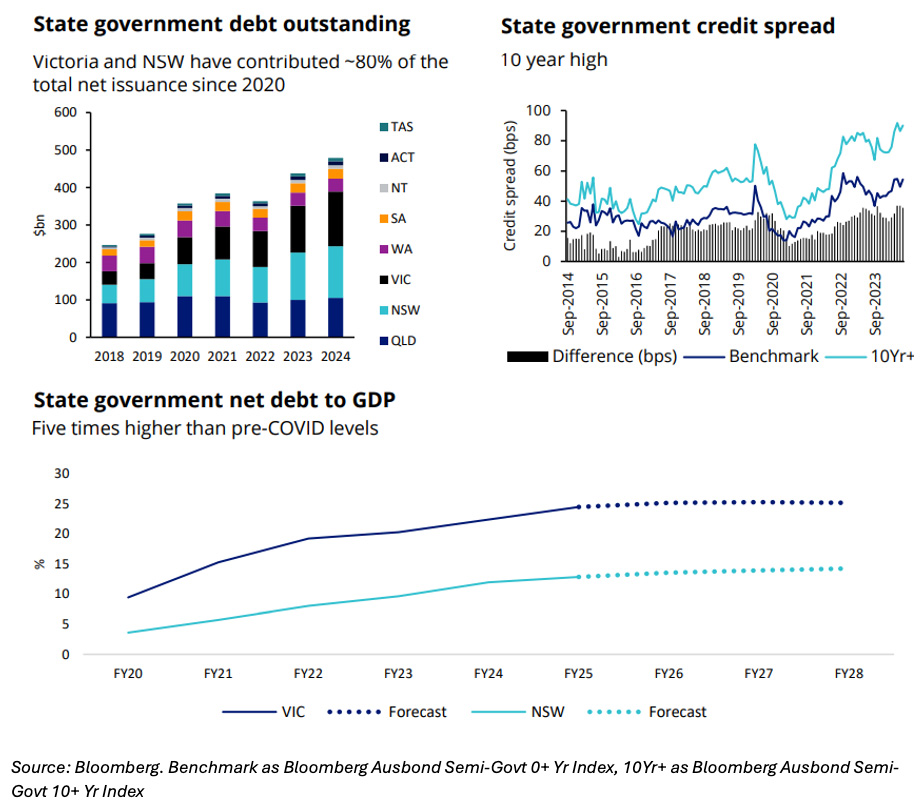

The semis market has grown twofold in the last five years, reaching $500 billion. The COVID-19 pandemic led to a significant increase in debt, mainly due to extended lockdowns in Victoria and New South Wales.

The rise in issuance has pushed spreads to their highest levels since the global financial crisis, particularly for long-term bonds. Such a trend is considered appropriate in light of the rise in government debt compared to GDP.

3. Australian investment grade bonds

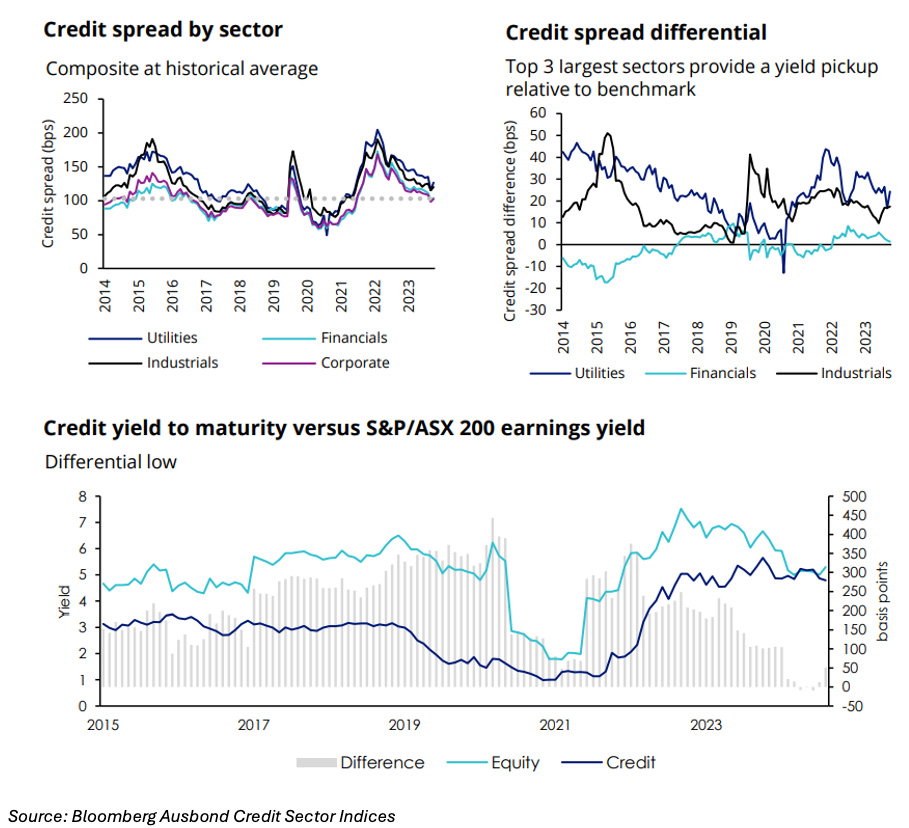

Solid credit fundamentals, supportive economic backdrop and healthy credit demand may contribute to a marginal narrowing of credit spreads.

Bank spreads are slightly above the historical average, offering relative good value. Capital requirement increase in the lower tranches in response to regulatory changes reduces the potential risk of loss on unsecured paper.

Credit attractive relative to equities as gap between equity earnings yield and yield to maturity is narrow.

4. Australian subordinated debt

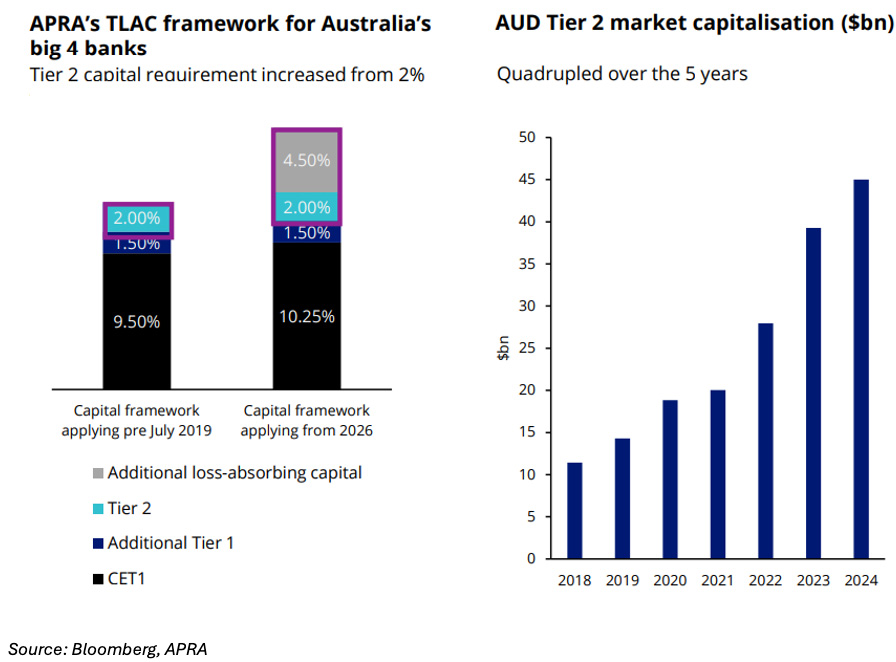

The Australian Prudential Regulation Authority (APRA) increased the Tier 2 capital requirement buffer for Australia’s big four banks on 9 July 2019 and 2 December 2021. The latest measure will take effect from January 1, 2026, specifically raising the Tier 2 capital requirement from 2% to 6.5% of Risk-Adjusted Assets (RWA).

These higher capital requirements were implemented to ensure that, in the event of a large or complex bank failure, it can be resolved with minimal impact on critical functions such as deposit taking and payments.

As a result of this announcement, AUD Tier 2 market capitalisation has quadrupled over the past five years, reaching over $42 billion.

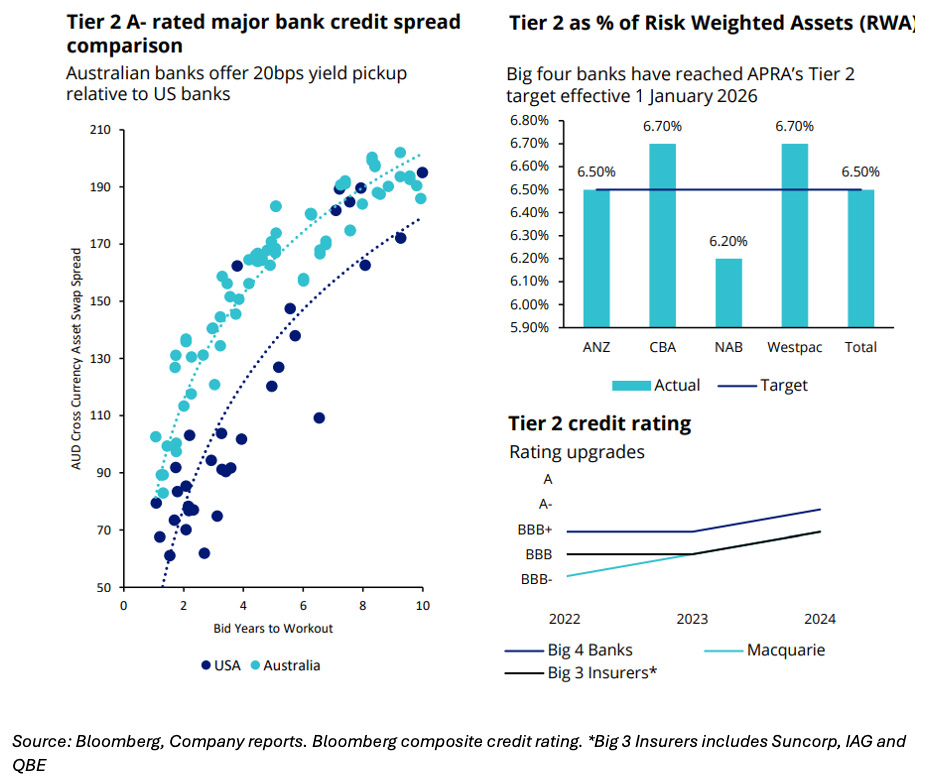

Amid market growth and favourable lending conditions, offshore banks such as Lloyds, HSBC, and Banco Santander have entered the market by issuing Tier 2 AUD paper to accommodate local demand.

The growth in Tier 2 market capitalisation and strengthening of bank and insurance capital buffers have contributed to improved credit ratings over the past few years. Further, single A 4 big bank credit rating has expanded the investable universe for many fund managers.

High issuance year-to-date has enabled Australia’s major banks to meet APRA’s T2 target of 6.5% of risk-weighted assets (effective from January 1, 2026).

Future issuance is expected to be on a replacement basis as existing bonds are called.

Credit spreads may tighten due to strong investor demand, limited excess supply and yield pickup relative to comparable US bank A- rated subordinated bonds.

5. Australia hybrids (AT1)

Note: Some comments regarding hybrids have been excluded as they are no longer relevant with APRA’s announcement this week.

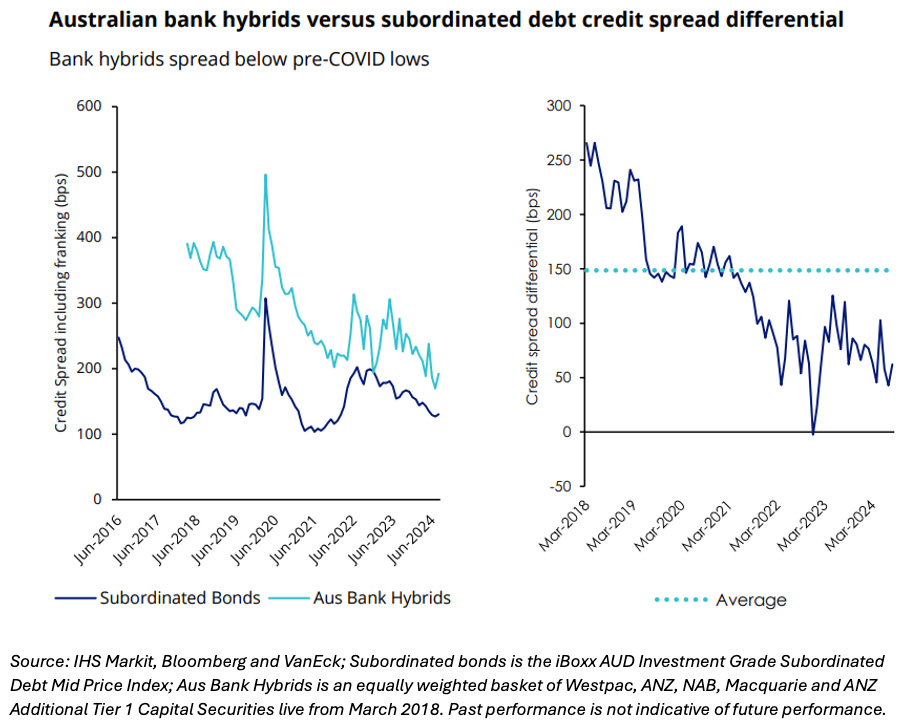

We see better value in subordinated debt. Both instruments offer a similar yield (~55bps difference including franking), despite subordinated debt being higher up the bank capital structure. The yield differential is also below its historical average.

6. Global hybrids

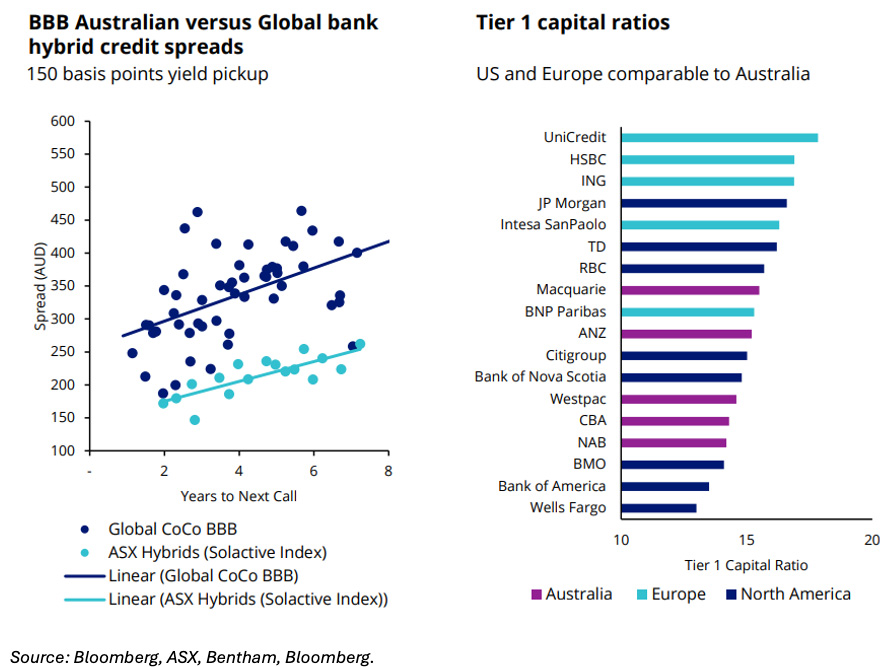

Global hybrid securities, which include instruments like contingent convertible bonds (CoCos) and other hybrid capital instruments, are an important part of the banking capital structure. These securities are designed to absorb losses during times of financial stress, providing a buffer to protect the core capital of banks.

US and European bank hybrids provide a 150 basis points higher yield compared to Australian bank hybrids, despite offering similar Tier 1 capital ratio buffers.

7. US high yield

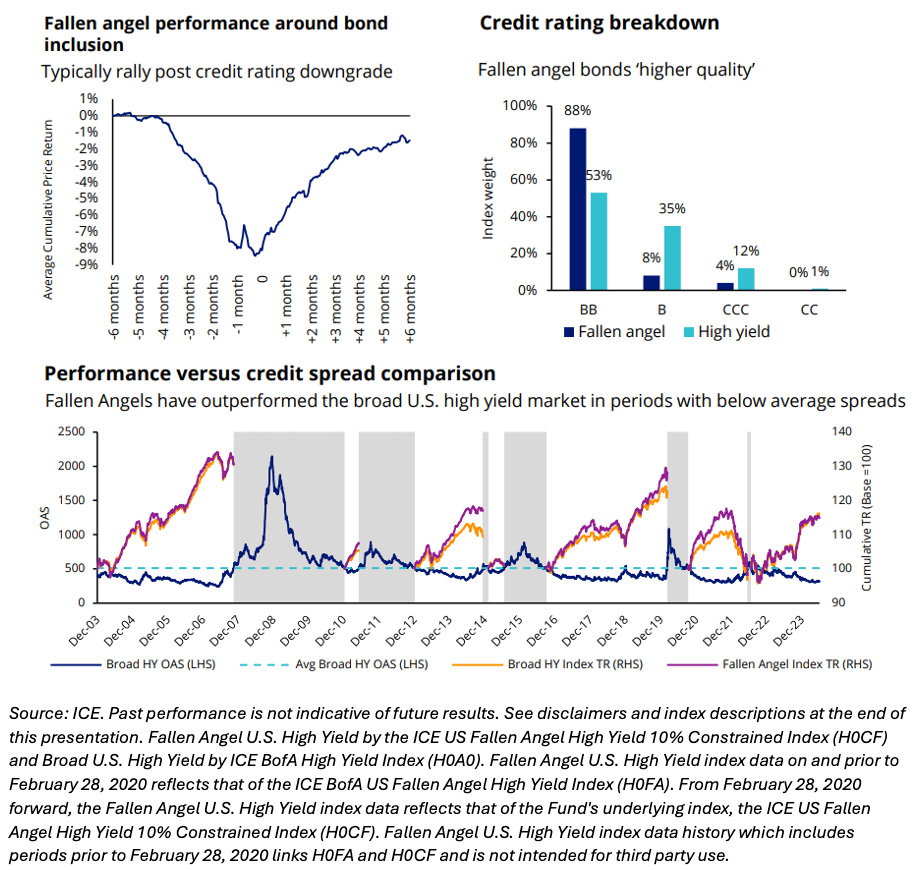

Fallen angel high yield bonds are part of the overall high yield universe but unique in that they were originally issued with investment grade ratings and later downgraded to non-investment grade, or high yield.

The unique performance drivers of fallen angel bonds—such as systematically buying oversold bonds, differentiated sector exposure, and higher credit quality—have led to outperformance compared to the broader high yield market, especially in tighter spread environments like the one we’re currently experiencing.

It’s crucial to be selective in the high yield space. A prolonged “higher rates for longer” environment could challenge the debt serviceability of lower-quality instruments.

8. Global listed private credit

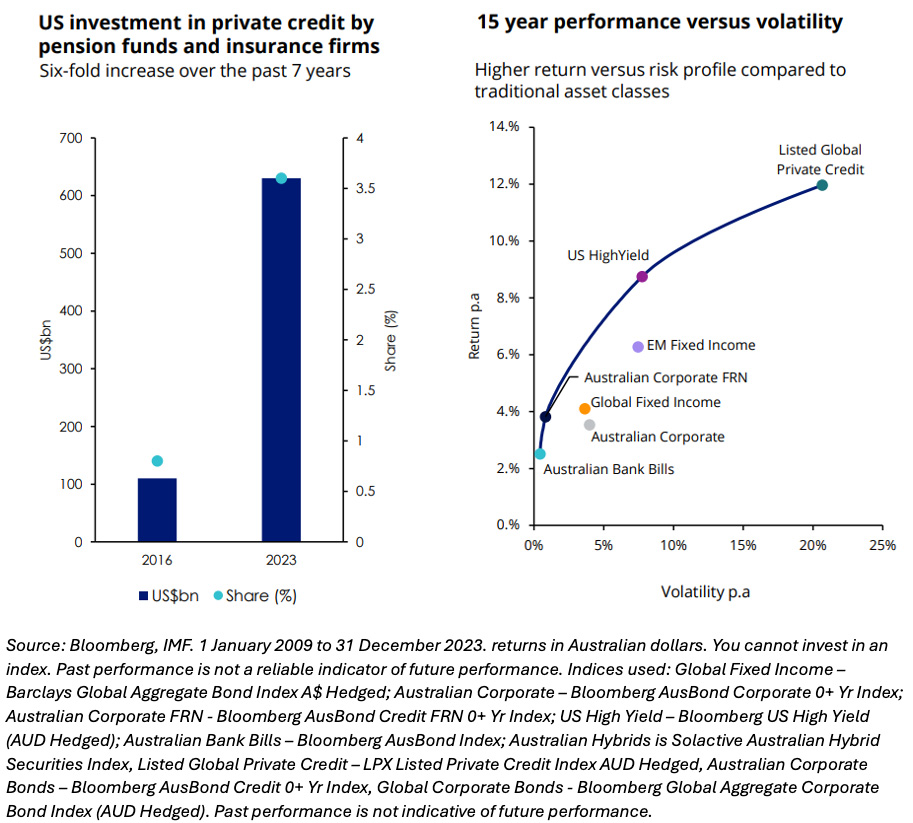

Private credit is gaining prominence among asset owners as a well-established asset class, driven by a surge in demand.

Private credit AUM held by asset owners has increased six-fold over the past 7 years.

Investors are attracted by the higher return versus risk profile compared to traditional asset classes, diversification benefits and for potential protection against rising rates as most loans are floating.

Price discovery and mark-to-market valuations will test investor risk appetite and liquidity constraints.

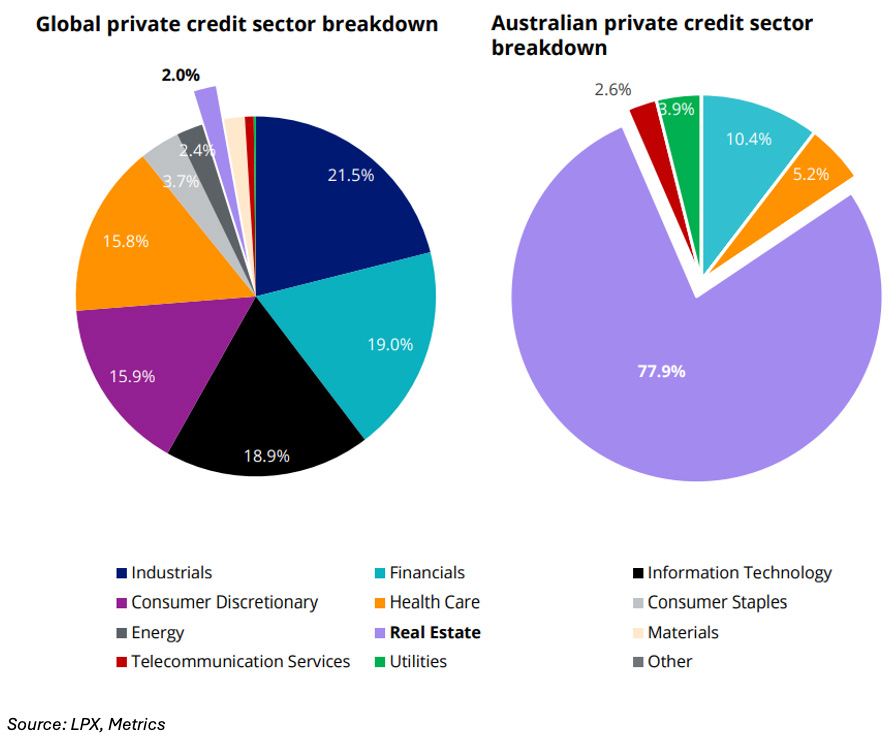

Global listed private credit has been pivotal in scaling up technology infrastructure and enhancing workflow efficiencies while allowing business owners to retain equity stakes.

Global listed private credit primarily serves service-based industries.

Australian private credit funds typically provide concentrated exposure to real estate.

Insolvencies in the property and construction sector are rising, adding to the risk of loan defaults. ASIC, the Australian corporate regulator reported that 28% of business collapses in 2023 were in the building and construction industry.

9. Emerging market debt

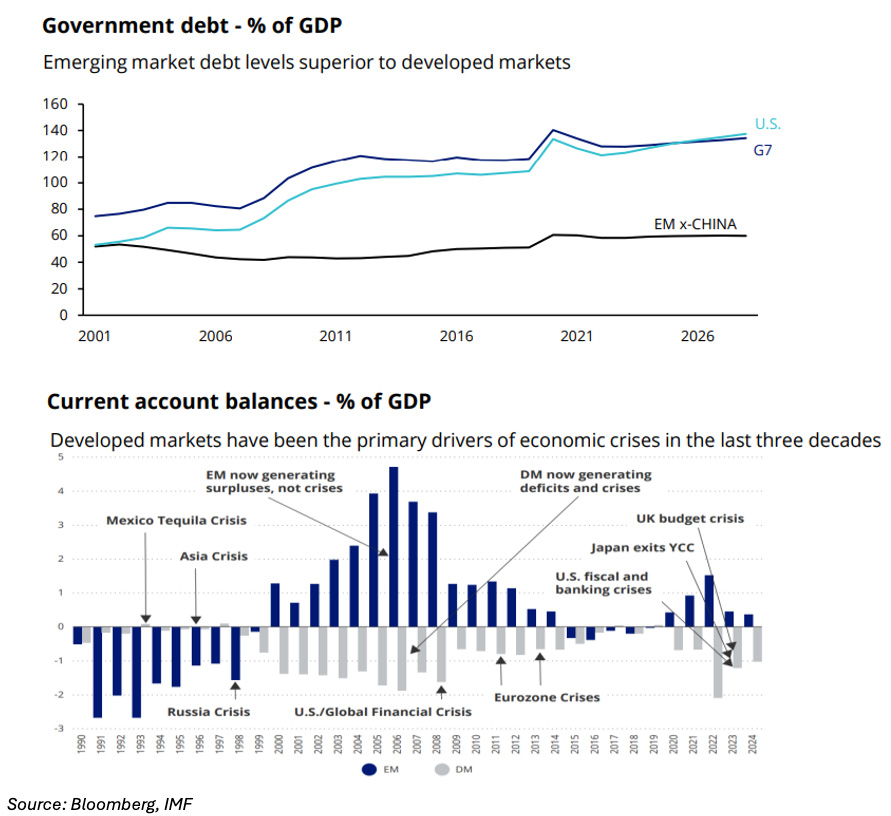

Over the past three decades, there has been a notable transition.

Economies of emerging markets have shifted from deficits to surpluses. Concurrently, economies in developed markets have been accumulating deficits. This has led to a change in the source of economic crises.

Previously, up to the end of the 20th century, emerging markets were commonly associated with bond crises. However, since 1998, most financial crises have implicated major developed markets.

Despite this, bond portfolios have not adjusted to acknowledge this shift, which positions emerging market debt as a compelling investment.