Verdict

Short duration bonds often outperform during rising rate periods, show resilience in recessionary conditions and—overall—produce lower volatility and better risk-adjusted returns. However, bad debt may crowd the short-duration high yield market at times of credit stress.

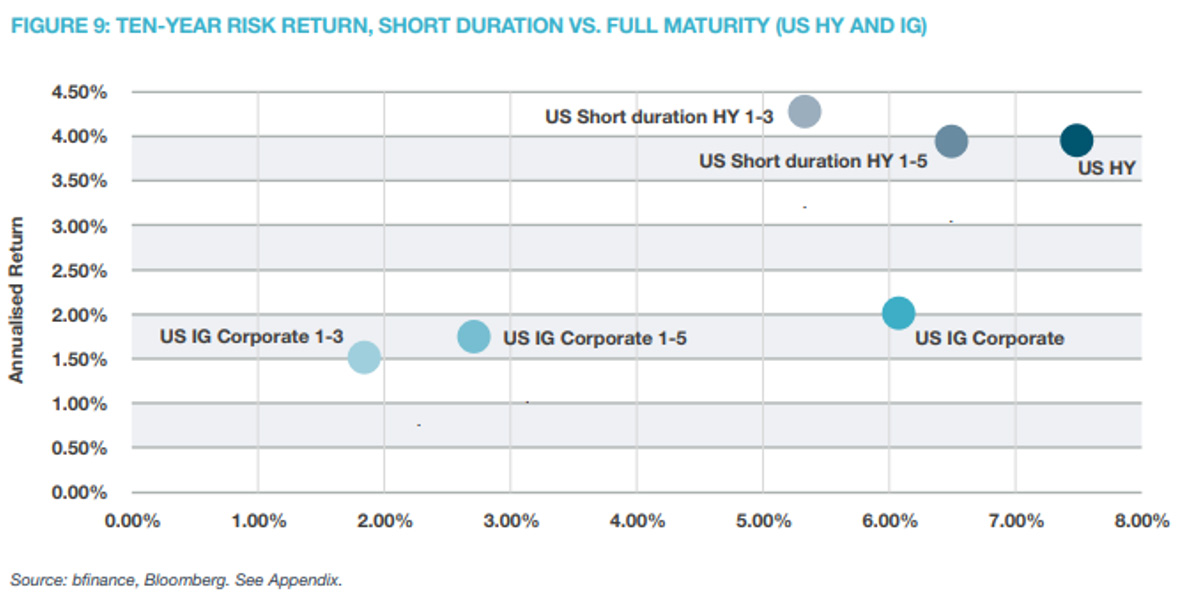

Shorter duration fixed income has substantially underperformed the wider market over the past decade, albeit with even greater reductions in volatility. Yet readers may already have noted the eye-catching performance of shorter-duration Investment Grade and High Yield securities that was shown in Figures 3 (rising-rate periods) and 7 (NBER recession periods). See Popular Belief Part 1 and Part 2 respectively.

Firstly, in Figure 3, we saw that short duration fixed income did provide meaningful protection during the most recent rising-rate period, in both high yield and investment grade credit. This is intuitive: the shorter a bond’s maturity, the less sensitive it is to rate moves. Indeed, a closer look at 2022 shows that short duration provided particularly strong protection at the time when the Fed implemented hikes. While US Investment Grade Credit lost 12.3% between July 2020 and December 2022, short-duration IG Credit (1-3 year) only lost 2.6%. Meanwhile, US High Yield only gained 4.3% during this period, while short-duration high yield (1-3 year) gained 13.1%. To some extent, shorter duration was also beneficial in the 1993-4 and 1998-2000 rising-rate periods, but there was no evident advantage to shorter-duration bonds in the 2003-6 or 2015-18 periods – when fixed income of all colours performed well. One might say, perhaps, that shorter duration has been most helpful during the handful of rising-rate periods when that help was more valuable.

Secondly, in Figure 7, we saw shorter duration fixed income providing some performance uplift during NBER recessions. In 2007-9, short duration was helpful in both Investment Grade and High Yield: US Investment Grade 1-3 year beat the wider IG market (+5.8% vs. +1.7%) and US High Yield 1-3 year did even better (+6.7% vs a -4.5% loss in US HY). In the 2001 recession, short duration was again helpful on the High Yield side (+6.1% vs.-2.4%).

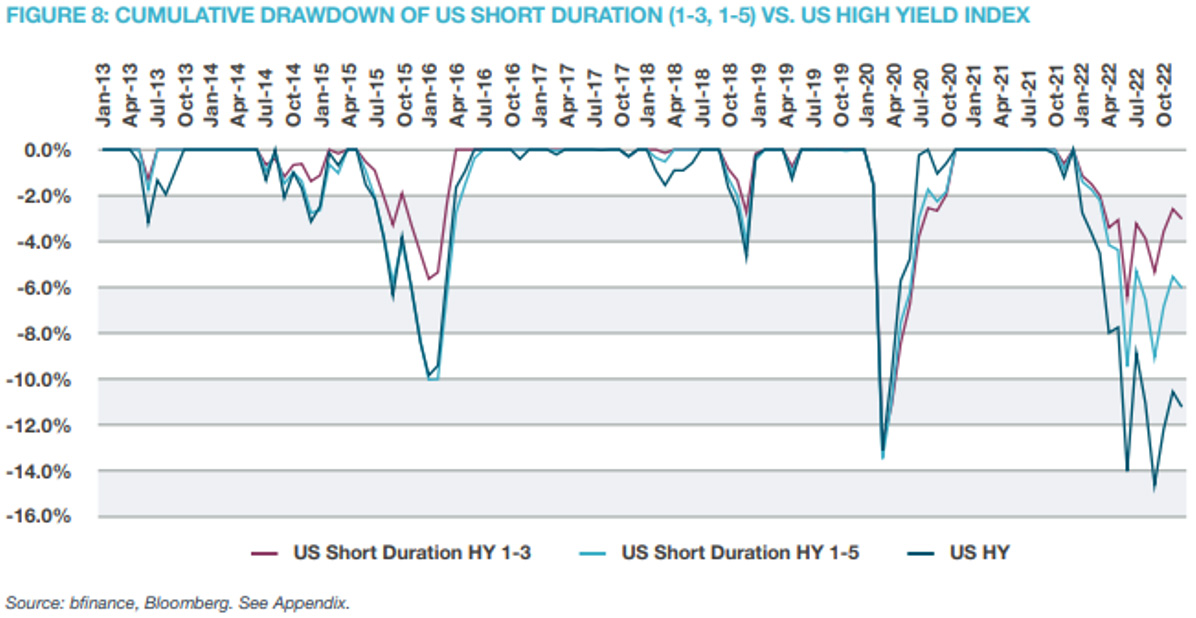

The performance of short-duration credit amid recessionary conditions is a matter of some debate. Historically, short duration high yield bonds have only experienced 60% of the drawdown of the wider HY bond market, often with a quicker time to recovery (Figure 8).

There is meaningful fundamental support for low price volatility in short duration credit. Bonds running closer to maturity tend to be less liquid than new issues, creating helpful price inertia.

However, bad debt may crowd the short-duration high yield market at times of credit stress. Issuers like to call their debt ahead of maturity, but companies whose financials are deteriorating may struggle to call their bonds and prefer to let them run until maturity (this is not technically a default, of course). In such scenario, stressed issuers gradually represent a larger part of the short-duration bond market as high-quality issuers refinance their debt with longer dated issuance and exit the short duration space. For this reason, asset managers running short duration High Yield portfolios tend to exclude CCCs and/or underweight more cyclical sectors such as energy to ensure that they deliver the main objective: maintaining a relatively low level of risk.

Overall, it’s worth noting that short duration bonds have produced better risk-adjusted returns than the wider market over the past decade, although their absolute returns had historically been weaker before 2022. US short duration high yield bonds have delivered between 15% (1-5 years) and 30% (1-3) less volatility than the overall market. Meanwhile, short duration investment grade bonds saved between 55% (1-5) and 70% (1-3) of the volatility (while sacrificing 15% and 25% of the return).

Also read:

Popular Belief 1. Fixed income does poorly in periods of rising interest rates.

Popular Belief 2. Investment grade bonds outperform high yield bonds during recessions.

This is part of a series of articles from London-headquartered specialist consultant bfinance, based on their whitepaper: Recessions, Rising Rates and Received Wisdom in Fixed Income Investing.