Ninety One’s Multi Asset Credit team explains that although the high-yield debt market compares favourably with bank capital from the perspective of index-level credit spreads, beneath the surface the differences are stark; bank capital is among specialist credit markets that present a smarter choice for investors.

Much of the US high-yield market offers investors a lower credit spread than the overall index. In contrast, active credit investors can still find plenty of compelling bottom-up opportunities in the bank capital market.

The context

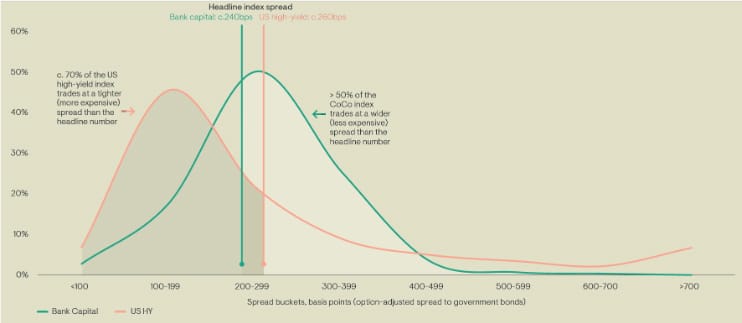

We’ve previously discussed1 how misleading index-level spreads can be – particularly in the US high-yield market, which is heavily skewed by a stubborn right tail of weaker credit issuers (as the chart shows). Today, around 70% of bonds in the US high-yield index pay investors a lower spread than the headline index spread (c.260bps).

Darpan Harar, Multi Asset Credit Portfolio Manager, Ninety One said: “The driver of this so-called ‘fat left tail’ of the market is the ongoing demand for higher-quality segments of high-yield markets as a widening pool of investors are buying these based largely on the (historically high) level of yields on offer as opposed to the (historically low) credit spreads.”

While headline spread levels for the bank capital market (among other specialist credit markets) are even tighter (c.240bps), the market is less skewed by the tails. As the chart shows, more than half of the bank capital market offers higher credit spreads than the headline spread, compared to just 30% in the US high-yield market. In other words, while the broad-based bargains in bank capital may be less pronounced than a year or so ago, investors can still find better deals in the asset class than in more mainstream credit markets.

Also read: The Risk of No Landing

“This is despite the intrinsic difference in credit quality, with the bank capital index rated three notches higher than the US high-yield index. The driver of this favourable credit quality comparison is a strengthening of fundamentals: the higher-for-longer interest rate environment has boosted banks’ net interest income, while disciplined cost management and low levels of non-performing loans have kept asset quality solid,” Harar added.

Furthermore, the bank capital market is supported by favourable technical (supply/demand) dynamics2.

The conclusion

In contrast to the US high-yield market – where the majority of constituents offer scant compensation for risk – investors can find plenty of opportunities in the bank capital market to earn a decent spread, and for a lower level of credit risk. The headline index spread level masks this reality.

“That said, a selective approach is important. Within the bank capital market, we see the best opportunities in relatively shorter-call dated bonds with strong structures that offer an attractive yield-to-call while also benefiting from more favourable downside characteristics than the broader market,” Harar said.

1 The misleading mean and fat tails and phantoms.

2 There has been a notable increase in tender (buy-back) activity and early calls of AT1s, further boosting investor confidence and lowering the perceived extension risk (the risk of bonds not being called). For context, early AT1 tenders are when a bank offers to buy back its AT1 bonds from bondholders before the call date at a specific price. Typically done through cash tender offer where the bank offers to buy back its AT1 bonds or a debt exchange offer where the bank would exchange for newly issued AT1.