As investors move through life, their appetite for risk and reward changes. It’s common for older investors to choose lower risk investments as they have less time to remedy any losses if they occur.

While there are no set ‘rules’ for asset allocation by age, one of the most famous rules of thumb was coined by the late John Bogle, founder of global asset manager Vanguard.

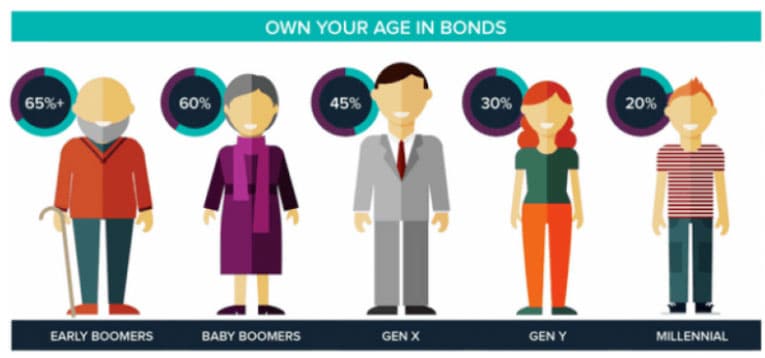

Bogle’s asset allocation recommendation was: ‘own your age in bonds’ i.e. the percentage of your portfolio that comprises bonds should roughly equal your age.

While clearly not an exact science, it demonstrates the increasing need for fixed income to meet the reduced appetite for risk as we move through life.

Why the ‘own your age in bonds’ rule works

If, like me, you’re Gen-X or a Baby Boomer, chances are you’ve worked hard and done your best to save for retirement. The great thing about retiring is the chance to move away from full-time work, and finally enjoy the things you’ve never had time to. The downside is that you no longer receive a regular salary.

The challenge lies in creating predictable and regular income. Income that can weather difficult market conditions and meet the longevity test, without adding risk to your capital. This challenge is top of mind for a growing number of Australians right now.

For many retirees, term deposit (TD) income has become their ‘salary’. Australian household deposits are now over $1 trillion¹, with a large part of this being TDs. TDs are popular because they offer savers less risk than many other investments.

For other investors, high-dividend yielding shares are a key source of income. While both are valuable assets in their own right, it’s important to recognise the limitations of each.

Shares – no longer the golden goose

Even for the most ardent equity investor, it has become clear that the halcyon days of the 1990s and early 2000s are over. Recent dividend cuts are not one-offs – Australian share dividends are on the decline. Australian companies have been paying out far more than in other countries and this doesn’t appear sustainable.

We shouldn’t overlook the volatility of shares and the intermittent post-GFC series of shock-waves that cause fear and uncertainty every six months.

With share markets, you could decide to wait and find out. If Aussie shares hold up, we’ll be the lucky country like we were post-GFC. But if Australian companies can’t sustain this level of dividends, share prices may tumble, along with your income.

The question for all of us is “do I want to take this risk?” Millennials may say yes but, if you’re a retiree, or close to it – you can’t afford to be cavalier with your future.

Don’t get me wrong – well-selected shares represent a great investment and should form a component of most investment portfolios, regardless of age. But can they be relied upon for regular, long-term, stable income?

Term deposits – the search for stable income

You may not have the luxury of waiting for your investments to recover in five to 10 years. Recognising this, many Australians have turned to the investments that sit below shares on the risk-return spectrum.

If you have TDs you already have a stable income. As per John Bogle’s words, the older we get, the greater our allocation to these sorts of investments should be. But low rates are really hampering the returns TDs can offer. You’ll have watched your TD rates fall further and further over the past few years. I’m sure you’re now wondering is there a way to increase your ‘salary’ without jumping onto the equity or hybrid rollercoaster.

Corporate bonds are worth a look

Fixed income generally provides investors with more secure and capital stable investments than shares, hybrids, property and other growth assets. But, not all fixed income investments are equal.

Government bonds are lower yielding than TDs because they have even lower investment risk. Investors have tended to bypass these, opting instead for higher yielding TDs. However, government bonds dominate key Australian fixed income indices that managed funds benchmark against their own performance. Many fixed income ETFs also track these indices.

If you own fixed income managed funds or ETFs, chances are you are already invested in low yield government bonds. The funds are safer for having government bonds in them as they are less likely to default, but this takes away from their yields.

Corporate bonds offer higher yields than TDs

Corporate bonds generally have higher yields than TDs². There are a number of ways to access corporate bonds, including bond ETFs and managed funds. However, both of these have a key limitation – they do not mature. They are perpetual investments, so you cannot predict the future income and capital you will receive from them – this makes your retirement planning much harder.

If you want to control the timing and exact return on your money, looking at individual bonds may be a better strategy. Corporate bonds have always been available to large investors that can trade in the over-the-counter market.

However, for most investors, trading corporate bonds in this way is out of reach, due to the minimum investment size. If you have millions of dollars to invest, you can choose from a wide range of corporate bonds issued by successful Australian companies. Whilst they may trade in parcels of $50,000, more commonly it’s $500,000 at a time. This leaves them inaccessible to most investors.

A more accessible way to ‘own your age in bonds’

Corporate bonds can deliver greater returns than cash, with much lower risk than shares.

For example, you might be receiving a return of 1.0% from the bank on your term deposits, but you could get over 2% from a corporate bond. It might not look like much at first blush, but that is more than a 50% increase in your ‘salary’.

If your money is invested too aggressively in the retirement phase and the share market drops, it will become extremely hard to rebuild your assets. Fixed income can play an important role in generating solid, regular income for investors. It offers strong capital preservation benefits. So, allocating some of your money to corporate bonds can be a great way to safeguard your retirement savings.

John Bogle’s rule of thumb is a great place to start. If you’re nudging retirement and are heavily weighted towards shares, it may well be time to balance your portfolio out with a greater corporate bond allocation.

Contributing author – Richard Murphy, Co-Founder and CEO, XTB

XTBs provide access to senior bonds of top 100 ASX companies. This makes them a capital stable and relatively safe investment. Compared to government bonds, TDs or cash management accounts, XTBs provide the same steady and predictable income but also offer potentially higher returns.

¹ Source: APRA Banking Statistics May 2020

² Term Deposits may enjoy the benefit of protection under the Financial Claims Scheme

This article was first published in February 2018 and updated in August 2020

Disclaimer

The information in this article is general in nature. It should not be the sole source of information. It does not take into account the investment objectives or circumstances of any particular investor. You should read the PDS that relates to that Class of XTB prior to making an investment decision and consider, with or without advice from a professional adviser, whether an investment is appropriate to your circumstances. Australian Corporate Bond Company Limited is the Securities Manager of XTBs and will earn fees in connection with an investment in XTBs.