From Matthew Macreadie, Executive Director, Credit Strategy and Portfolio Management – IAM Capital Markets

We see potential for the Suncorp Float 06/27/2034 bonds to be bought back/tendered at $107-$108 based on historical experience and the senior / subordinated (T2) differential.

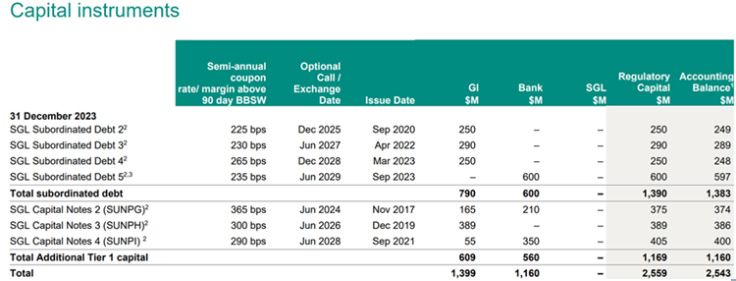

Post ANZ’s acquisition of Suncorp Metway, we see a small opportunity arising for Suncorp Group Tier 2 investors to capitalise on higher bond returns. For background, Suncorp Group is the old insurance business which will continue to have Tier 2 (T2) and Additional Tier 1 (AT1) instruments outstanding. The positive catalyst we expect to translate into potentially higher bond returns is that Suncorp Group will materialise post ANZ transaction with too much capital.

What Does This Mean?

Well, with too much capital you can generally do two things:

1. Return to shareholders – through buybacks/special distributions; and/or

2. Return to debtholders – through buybacks/tenders.

Re (2), historically Australian insurers have had to pay up to buyback/tender existing capital instruments. The recent evidence points to QBE paying up to $2-$5 above market to buyback its USD capital instruments. If this is the case, then a similar outcome for T2 investors would be viewed positively from a capital upside perspective. Examining the senior / subordinated (T2) differential for Suncorp Group, it appears to be around 100bps. For an instrument with 4.5 years credit spread duration, this would equate to an increase of AUD4.5ppts in price (all else-equal the issuer would have to “pay-up”). However, even if the securities are not called as expected, you still earn a healthy margin of 3m BBSW + 235bps until call date of July 2029 (current coupon of 6.808%). This suits those investors who think rates may continue to stay higher for longer as well.

Also read: Global Economic Worries Allowed Yields To Fall And Yield Curves To Steepen

Suncorp Group is currently sitting on too much capital at not only a common equity tier 1 (CET1) level but also a total capital (includes CET1, AT1, and T2) level. This means they can effectively do (1) and (2) as above. In the T2 space, the most obvious candidate for a buyback/tender is the Suncorp Float 06/27/2034. Note, there are four T2 notes outstanding that could be bought back/tendered.

Why?

Well, four key reasons driving this:

1. This line is AUD600m outstanding and so management would get a better bang for buck from optimising their funding base in this security.

2. This line has the shortest maturity (2034 vs 2035-2038). In essence, the shorter the maturity, the less insurance equity credit is given by the rating agencies, which means the security becomes effectively expensive debt.

3. The capital was used to fund the bank and so would be transferred back to the group post transaction. Would make sense from an administration perspective to then enact this capital optimisation strategy.

4. The 29/34 does not qualify for equity credit. Its original maturity was short of the 15yr minimum for equity credit, but as it was raised specifically for the bank, equity credit wasn’t a consideration. So as of the bank’s sale, it is excess with no equity credit. Thus, it is not only expensive debt, but given the proceeds of the sale and re-capitalisation, it should be considered excess debt, not just expensive.

Source: Suncorp Group Investor Presentation

The Suncorp bonds are currently available to pick up ~104 and we see potential for them to be bought back/tendered at $107-$108.