Last Friday, CBA launched and issued a new subordinated bond into a hotly contested market.

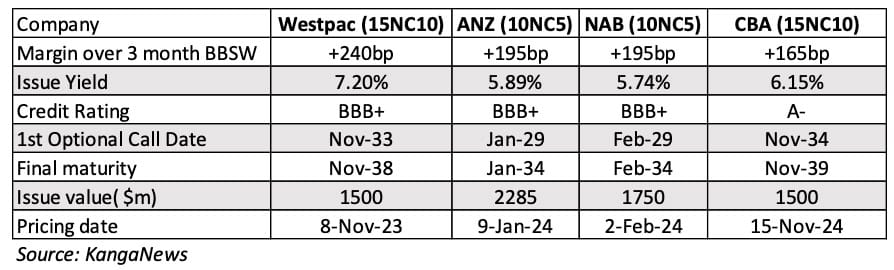

Price guidance for the (15NC10) 15-year, non call, 10 issue was 175bps, but the fixed to floating rate issue printed at 165bps. The initial fixed coupon rate was 6.152% for the expected S&P Global rated A- issue.

CBA raised $1.5billion, but likely could have printed more given the solid yield and investment grade credit rating.

Also read: New Ethical Australian Fixed Income ETF

The major bank subordinated debt market has seen spreads contract significantly over the past 12 months. In November 2023, Westpac issued a 15NC10 subordinated bond, with a margin over 3-month BBSW of 240bps. CBA’s new issue was 75 basis points, roughly 30% lower.

The CBA issue was announced and printed on the same day, which is quick.