Elizabeth Moran takes a look at the new BOQ Tier 2 subordinated debt issue and compares it to the recent Judo Bank and QBE issues.

Bank of Queensland (BOQ) is in the market taking an indications of interest (IOIs) for a new 10.25 year, non call 5.25 year (10.25NC5.25) subordinated bond. The expected issue rating is BBB and price guidance is 3 month BBSW +205 basis points, yielding over 6%, annualised at first issue.

New subordinated bonds have been massively oversubscribed this year as investors like the higher return with a marginal increase in risk compared to senior unsecured bonds.

BOQ is perhaps the weakest credit regional bank, so how does this issue compare to other subordinated bond issuance this year?

Online challenger bank, Judo Bank was the last to issue into the Tier 2 market. Its issue rating was two notches lower at BB+ and the bank sought expression of interest at a 370 basis point margin over 3 month BBSW. The deal was eight times over subscribed and the margin tightened by 35 basis points to 335bps. Interestingly, the final margin was a whopping 165 basis points tighter than its last sub debt issue.

Back in early September QBE Insurance Group issued a (10.75NC5.75) and a fixed to floating (15NC10) Tier 2 issue. Similarly, the rating was also rated BBB flat but the issue margin for the sorter dated Tier 2 settled lower at 195bps after price guidance of 215bps.

Also read: Opportunities Resonate Across DM Yield Curves: Amundi

All three of the above bonds used the over-the-counter market to raise funds. In the OTC market, minimum parcels are $500,000 but some brokers break the bonds down into smaller parcels from $10,000. See our list of small parcel brokers on the Bond Portfolio page.

There are two dedicated subordinated bond ETFs that trade on the ASX:

- Betashares Australian Major Bank Subordinated Debt ETF (ASX:BSUB)

- VanEck Australian Subordinated Debt ETF (ASX:SUBD).

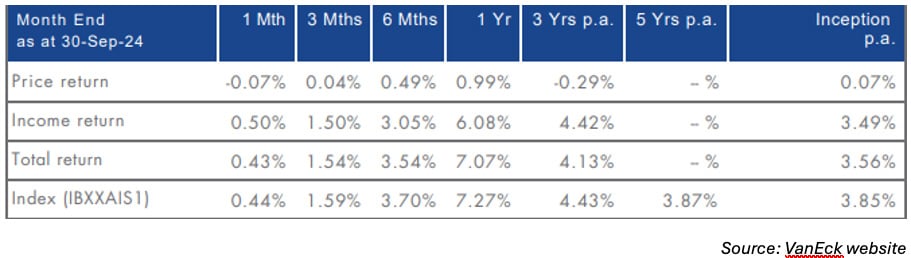

VanEck’s SUBD is the longer term ETF. Inception was October 2019. Over the last year to 30 September 2024, the fund returned 7.07% (see below). For six months the return was 3.54% and since inception 3.56%.

The fund holds 30 securities, has a yield to worst of 5.03%pa ( the worst possible return if the bonds are called at the worst possible time) and running yield (12 month income) of 6.27%. Management fees are 0.29%, with monthly distributions and $1.9 billion in funds under management. There is no minimum investment.

Note: this article is for education purposes only and none of the securities mentioned are recommendations.