Fixed Income News Australia recently published Two fixed Income Funds return 10%+ over the last year and the article generated significant interest.

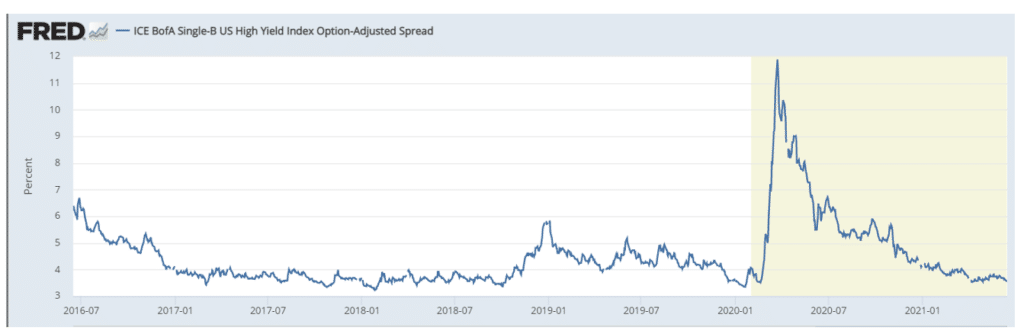

Readers liked the direct comparison and an ex-colleague, Jon Sheridan from FIIG Securities, rightly pointed out that a year ago sub-investment grade credit hit a low point.

Spreads for the ICE BofA Single ‘B’ High Yield Index Option Adjusted Spread peaked at just under 12% in March 2020. They remained elevated at more than 6% up until July 2020.

Spreads have contracted since then and therefore prices of high yield securities in the single ‘B’ range have risen, helping funds generate double digit returns.

Current spreads are closer to 3.6%, so it’ll be difficult for funds to continue generating very high yields unless there is a talented fund manager at the helm!

Importantly, those funds invested in bank loans did particularly well. This segment saw large capital inflows with investors chasing yield, attracted by underlying properties securing many loans and the fact the loans are floating rate. Therefore, if inflation continues to rise and interest rates are also expected to move higher, so too will income on the securities.

Clearly there were other funds that would have reported double digit returns and it’s only right that I inform you of other high performers.

Our ETF and Managed Fund finders helped me to identify other funds, but the list below is by no means conclusive.

Bentham Asset Management – various funds

Bentham Asset Management specialise in the high end part of the fixed income asset class and a number of funds recorded double digit returns for April and also May, showing recovery of high yield spreads over the last 12 months or so.

Bentham Asset Management

| Syndicated Loan Fund | Global Income Fund | Global Opportunities Fund | High Yield Fund | |

| Inception Date | 16-Aug-04 | 16-Sep-03 | 8-June-17 | 15-Oct-98 |

| Assets under management | A$2,945m | $A2,112m | A$682m | $A147m |

| Performance | 31 May 2021 | 31 May | 31 May | 31 May |

| 6 months | 4.65% | 4.51% | 6.19% | 3.76% |

| 1 year | 14.47% | 12.88% | 16.47% | 13.91% |

| 3 years | 2.61% | 3.80% | 5.93% | 4.84% |

| 5 years | 4.70% | 5.55% | N/A | 6.21% |

| Since inception | 7% | 6.80% | 5.75% | 7.94% |

| Fees | ||||

| Management Fee | 0.77% | 0.72% | 1.00% | 0.60% |

| Administration Fee | 0.03% | 0.01% | 0.05% | 0.07% |

| Performance Fee | N/A | N/A | ||

| Buy / Sell spread | 0.35% / 0/35% | 0/27%/0.27% | 0.30%/0.30% | 0.17%/0.17% |

| Distribution Frequency | Monthly | Monthly | Quarterly | Quarterly |

| Benchmark | Credit Suisse Lev. Loan Index (hedged) | 50% Bloomberg Ausbond Composite Bond and 50% Bloomberg Ausbond Bank Bill Index | Bloomberg Ausbond Bank Bill Index | ICE BofAML US Cash Pay High Yield Constrained Index (hedged) |

| Credit Ratings | ||||

| AAA | 6% | 3% | ||

| AA | Av credit quality B+ | 13% | 3% | Av credit quality B+ |

| A | 3% | 2% | ||

| BBB | 19% | 20% | ||

| BB | 12% | 28% | ||

| B or Below | 35% | 54% | ||

| Cash | 12% | -10% | ||

| Interest Rate Duration | 1.46 years | -1.77 years | -2.06 years | 3.71years |

| Minimum Investment | $10,000 | $10,000 | $250,000 | $10,000 |

| Permitted gearing | No | No | Yes | No |

*Note – Before fees

Betham’s flagship fund, the Syndicated Loan Fund, has close to A$3 billion in assets under management. It’s one year return was 14.47% after fees, but looking at three years the fund return was 2.61%, highlighting recent past negative returns.

The longer you can look at high yield funds the better. Typically, they are more volatile, showing greater positive and negative returns. This fund has returned 7% since inception in 2004 (17 years) and is a better indication of what to expect going forward.

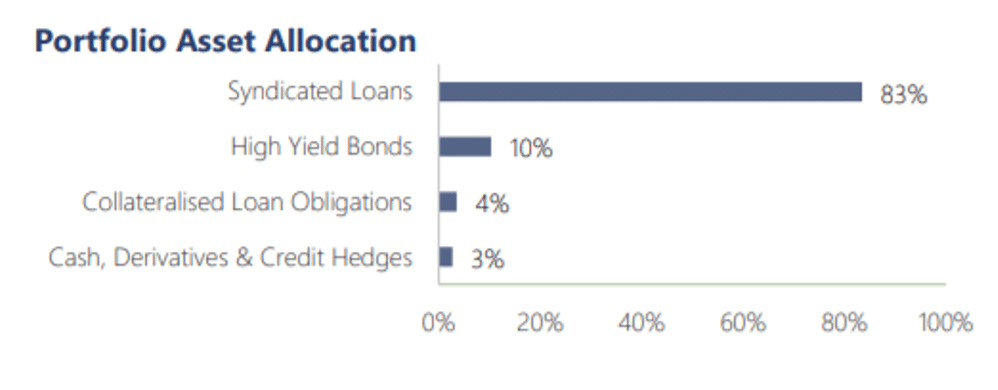

More than 80% of the fund is invested in syndicated loans and practically all of the fund is sub-investment grade, with 73% invested in securities with a credit rating of single ‘B’ or below.

This is a very high risk fund where you would expect fairly frequent negative returns.

Positively, the portfolio would mostly be floating rate investments, likely to benefit investors in a rising interest rate environment. Interest rate duration is 1.46 years.

The fund has great diversification investing in 420 issuers and the fund provides a full list of investments. To 31 May 2021, the fund’s three largest industry exposures are 12.1% in Healthcare, Education and Childcare, 10.8% in Electronics and 7.9% in Diversified/Conglomerate Service.

The fund’s top three company exposures are 0.9% in Burger King, 0.9% in Finastra and 0.9% in Deerfield Dakota.

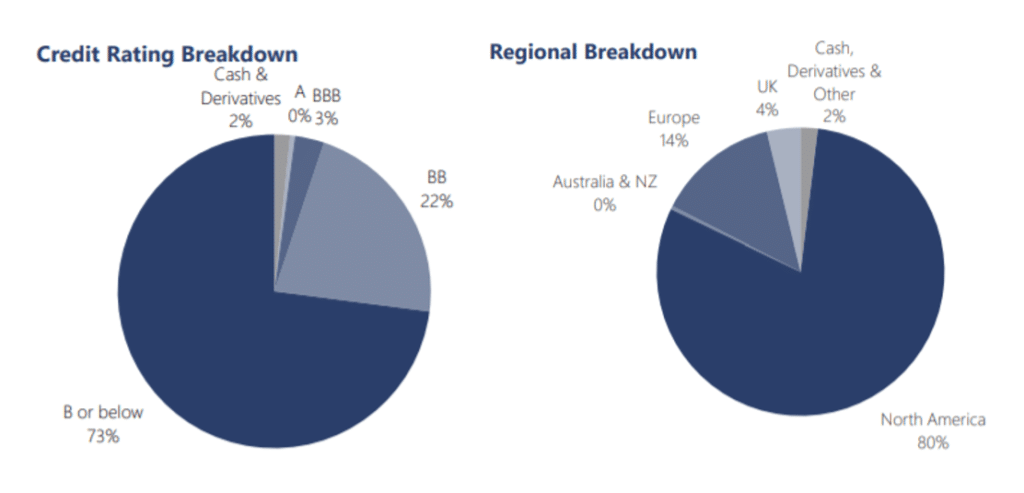

Other high performing funds

There were two other funds that would have had double digit returns to 30 April 2021:

- Janus Henderson Diversified Credit Fund

- Invesco Wholesale Senior Secured

The table below shows performance to 31 May 2021. The Janus Henderson fund returned 13.5% until 30 April, while the Invesco Wholesale Senior Secured Income Fund returned 16.74%.

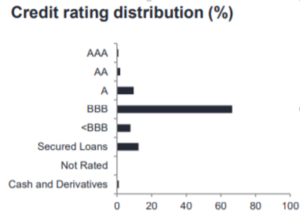

The Janus Henderson fund’s performance has slipped below 10% but the return remains high, especially given its weighted average credit rating is BBB, investment grade when the Invesco and Bentham funds are sub-investment grade.

Janus Henderson Diversified Credit Fund

The Janus Henderson Diversified Credit Fund returned 13.5% to 30 April 2021. This is an outstanding result given a better quality portfolio, with 80% of the portfolio in investment grade securities and less than 20% sub-investment grade or high yield. For the 12 months to 31 May 2021, the fund’s gross return was 9.05% and net 8.74%.

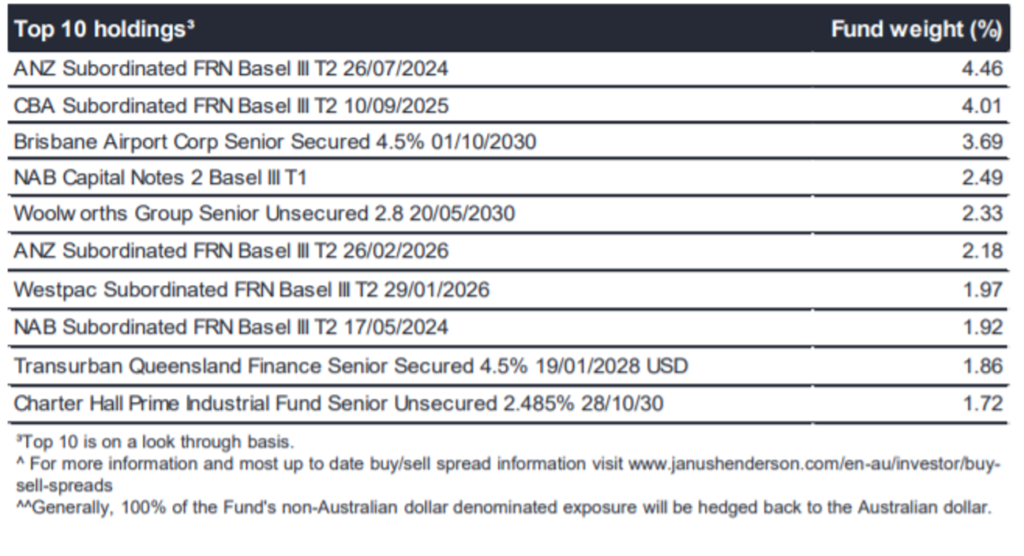

This fund is very well diversified, investing in 629 securities and a good sector allocation – Australian Senior Debt 35%, Australian Sub-Debt 25%, Australian Hybrids 21%, Secured Loans 13%, Global High Yield 4% and other 2%.

The top three holdings – an ANZ and CBA subordinated bonds and a Brisbane Airport Senior Secured bond contributed 12.16% of the portfolio.

If you bought into the fund on 31 May 2021 and held onto the investment until all the securities had matured, your estimated weighted average yield to maturity is 2.66%. By trading securities, the fund managers may improve that number for long term investors. The fund’s return since inception on 31 October 2012 is 4.75% p.a. net.

Invesco Wholesale Senior Secured

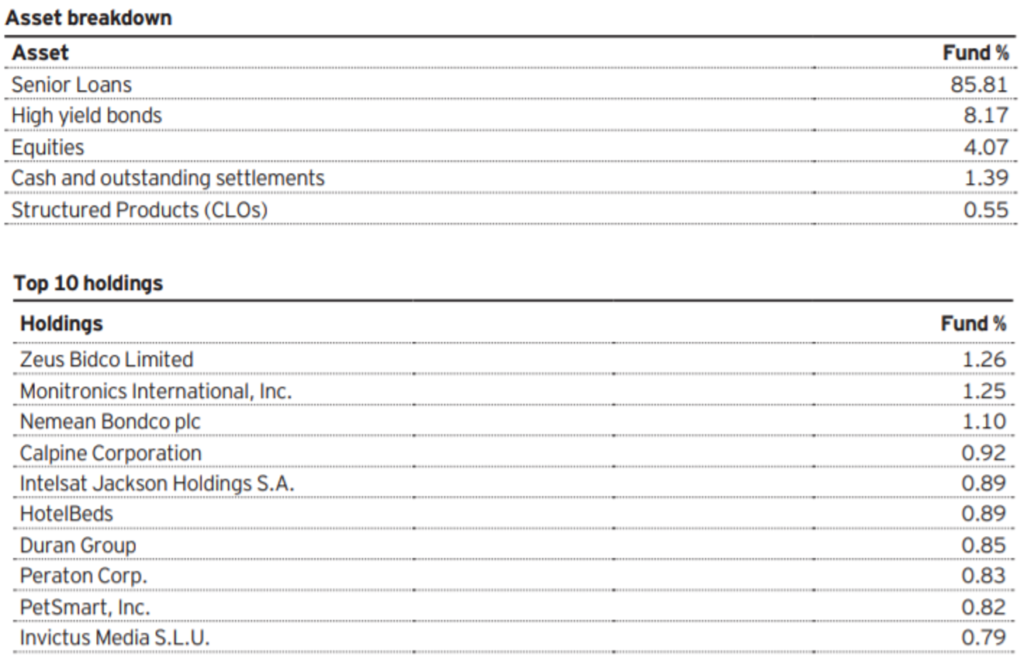

The Invesco Wholesale Senior Secured fund is small with just $26m invested. Less than 2% of securities are investment grade, making this fund very high risk. Like the Bentham Global Opportunities Fund, it returned more than 16% for the year to 31 May 2021.

A total of 85% of assets were senior loans and there is a 4% allocation to equities. This fund invests in an underlying fund – the Invesco Zodiac Fund.

This is a global fund with 75% of the securities US based and 22% European. The website didn’t disclose the number of securities or issuers, but the fund seems well diversified with the top three investments worth just 3.61% of the total portfolio.

Summary

Practically all the funds mentioned in this note are considered high risk but invest in different ways to achieve recent, stand out, high returns. The exception is the Janus Henderson Diversified Credit Fund.

Remember past returns are no guide to the future and persistent low interest rates are likely to pull down the ‘since inception’ return over time.

Stay tuned for a future article exploring which ETFs have delivered 10%+ returns.

Note: The funds mentioned in this article are not recommendations. Please do your own research and discuss with your financial adviser before investing.