By Erik S. Weisman, Chief Economist and Portfolio Manager, MFS Investment Management

The jury is out on whether the United States economy will be able to avoid a hard landing

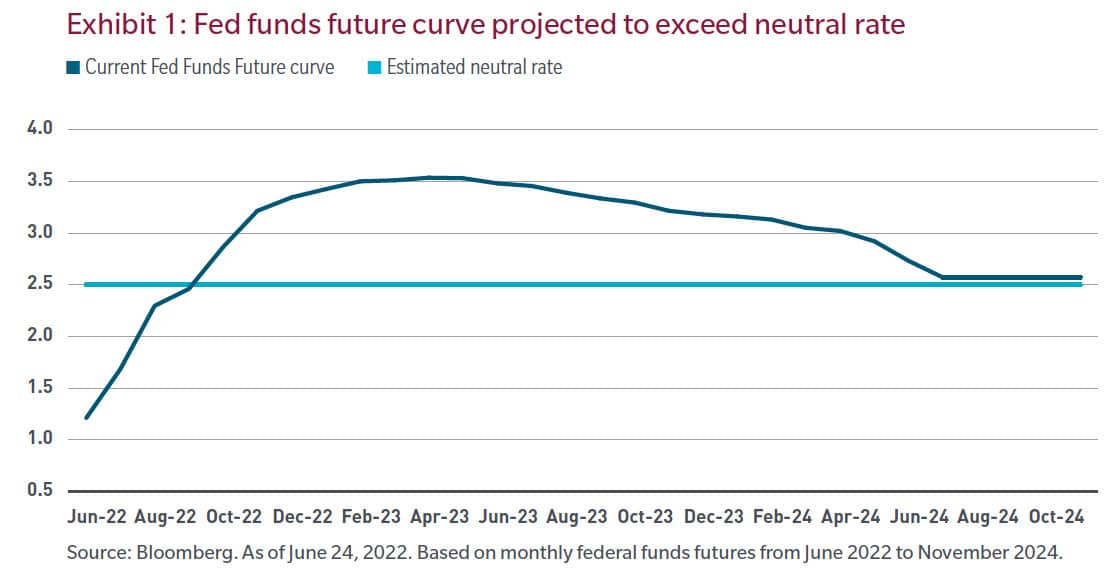

We believe the probability of a recession has risen considerably, reflecting concerns over the threat of policy overtightening by the US Federal Reserve. As shown in Exhibit 1, the Fed funds future curve is projected to exceed the estimated neutral rate by a significant margin. When considering the Fed’s dual mandate, Chairman Jerome Powell has made it clear that he is far more focused on containing inflation than safeguarding economic growth. As such, the Fed has signaled that it stands ready, if necessary, to engineer a recession —collateral risk — in its unconditional fight against inflation. Should a hard landing materialize, it is likely the Fed would change gears and re-engage in policy easing, but only if inflationary dynamics are safely back in the box. Overall, the US economy is facing a period of significant volatility and uncertainty, and there is a wide range of potential outcomes.

Also read: Stock Bond Correlation – A Global Perspective

There is still a path to soft landing, but it is increasingly narrow

Should the US manage to avoid a recession, it would mainly be the result of the US consumer demonstrating resilience, along with some supply constraint relief. The challenge will be to strike the right balance: Persistent, strong consumer spending would likely induce the Fed to continue raising rates, producing a recession in the process. However, mounting inflation pressures have driven consumer confidence to a historical low, and the risk going forward is that consumer spending will slow considerably and no longer function as the primary engine of economic growth. The critical factor in determining whether a soft landing can be achieved will be near-term inflation dynamics. So far, there has been little evidence that inflation is about to retrace its steps; the Fed will need to observe a clear downward trend in core inflation before pivoting back to a more neutral policy bias. In addition, the central bank has grown concerned about the marked uptick in long-term inflation expectations. However, inflation could be put on a better trajectory with the normalization of supply constraints (i.e., a positive supply shock) as well as a dampening of overheated demand.

What are the implications for the fixed income markets?

With a recession increasingly likely, the case for being aggressively short duration is weaker. We are of the view that there is a lower probability of longerterm rates moving much higher from current levels. However, rates at the front-end of the curve may remain susceptible to continuing high inflation, a robust labor market and a hawkish Fed, with the risk of further increases to short-term rates persisting. If macroeconomic fundamentals continue to deteriorate and a recession does materialize, we expect a widening of credit spreads, which will require careful analysis and security selection to help manage credit exposures.