Major Asset Classes: Equities, Bonds and Cash

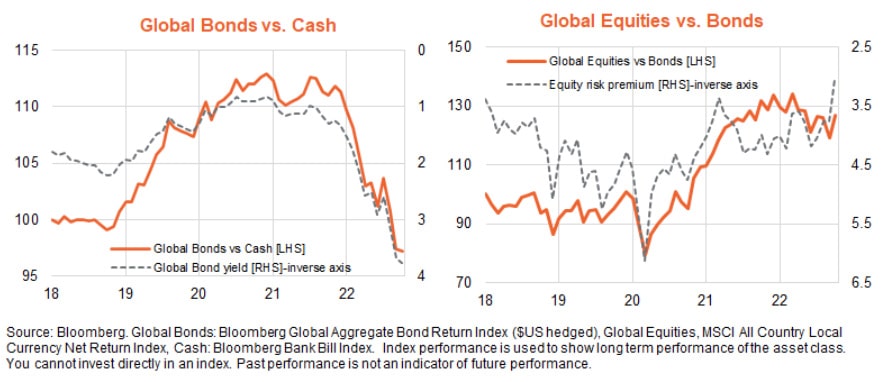

Although global bond yields lifted modestly further and forward earnings slipped lower in October, global equities rebounded as hopes of a slowdown in central bank tightening caused a solid bounce in PE valuations and a decline in the equity risk premium. Overall, global bond returns were flat. As a result, equity returns beat that of bonds, while cash again (marginally) outperformed bonds.

The key narrative over the month focused on ongoing hopes that the US Federal Reserve (the Fed) could soon signal a slowing – a pause, even – in interest rate hikes given the speed of interest rate increases to date. Also somewhat supportive of investor sentiment is the ongoing resilience in US economic growth, leading to hopes that the Fed could pause rate hikes – especially if inflation starts to slow soon – before an economic hard landing becomes evident.

Of course, the question remains: can US inflation slow quickly enough to entice the Fed to pause and reduce the risk of recession? In my mind, that still seems wishful thinking given that solid consumer spending and employment growth mean both businesses and workers retain strong price and wage-setting powers, respectively. Although inflation appears to have peaked, underlying inflation data remains fairly sticky – underpinned by growth in labour costs, medical bills and rents. In short, a decent US economic slowdown – and likely outright recession – still seems required to get inflation down in a timely manner.

All up, the Bloomberg Global Aggregate Bond Return Index (US Dollar hedged) was flat, with income returns offsetting a modest further capital loss due to a small 0.06% rise in the index’s yield-to-maturity to 3.76%. Despite the modest rise in overall global bond yields, US 10-year bond yields rose 0.2% to 4.03% and the market’s expected US Fed Funds Rate in 12 months’ time rose 0.42% to 4.82% (compared to an end-quarter actual Fed Funds Rate of 3.1%). In Australian Dollar-hedged terms, global bonds declined by 0.1%.

Also read: RBA Doing Whatever Is Necessary To Curb Inflation

The MSCI All-Country World Equity Return Index (in local currency terms) rose 6.3%, after an 8.4% decline in September. The global market’s price-to-forward earnings ratio rose 7.5% to 14.1, while forward earnings edged down by 1.1% after a 0.2% decline in September. Reflecting strength in global currencies versus the Australian Dollar, global equity returns in unhedged Australian Dollar terms rose by a stronger 6.9%. The energy sector again displayed relatively strong performance with a 17% gain, followed by industrials (10.0%), healthcare and technology (both up 8.1%), and financials (7.9%). Global value stocks again outperformed growth stocks.

As discussed in previous Market Trend reports, with aggressive central bank rate hikes priced into the market and inflation likely past its peak, the flatter performance of bonds last month is consistent with the view that the period of bond underperformance versus cash could be nearing an end.

The outlook for equities, however, remains more challenging given still-high inflation and the growing downside risk to corporate earnings. The one upside risk to equities remains a speedy decline in global inflation, which would then allow central banks to ease back on their policy tightening intent. In this optimistic scenario, both bonds and equities would be expected to rally.

Australia vs. the World

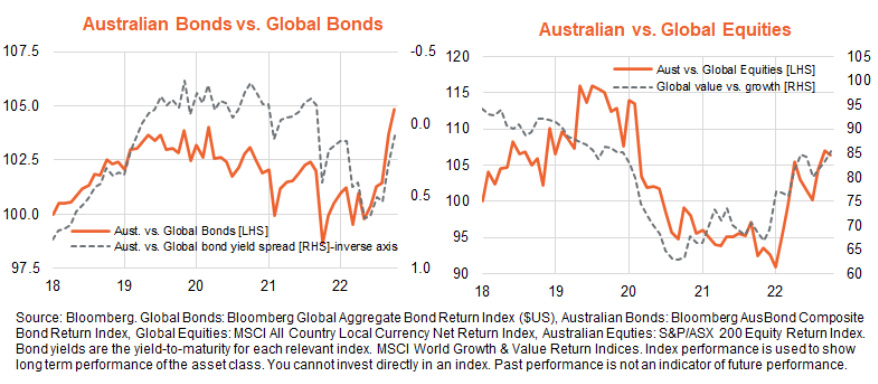

Australian bond yields fell relative to global yields over the past month, resulting in further local bond outperformance – with the Bloomberg AusBond Composite Bond Index returning 1.0% after a 1.4% decline in September. Indeed, a notable local feature in October was the Reserve Bank of Australia’s (RBA) surprise decision to only increase the official cash rate by 0.25% rather than the widely expected 0.5% move, taking the cash rate to 2.6%.

The yield on the Bloomberg AusBond Composite Index fell 0.15% to 3.84% over the month, while the market’s expectation for the RBA cash rate in twelve months’ time also declined by 0.15% to 3.94%. Over the past six and twelve months, Australian bonds have outperformed Australian Dollar-hedged global bonds by 3.6% and 5.5% respectively.

On the view that local policy tightening expectations are still somewhat aggressive, there remains scope for further Australian bond outperformance over coming months. My expectation remains that the RBA will raise rates to only 3.6% by mid-2023.

Australian equities marginally underperformed (unhedged) global stocks last month, with the S&P/ASX 200 Return Index rising by 5.8%. The financial sector (excluding listed property) enjoyed the strongest gain, rising by 11.9%. Energy and listed property also performed relatively well, with returns of 9.0% and 8.1% respectively.

However, assuming that a slowdown in global growth begins to place downward pressure on global bond yields and commodity prices, there remains the risk of Australian equity market underperformance in the months ahead.

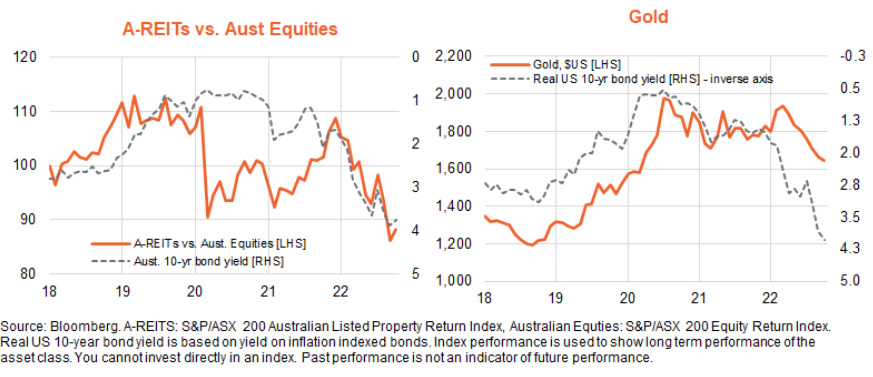

Listed Property and Gold

As noted above, Australian listed property enjoyed a strong bounce-back last month – reflecting a decline in local bond yields. While the relative performance trend so far this year has been downward, relative performance could start to improve as and when bond yields level out. Gold, meanwhile, continued to remain under pressure – dropping a further 1.1% in US Dollar terms, reflecting rising real global bond yields and a still-firm US Dollar.

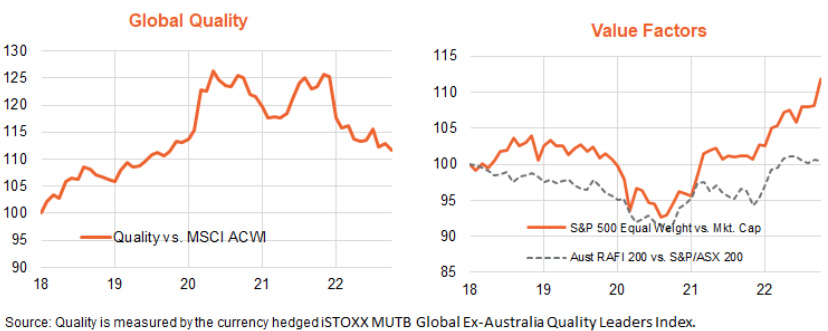

Selected Equity Themes

Among selected smart beta and factor exposures, a key underlying driver remains the relative underperformance of growth/technology areas compared to energy/value areas of the market.

Indeed, the one standout area over October remained the S&P 500 equally weighted index (QUS ETF) over its market-cap weighted counterpart – with the former returning 10.6% in Australian Dollar terms over the month, compared to an 8.6% return for the latter*. Relative performance of the fundamentally weighted Australian equity ETF (QOZ) versus the S&P/ASX200, however, has flattened off in recent months after solid gains earlier this year, while the technology heavy global quality factor continues to underperform the global benchmark.

*Returns are based on the QUS and VTS ETFs respectively. Past performance is not an indicator of future performance.

Article originally published 2 November 2022 here.