From Challenger

Since its inception in the 1970s, the global asset backed securities market has evolved beyond mortgage-backed assets to include loans secured by autos, equipment, credit card/personal loan receivables as well as high yield corporate loans. As the range of investment opportunities has grown, there is an opportunity for enhanced yield compared to similarly rated corporate credit.

Market standards are higher following lessons learned across markets through GFC

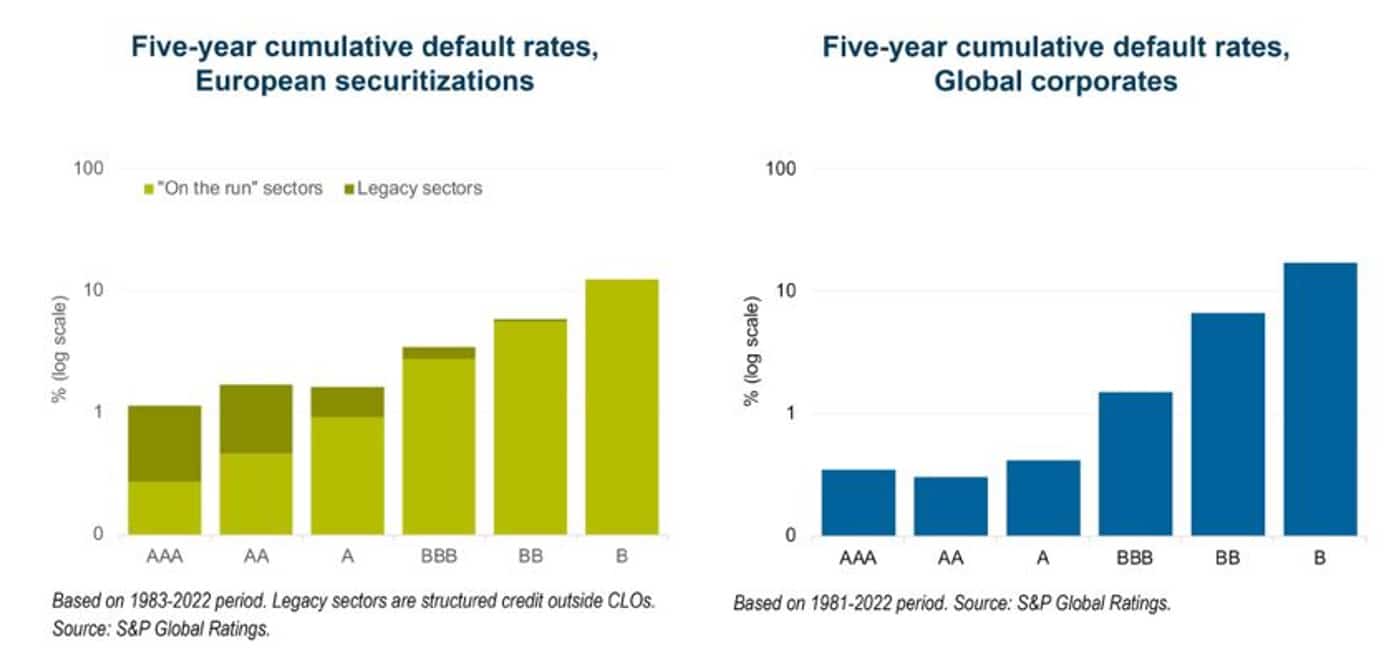

Pre-Global Financial Crisis (GFC), risks in the subprime mortgage and Collateralised Debt Obligation (CDO) markets were generally underappreciated by the market. More than a decade on, lessons learnt in these markets have been incorporated more widely across ABS sectors and deal structures which have improved markedly, resulting in significantly lower credit risk. In fact, long term default rates are similar to corporate credit when adjusting for legacy sectors, as shown in the chart below. Yet, this asset class often remains overlooked. What is sometimes less understood is the lessons that have been learned and implemented.

- Underwriting standards for the underlying loan pool have improved significantly and structural enhancements have taken place. For example, assets are tested to withstand severe stress scenarios with higher rated tranches subject to more stringent requirements.

- Increased oversight by global regulatory bodies has led to better transparency and standardisation.

- Loan data and performance data is more widely available.

Also read: Now Is The Time To Re-Evaluate Portfolio Positioning

Following the GFC, global regulatory bodies established a framework of rules intended to prevent excessive risk taking within the banking, insurance and pension fund ecosystems, a byproduct of which increased the cost and decreased the availability of asset backed capital within these ecosystems. This has allowed alternative financiers to step in to fill the gap.

Time to consider ABS?

The global asset backed securities market provides investors with high quality, yield enhancing and diversifying investment opportunities.

- Low duration: Most ABS securities issued in European and Australian markets are floating rate which means not only higher returns in a rising rate environment but also lower duration relative to traditional fixed income.

- Shorter repayment: Typically, repayments are within 1 to 5 years, much faster than traditional corporate credit exposures. This reduces the underlying volatility and correlation of asset backed finance with traditional growth assets as well as traditional fixed income products due to the insulation from interest rate and credit spread duration risk.

- Diversification and niche market opportunities: With a broad range of asset classes, capital structures, underlying collateral types and jurisdictions, relative value opportunities continually present themselves as the performance outlook and investor appetite across sectors change. The breadth of securitisation markets also gives rise to attractive niche markets, such as the Australian non-bank mortgage market. Despite being relatively niche, the opportunities in these markets can be significant and provide attractive relative value for investors who have access to them.

The UK LDI crisis in September 2023 was a prime example of when this combination of floating rate, short duration and a robust performance outlook presented a compelling opportunity for asset managers. Many were able to carry out large sales of highly rated securitised bonds at relatively low discounts to par. This experience stood in stark contrast with more traditional long duration fixed income instruments which experienced large capital losses and consequently extreme illiquidity during this period. We estimate that over a 3-week period roughly $15 billion in securitised bonds traded, a telling demonstration of demand for the asset class and also, the liquidity available.

The complexity of the asset class does necessitate specialised investment management. Deep experience and expertise is a pre-requisite. Underwriting a corporate borrower is a very different skillset to underwriting a highly granular and diversified pool of collateral. In addition to making an assessment on the credit risk of the investment, it is essential to understand how the cashflows from the collateral will pass along a bespoke cashflow waterfall structure. The reticence and underweight allocation to securitised assets from some investors creates a bigger opportunity for those that understand the asset class and its evolution.