For some investors, credit spread valuation may be perceived as a major headwind for fixed income. But we are of the view that the outlook for fixed income total returns remains robust in the period ahead despite the current level of spreads, which looks stretched by historical standards. This is because the major source of total returns will likely come from somewhere else, namely the impact of rate decline, the elevated carry and, last but not least, the potential contribution from alpha.

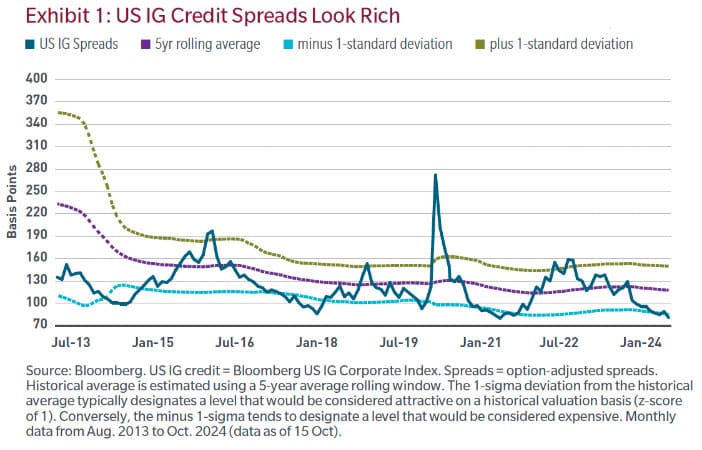

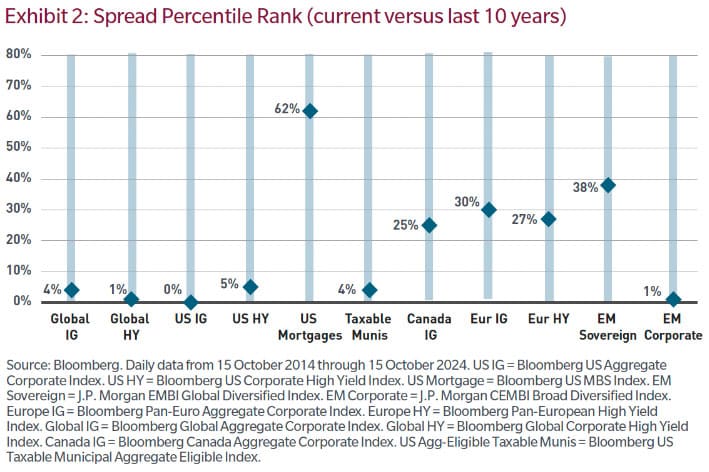

There is no denying that credit spreads look stretched in many segments of global fixed income. For instance, US investment-grade credit spreads currently stand at about 80 basis points, well below their 5-year average of 118 bps (Exhibit 1). The current level at 80 bps corresponds to a z-score of -1.16, which points to significant overvaluation.[1] It’s not just US IG. Many asset classes are currently displaying spread levels that look rich. Based on the 10-year percentile rank, the percentile is close to zero in the cases of IG, high yield, taxable munis (municipal bonds) and emerging market corporate debt, suggesting that we are currently observing very tight spread levels by historical standards (Exhibit 2).

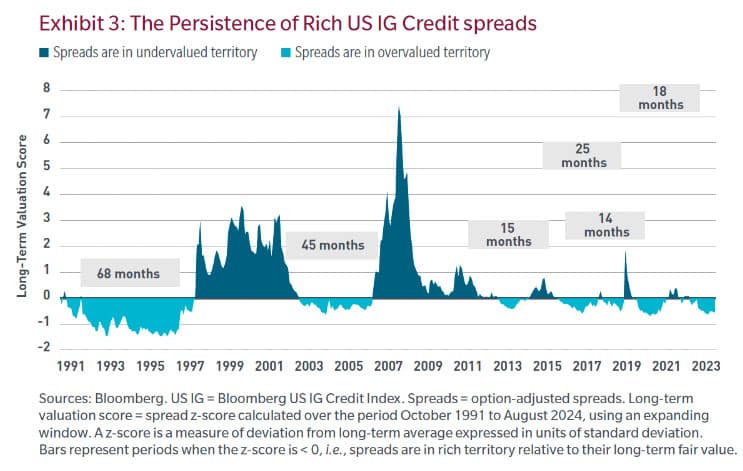

The good news is that stretched spread valuation is not uncommon. In itself, a stretched level of spreads doesn’t necessarily mean that a major spread correction is on the way. In fact, throughout recent history, we have observed many lengthy episodes of rich credit spreads. As long as there are no correction catalysts, spreads can remain in overvalued territory for an extended period of time, especially if market technicals, including inflows into the asset class, are robust and if the global risk appetite remains healthy (Exhibit 3).

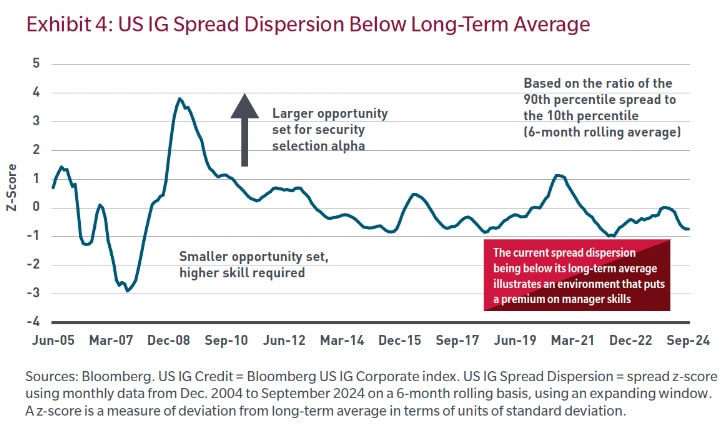

For credit risk, it is currently more about alpha than beta. Given where spreads are, it is unlikely that spread compression will act as a major contributor to credit total returns. Against this backdrop, the role of alpha, i.e., the excess return generated by the active asset manager, takes predominance. Not only are spreads tight, but spread dispersion is also well below its historical average (Exhibit 4). Under tight spread dispersion, the opportunity set for security selection alpha tends to shrink, which means there is a premium on the quality and skill of the asset manager. In other words, a tight spread dispersion environment is an opportunity for the highly-skilled asset manager to shine. A thorough security selection investment process and a developed global research platform are likely to be paramount to adding value in the face of the current valuation landscape, in our view.

Also read: Trump and the US Govt 10-Year

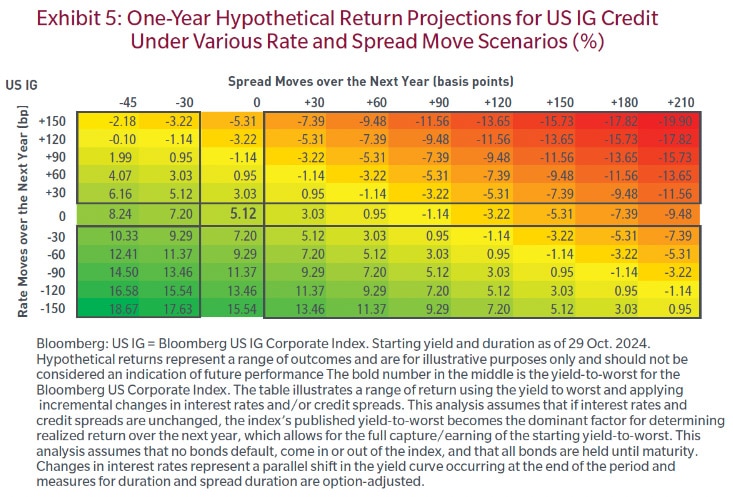

Despite the spread valuation backdrop, credit total return expectations continue to be robust. The impact of rate cuts, the attractive carry, combined with the potential contribution from alpha are likely to play out as the key drivers of the asset class’s performance over the next year. The initial conditions appear favorable to us, given where total yields currently are. For instance, the yield on US IG credit currently stands at 5.12%.[2] This means that the potential income return is likely to be elevated by historical standards. To that income return, one must add the contribution from both the spread and rate moves, as summarized in Exhibit 5. Under a scenario characterized by lower rates — following the impact of rate cuts — and stable credit spreads, expected returns over a one-year horizon could potentially hover around the high single-digit territory.

Also read: Buying Bonds – OTC vs ETFs

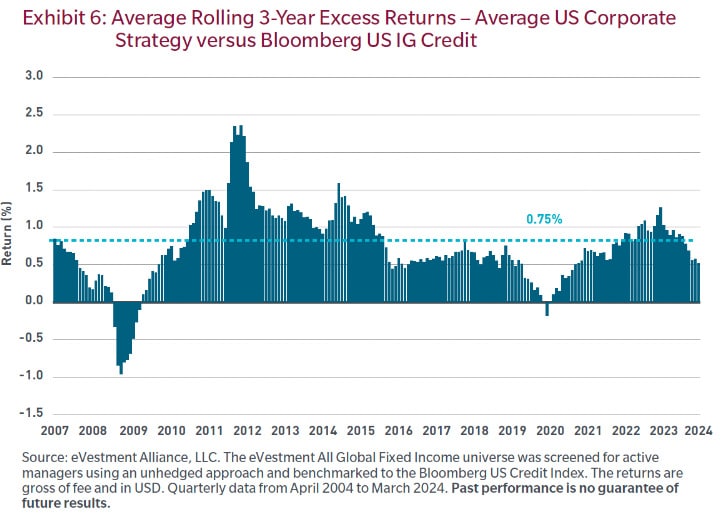

Away from beta, excess returns have historically been significant, thereby reinforcing the case for active management in fixed income. Looking at the history of the community of asset managers that use the Bloomberg US Credit Index as their benchmark, the alpha generated over the past 20 years has reached 75 bps per year on average, which is substantial. The alpha levers at the disposal of the asset manager are diverse, ranging from security selection to sector allocation, relative value or curve positioning. Given that the 20-year beta return for US IG Credit currently stands at 4.03%, a 75 bp alpha represents a major uptick.

Overall, the outlook for total returns in fixed income remains robust, mainly reflecting the contribution from expected rate declines and the elevated carry. Spreads, however, are unlikely to play out as a major contribution to performance. Ultimately, we believe, in credit, this is an environment that is a lot more supportive of alpha as a source of return than beta.