One of the great advantages of managing benchmark unaware credit strategies is the greater avenues at your disposal to extract higher risk returns through a cycle. Indeed, as with the Scorpions’ famed 1990 ballad, we believe that ‘listening to the wind of change’ is helping to keep us ahead of the prevailing risks and availing us of emerging opportunities.

While we may all yearn for less volatile times in financial markets – who doesn’t! – for now at least, they look to be edging towards the rear-vision mirror, notwithstanding the prospect of weaker economic growth going into 2023.

For our portfolio, this elongated period of high volatility has also presented us with higher risk adjusted return opportunities, ranging from investing in beaten-up investment grade credits in the aftermath of the initial 2020 COVID wave, to taking advantage of a very steep yield curve and low interest rate hedging costs last year to lengthen portfolio spread duration.

In our floating rate portfolios, these strategies have significantly contributed to outperformance, while also enabling us to preserve investor capital as credit spreads and interest rates have normalised over the past 6-9 months.

Also read: Patiently Underweight Risk Assets

Going forward, we’re looking at the remainder of this year into 2023 with confidence. While we do not expect Australia to fall into recession, growth slowing to ~1.5% in 2023 is likely to present opportunities as some assets are invariably mispriced.

For instance, recent credit margin widening on residential mortgage-backed securities (RMBS), associated warehousing facilities and secondary BWICs (bids wanted in competition) are offering up attractive opportunities to simultaneously trade-up in credit quality and earn higher returns.

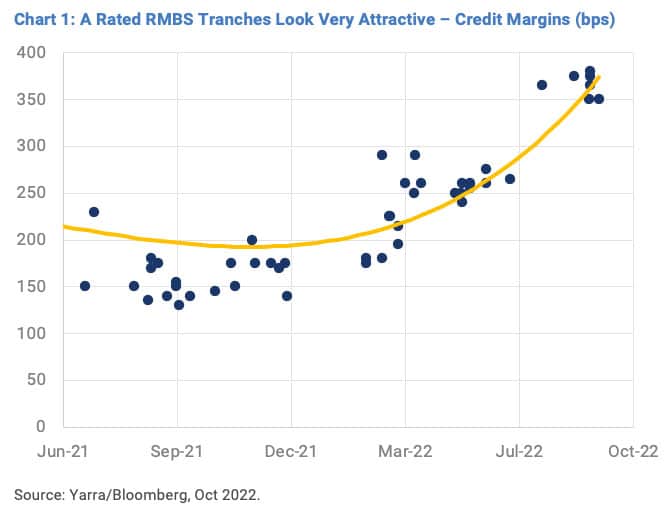

In RMBS, a less certain outlook in the form of higher interest rates and declining house prices has pushed credit margins significantly wider. Looking specifically at the higher quality A rated prime RMBS tranches, credit margins on recent deals at ~+350bps (>6% yield) are more than double the levels from 12 months ago (refer Chart 1).

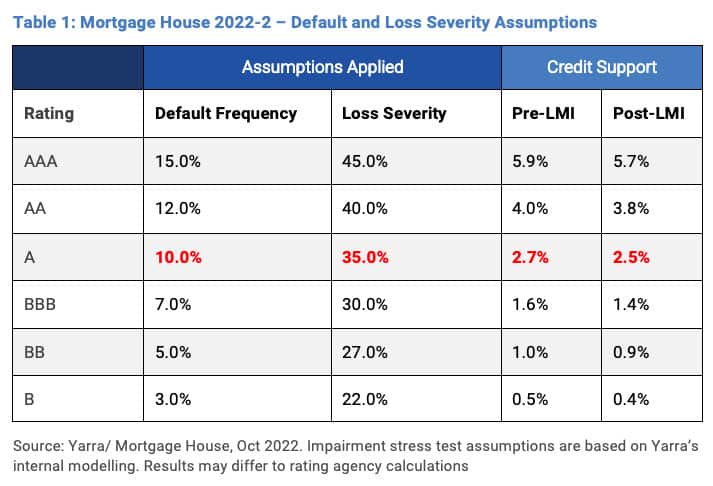

While appealing enough at face value, the wider pricing looks even more attractive when the underlying risk is factored in. We are particularly interested in the underlying default/loss severities required for impairment on every tranche of the recent prime Mortgage House 2022-2 transaction (refer Table 1). With 2.6% in total credit support, the A-rated tranche can withstand a housing downturn encompassing a 10% default rate and a 35% decline in Australian house prices.

Since we have never experienced meaningful defaults and house price declines in Australia, we have looked to the US and UK experience during the GFC. While both of their economies experienced unemployment spikes to between 8-10%, resulting in severe recessions, it is noteworthy that mortgage defaults in both markets peaked at ~5% despite house prices declining 20-25%.

With unemployment in Australia currently below 4%, it is difficult to envisage a realistic recession and unemployment scenario which would bring 10% defaults and 35% declines in house prices. Our current attraction to single A rated tranches looks the sweet spot, with outsized returns on offer for manageable risk.

By contrast, we are negative on most asset backed securities (ABS) types and any security generally backed by discretionary cash flows, with increasing interest rates expected to significantly impact discretionary consumption spending in 2023. Understandably, Australians have a track record of cutting back these expenditures to meet rising mortgage payments, and it is difficult to see why this cycle will be any different.

With running yields of ~5% p.a. (and rising) from their average investment grade portfolios, both the Yarra Higher Income Fund and the Yarra Enhanced Income Fund are well placed to navigate increased volatility, with both portfolios positioned to take advantage of very attractive risk-adjusted opportunities on offer.